FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

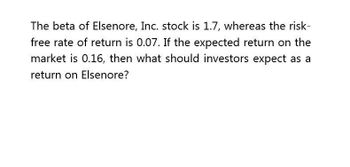

Transcribed Image Text:The beta of Elsenore, Inc. stock is 1.7, whereas the risk-

free rate of return is 0.07. If the expected return on the

market is 0.16, then what should investors expect as a

return on Elsenore?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What should investors expect as a return on Elsenore on these accounting question?arrow_forwardThe risk-free rate of return is currently 0.03, whereas the market risk premium is 0.04. If the beta of RKP, Inc. stock is 1.4, then what is the expected return on RKP?arrow_forwardCan you please solve these accounting question?arrow_forward

- Please help with this question with full working out.arrow_forwardMulherin's stock has a beta of 1.34, its required return is 8.33%, and the risk-free rate is 2.30%. What is the required rate of return on the market? (Hint: First find the market risk premium.) Do not round your intermediate calculations. Please explain process and show calculations.arrow_forward. The risk free rate is 7.6%.(i) Potpuri Inc Stock has a beta of 1.7 and an expected return of 16.7% underCAPM. What is the expected market risk premium of Potpuri Inc.(ii) Magnolia Ind stock has the beta of 0.8 what is the expected return on the MagnoliaInd?arrow_forward

- Company A has a beta of 0.9 , while Company B's beta is 1.4 . The market risk premium is 13.78 %, and the risk-free rate is 4.25%. What is the difference between A's and B's required rates of return? (Hint: find the required returns on each stock and then subtract them.)arrow_forwardCalcitron Inc. has common stock with a beta of 1.4. The risk-free rate is 3.7 while the market rate of return is 13. What is the equilibrium required rate of return on this stock? Answer:arrow_forwardA stock has a beta of 1.04, the expected return on the market is 11.75, and the risk-free rate is 3.75. What must the expected return on this stock be? Can the calculator and excel solution be provided?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education