FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:10/

Waterway Corp. is a medium-sized corporation specializing in quarrying stone for building construction. The company has long

dominated the market, at one time achieving a 70% market penetration. During prosperous years, the company's profits, coupled with

a conservative dividend policy, resulted in funds available for outside investment. Over the years, Waterway has had a policy of

investing idle cash in equity securities. In particular, Waterway has made periodic investments in the company's principal vendor of

mining equipment, Norton Industries. Although the firm currently owns 12% of the outstanding common stock of Norton Industries,

Waterway does not have significant influence over the operations of Norton Industries.

Cheryl Thomas has recently joined Waterway as assistant controller, and her first assignment is to prepare the December 31, 2025

year-end adjusting entries for the accounts that are valued by the "fair value" rule for financial reporting purposes. Thomas has

gathered the following information about Waterway's pertinent accounts.

1. Waterway has equity securities related to Delaney Motors and Patrick Electric. During 2025, Waterway

purchased 95,000 shares of Delaney Motors for $1,330,000; these shares currently have a fair value of $1,504,000.

Waterway' investment in Patrick Electric has not been profitable; the company acquired 50,000 shares of Patrick in April

2025 at $18 per share, a purchase that currently has a value of $727,000.

2.

Prior to 2025, Waterway invested $22,322,000 in Norton Industries and has not changed its holdings this year. This

investment in Norton Industries was valued at $21,538,000 on December 31, 2024. Waterway' 12% ownership of Norton

Industries has a current fair value of $22,212,000 on December 31, 2025.

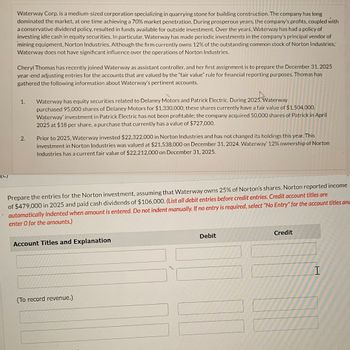

Prepare the entries for the Norton investment, assuming that Waterway owns 25% of Norton's shares. Norton reported income

of $479,000 in 2025 and paid cash dividends of $106,000. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles anc

enter O for the amounts.)

Account Titles and Explanation

(To record revenue.)

Debit

Credit

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (b) Prepare the entry to record the accrued interest and the amortization of premium on December 31, 2025, using the straight-line method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 1,225.) Date Dec. 31, 2025 Account Titles and Explanation Debit Creditarrow_forwardThe trial balance of Sam’s Deli Inc. at October 31, 2020, does not balance: The accounting records contain the following errors: -Recorded a $1,000 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. -Posted a $1,000 credit to Accounts Payable as $100. -Did not record utilities expense or the related account payable in the amount of $200. -Understated Share Capital by $1,100. -Omitted insurance expense of $1,000 from the trial balance. Q1: Prepare the correct trial balance at October 31, 2020, complete with a heading. Journal entries are not required but will be helpful in correcting the trial balance. Q2: Organize the elements of the trial balance in a way that would assist a bank manager who has to decide whether to loan money to Sam’s Deli.arrow_forwardNot a graded assignmentarrow_forward

- answer in text form please (without image)arrow_forwardPlease Do not Give image formatarrow_forwardWhispering Company has a stock portfolio valued at $3,800. Its cost was $3,200. If the Fair Value Adjustment account has a debit balance of $260, prepare the journal entry at year-end. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit 1187arrow_forward

- At December 31, 2018, Wynne Company reported Accounts Receivable of $45,000 and Allowance for Doubtful Accounts of $3,500. On January 7, 2019, Brown Enterprises declares bankruptcy and it is determined that the receivable of $1,200 from Brown is not collectible. What is the cash realializable value of accounts receivab;le after the Brown account is written off?arrow_forwardVishnuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education