FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

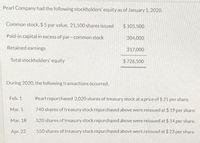

Transcribed Image Text:Pearl Company had the following stockholders' equity as of January 1, 2020.

Common stock, $5 par value, 21,100 shares issued

$ 105,500

Paid-in capital in excess of par-common stock

304,000

Retained earnings

317,000

Total stockholders' equity

$726,500

During 2020, the following transactions occurred.

Feb. 1

Pearl repurchased 2,020 shares of treasury stock at a price of $ 21 per share.

Mar. 1

740 shares of treasury stock repurchased above were reissued at $ 19 per share.

Mar. 18

520 shares of treasury stock repurchased above were reissued at $ 14 per share.

Apr. 22

550 shares of treasury stock repurchased above were reissued at $ 23 per share.

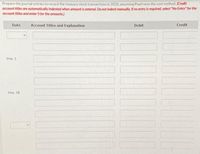

Transcribed Image Text:Prepare the journal entries to record the treasury stock transactions in 2020. assuming Pearl uses the cost method. (Credit

account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Mar. 1

Mar. 18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- On January 1, 2021, Fascom had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 250,000 shares issued $ 250,000 Paid-in capital—excess of par, common 500,000 Paid-in capital—excess of par, preferred 100,000 Preferred stock, $100 par, 10,000 shares outstanding 1,000,000 Retained earnings 2,000,000 Treasury stock, at cost, 5,000 shares 25,000 During 2021, Fascom Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). February 17: Distributed the property dividend. April 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Fascom chose to reduce Paid-in capital—excess of par.) The fair value of the stock was $4 on this date. July 18: Declared and distributed a 3%…arrow_forwardKohler Corporation reports the following components of stockholders’ equity at December 31, 2018. Common stock—$25 par value, 100,000 shares authorized,45,000 shares issued and outstanding $ 1,125,000 Paid-in capital in excess of par value, common stock 60,000 Retained earnings 400,000 Total stockholders' equity $ 1,585,000 During 2019, the following transactions affected its stockholders’ equity accounts. Jan. 2 Purchased 4,500 shares of its own stock at $15 cash per share. Jan. 5 Directors declared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1,688 of its treasury shares at $19 cash per share. Aug. 22 Sold 2,812 of its treasury shares at $12 cash per share. Sept. 5 Directors declared a $6 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the…arrow_forwardAt the end of 2019, Haley Corporation had the following equity accounts and balances: Common stock, $10 par $800,000 Additional paid-in capital-common stock 200,000 Retained earnings 279,000 During 2020, Haley engaged in the following transactions involving its equity accounts: a. Sold 5,000 shares of common stock for $19 per share. b. Sold 1,200 shares of 12%, $50 par preferred stock at $75 per share. c. Declared and paid cash dividends of $22,000. d. Repurchased 1,000 shares of treasury stock (common) for $24 per share. e. Sold 300 of the treasury shares for $26 per share. Required: 1. Prepare the journal entries for Transactions a through e. 2. Assume that 2020 net income was $123,700. Prepare a statement of stockholders' equity at December 31, 2020.arrow_forward

- On January 1, 2021, Fascom had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 250,000 shares issued Paid-in capital-excess of par, common Paid-in capital-excess of par, preferred Preferred stock, $100 par, 10,000 shares outstanding Retained earnings Treasury stock, at cost, 5,000 shares During 2021, Fascom Inc. had several transactions relating to common stock. $ 250,000 500,000 100,000 1,000,000 2,000,000 25,000 January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). February 17: Distributed the property dividend. April July December 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Fascom chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date. 18: Declared and distributed a 3% stock dividend on outstanding common stock. The fair value is $5 per…arrow_forwardThe stockholders' equity of Bonita Industries at July 31, 2021 is presented below: Common stock, par value $20, authorized 400,000 shares; issued and outstanding 170000 shares $3400000 Paid-in capital in excess of par 156000 Retained earnings 642000 $4198000 On August 1, 2021, the board of directors of Bonita declared a 16% stock dividend on common stock, to be distributed on September 15th. The market price of Bonita's common stock was $68 on August 1, 2021, and $74 on September 15, 2021. What is the amount of the debit to retained earnings as a result of the declaration and distribution of this stock dividend? a. $1849600. b. $1020000. c. $2012800. d. $1305600.arrow_forwardBramble Inc. began operations in January 2018 and reported the following results for each of its 3 years of operations. 2018 $283,000 net loss 2019 $36,000 net loss 2020 $746,000 net income At December 31, 2020, Bramble Inc. capital accounts were as follows. 9% cumulative preferred stock, par value $100; authorized, issued, and outstanding 5,300 shares $530,000 Common stock, par value $1.00; authorized 1,000,000 shares; issued and outstanding 758,000 shares $758,000 Bramble Inc. has never paid a cash or stock dividend. There has been no change in the capital accounts since Bramble began operations. The state law permits dividends only from retained earnings.(a) Compute the book value of the common stock at December 31, 2020. Book value per share $enter a dollar amount of the book value of the common stock at December 31, 2020 rounded to 2 decimal places (b) Compute the book value of the common stock at December 31,…arrow_forward

- Careful Carol's Creamy Crumpets had 200,000 shares of common stock outstanding at 12/21/2020. On April 1, 2020, the company issued an additional 50,000 shares. On July 31, 2020, the company repurchased 10,000 shares as treasury stock. On November 30, 2020, the company declared 5% stock dividend. The company reported net income for 2020 of $257,000. a. Compute basic earnings per share (EPS) The following additional information is available: Stock Options: The company had 30,000 stock options outstanding that were exercised throughout the period at a strike/exercise price of $13 per share. The average market price of the company's stock during 2020 was $10 per share. Convertible bonds: The company has $350,000 of 6% convertible bonds outstanding which was outstanding throughout the year. The bonds are convertible into 20,000 shares of the company's stock. The company's tax rate is 25%. b. Compute diluted earnings per share Show all work fully lablelarrow_forwardThe summarized balance sheets of Pharoah Company and Sheridan Company as of December 31, 2025 are as follows: Assets Liabilities Capital stock Retained earnings Total equities Assets Liabilities Capital stock Retained earnings Total equities Pharoah Company Balance Sheet December 31, 2025 O $444000. O $297000. O $345000. O $350000. Sheridan Company Balance Sheet December 31, 2025 $2000000 $220000 1000000 780000 $2000000 $1480000 $330000 990000 160000 $1480000 If Pharoah Company acquired a 30% interest in Sheridan Company on December 31, 2025 for $350000 and the equity method of accounting for the investment was used, the amount of the debit to Equity Investments (Sheridan) to record the purchase would have beenarrow_forwardThe stockholders’ equity accounts of Grouper Company have the following balances on December 31, 2020. Common stock, $10 par, 290,000 shares issued and outstanding $ 2,900,000 Paid-in capital in excess of par—common stock 1,120,000 Retained earnings 5,110,000 Shares of Grouper Company stock are currently selling on the Midwest Stock Exchange at $ 36.Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) A stock dividend of 7% is (1) declared and (2) issued. (b) A stock dividend of 100% is (1) declared and (2) issued. (c) A 2-for-1 stock split is (1) declared and (2) issued. No. Account Titles and Explanation Debit Credit (a) (1) enter an account title for case A to record the declaration of stock dividends…arrow_forward

- The shareholders’ equity section of the balance sheet of TNL Systems Inc. included the following accounts at December 31, 2020: Shareholders' Equity ($ in millions) Common stock, 340 million shares at $1 par $340 Paid-in capital—excess of par 2,720 Paid-in capital—share repurchase 1 Retained earnings 2,400 Required:1. During 2021, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. On February 5, 2021.Record the purchase of 8 million shares at $12 per share assuming the shares are retired. On July 9, 2021, Record the sale of 2 million shares at $14 per share. On November 14, 2023, Record the sale of 2 million shares at $9 per share Record the purchase of 8 million shares at $12 per share assuming the shares are viewed as treasury stock.…arrow_forwardOn January 1, 2020, the stockholders’ equity section of Skysong, Inc. shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,070,000; and retained earnings $1,220,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. July 1 Sold 10,500 treasury shares for cash at $17 per share. Sept. 1 Sold 9,000 treasury shares for cash at $14 per share.arrow_forwardMorgan Sondgeroth Inc. began operations in January 2018 and reported the following results for each of its 3 years of operations. 2018 $260,000 net loss 2019 $40,000 net loss 2020 $800,000 net income At December 31, 2020, Morgan Sondgeroth Inc. capital accounts were as follows. 8% cumulative preferred stock, par value $100; authorized, issued, and outstanding 5,000 shares 0000 $500,000 Common stock, par value $1.00; authorized 1,000,000 shares; issued and outstanding 750,000 shares $750,000 Morgan Sondgeroth Inc. has never paid a cash or stock dividend. There has been no change in the capital accounts since Sondgeroth began operations. The state law permits dividends only from retained earnings. Instructions a. Compute the book value of the common stock at December 31, 2020. b. Compute the book value of the common stock at December 31, 2020, assuming that the preferred stock has a liquidating value of $106 per share.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education