FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

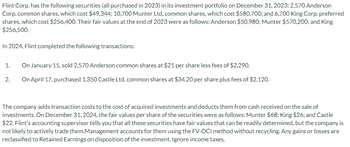

Transcribed Image Text:Flint Corp. has the following securities (all purchased in 2023) in its investment portfolio on December 31, 2023: 2,570 Anderson

Corp.common shares, which cost $49,344; 10,700 Munter Ltd. common shares, which cost $580,700; and 6,700 King Corp. preferred

shares, which cost $256,400. Their fair values at the end of 2023 were as follows: Anderson $50,980; Munter $570,200; and King

$256,500.

In 2024, Flint completed the following transactions:

On January 15, sold 2,570 Anderson common shares at $21 per share less fees of $2,290.

2. On April 17, purchased 1,350 Castle Ltd. common shares at $34.20 per share plus fees of $2,120.

1.

The company adds transaction costs to the cost of acquired investments and deducts them from cash received on the sale of

investments. On December 31, 2024, the fair values per share of the securities were as follows: Munter $68; King $26; and Castle

$22. Flint's accounting supervisor tells you that all these securities have fair values that can be readily determined, but the company is

not likely to actively trade them.Management accounts for them using the FV-OCI method without recycling. Any gains or losses are

reclassified to Retained Earnings on disposition of the investment. Ignore income taxes.

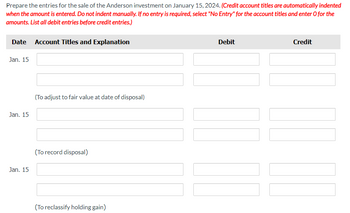

Transcribed Image Text:Prepare the entries for the sale of the Anderson investment on January 15, 2024. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries.)

Date Account Titles and Explanation

Jan. 15

Jan. 15

Jan. 15

(To adjust to fair value at date of disposal)

(To record disposal)

(To reclassify holding gain)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2021, Barto Company purchased marketable equity securities as short-term investment to be measured at fair value through other comprehensive income. The cost and market value on December 31, 2021 were as follows: Security No. of Shares Cost Market Value A 5,000 500,000 550,000 B 25,000 2,800,000 2,650,000 C 40,000 2,150,000 3,950,000 The entity sold 10,000 shares of B on January 5, 2022 for P150 per share. The market price per share of Security A and Security C is P320 and P150 respectively, as of December 31, 2022. What amount should be recognized in the Profit or Loss Statement as realized gain or loss on sale of equity securities during 2022?arrow_forwardOn December 31, 2020, Hazel Company held 1,000 ordinary shares of X Co. in its portfolio of long-term investments in equity securities. The shares were designated as at fair value through other comprehensive income. The shares had a cost of P150 per share and had a fair value of P130 per share at December 31, 2020. During 2021, Hazel acquired the following investments, all of which were designated as at fair value through other comprehensive income: 900 ordinary shares of Y Co. for P180 per share and 800 ordinary shares of Z Co. for P220 per share. At the end of 2021, market values per share were: X - P140; Y - P170; Z - P200. What is the net unrealized loss account balance reported in the stockholders' equity section of Hazel Company's statement of financial position at December 31, 2021? (A) PO B) P15,000 P20,000 D) P35,000arrow_forwardDuring 2020, Maria Company purchased trading securities with the following cost and market value on December 31, 2020: Security Cost Market Value A - 1,000 shares 200,000 300,000 B - 10,000 shares 1,700,000 1,600,000 C - 20,000 shares 3,100,000 2,900,000 5,000,000 4,800,000 The entity sold 10,000 shares of Security B on January 27, 2021, for P150 per share. What amount should be reported as gain or loss on sale of trading investment in 2021?arrow_forward

- Live Large Inc. had the following transactions involving non-strategic investments during 2020. 2020 Apr. 1 Paid $119,000 to buy a 90-day term deposit, $119,000 principal amount, 7.0%, dated April 1. 12 Purchased 4,900 common shares of Blue Balloon Ltd. at $22.50. June 9 Purchased 3,700 common shares of Purple Car Corp. at $51.50. 20 Purchased 1,650 common shares of Yellow Tech Ltd. at $16.00. July 1 Purchased for $86,894 a 9.0%, $84,000 Space Explore Inc. bond that matures in eight years when the market interest rate was 8.4%. Interest is paid semiannually beginning December 31, 2020. Live Large Inc. plans to hold this investment until maturity. 3 Received a cheque for the principal and accrued interest on the term deposit that matured on June 30. 15 Received a $0.95 per share cash dividend on the Blue Balloon Ltd. common shares. 28 Sold 2,450 of the Blue Balloon Ltd. common shares at $26.25. Sept. 1 Received a $3.00 per share cash…arrow_forwardSLC Corp. has the following portfolio of securities acquired for trading purposes and accounted for using the FV-NI model. SLC Inc. prepares financial statements every quarter. At Sept 30, 2021, the end of the company’s third quarter, the following information was reported: Investment Cost Fair Value 50,000 Common Shares – Seneca Inc. $215,000 $200,000 3,500 Preferred Shares – Loyalist Inc. $135,000 $140,000 2,000 Common Shares – Algonquin Inc. $180,000 $179,000 Transactions that occurred in the fourth quarter: Oct 8, 2021 The Seneca Shares were sold for $4.30 per share Nov 16, 2021 3,000 common shares of Humber Inc. were purchased at $44.50 per share SLC Inc. pays a 1% commission on purchase and sales of all securities. At the end of the fourth quarter, on December 31, 2021, the fair value of the shares were as follows: Investment Fair Value Loyalist Inc. $106,000 Algonquin Inc. $203,000 Humber Inc. $122,000 Instructions: Prepare the journal entries to record the sale, purchase and…arrow_forwardOn December 31, 2020, Dreamer Company reported as Available-for-sale securities: AT Company, 5,000 shares of common stock (a 1% interest) P 125,000 ITS Company, 10,000 shares of common stock (a 2% interest) 160,000 Two Company, 25,000 shares of common stock (a 10% interest) 700,000 Marketable equity securities, at cost P 985,000 Less: Valuation allowance 50,000 Marketable equity securities, at market P 935,000 Additional information: · On May, 2021, AT Company issued a 10% stock dividend when the market price of its stock was P24 per share. · On November 1, 2021, AT Company paid a cash dividend of P0.75 per share. · On August 5, 2021, ITS Company issued to all shareholders, stock rights on the basis of one right per share. Market prices at date of issue were P13.50 per share (ex-right) of stock and P1.50 per rights. Dreamer Company sold all rights on December 16, 2021 for net proceeds of P18,800. · On July 1, 2021, Dreamer Company paid P1,520,000 for 50,000 additional shares of Two…arrow_forward

- In March of 2019, Boyet Corporation purchased nontrading equity investments which are irrevocably designated at FV-OCI. On December 31, 2019, the balance in the unrealized gain/(loss) on these securities was P200,000. During 2020, stock FF was sold for P1,100,000. Pertinent data on Dec. 31, 2020 are as follows: Cost Market Value DD P2,100,000 P1,600,000 EE 1,850,000 2,000,000 FF 1,050,000 900,000 In its statement of changes in stockholder's equity for the year 2020, Boyet should report unrealized holding loss at what amount?arrow_forwardPenta Company purchased 1,000 bonds of Gone Company in 2018 for $810 per bond and classified the investment as securities available-for-sale. The value of these holdings was $272 per bond on December 31, 2019, and $421 per bond on December 31, 2020. During 2021, Penta sold all of its Gone bonds at $390 per bond. In its 2021 income statement, Penta would report: 53 Multiple Choice A trading gain of $31,000 and an unrealized holding loss of $390,00. A loss on the sale of investments of $420,000. A realized gain of $31,00O. A recognition of unrealized holding losses of $272,00o. 7 of 16 Next >arrow_forwardLive Large Inc. had the following transactions involving non-strategic investments during 2020. 2020 Apr. 1 Paid $119,000 to buy a 90-day term deposit, $119,000 principal amount, 7.0%, dated April 1. 12 Purchased 4,900 common shares of Blue Balloon Ltd. at $22.50. June 9 Purchased 3,700 common shares of Purple Car Corp. at $51.50. 20 Purchased 1,650 common shares of Yellow Tech Ltd. at $16.00. July 1 Purchased for $86,894 a 9.0%, $84,000 Space Explore Inc. bond that matures in eight years when the market interest rate was 8.4%. Interest is paid semiannually beginning December 31, 2020. Live Large Inc. plans to hold this investment until maturity. 3 Received a cheque for the principal and accrued interest on the term deposit that matured on June 30. 15 Received a $0.95 per share cash dividend on the Blue Balloon Ltd. common shares. 28 Sold 2,450 of the Blue Balloon Ltd. common shares at $26.25. Sept. 1 Received a $3.00 per share cash…arrow_forwardSunland Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other comprehensive income model at December 31, 2023. This was the first year that Sunland had purchased investments. In part due to Sunland's inexperience, by December 31, 2023, the market value of the portfolio had dropped $29,700 below its original cost. Sunland recorded the necessary adjustments at December 31, 2023, and was determined to hold the securities until the unrealized loss from 2023 could be recovered. By December 31, 2024, Sunland's goal of recovery had been realized and the original portfolio of shares and bonds had a fair market value $6,600 higher than the original purchase costs. Sunland's income tax rate is 30% for all years. Assume that any gains that will ultimately be realized on the sale of the shares and bonds are taxable as ordinary income when they are realized. Sunland applies IFRS. (a) Prepare the journal entries at December 31, 2023, to…arrow_forwardLarkspur Company has the following securities in its investment portfolio on December 31, 2020 (all securities were purchased in 2020): (1) 2,800 shares of Anderson Co. common stock which cost $50,400, (2) 10,800 shares of Munter Ltd. common stock which cost $604,800, and (3) 6,300 shares of King Company preferred stock which cost $270,900. The Fair Value Adjustment account shows a credit of $10,400 at the end of 2020. In 2021, Larkspur completed the following securities transactions. 1. On January 15, sold 2,800 shares of Anderson's common stock at $20 per share less fees of $2,160. 2. On April 17, purchased 900 shares of Castle's common stock at $33 per share plus fees of $2,030. On December 31, 2021, the market prices per share of these securities were Munter $65, King $40, and Castle $25. In addition, the accounting supervisor of Larkspur told you that, even though all these securities have readily determinable fair values, Larkspur will not actively trade these securities because…arrow_forwardRed Company issued shares as consideration for the purchase of inventory on January 1, 2021. The inventory was eventually sold on May 1, 2021. The value of the inventory on January 1, 2021 was P2,500,000 and its value on the date of sale was P2,700,000. The sales proceeds amounted to P3,700,000. The shares issued have a market value of P2,200,000 and a par value of P2,000,000. How much is the gross profit from the sale of the inventory on May 1, 2021?arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education