FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please excel form answer.

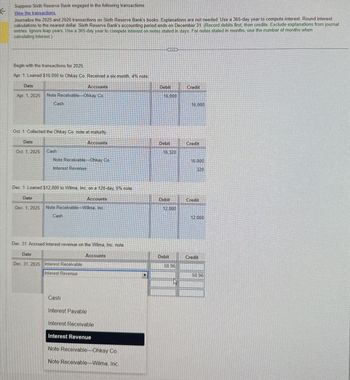

Transcribed Image Text:Suppose Sixth Reserve Bank engaged in the following transactions:

View the transactions.

Journalize the 2025 and 2026 transactions on Sixth Reserve Bank's books. Explanations are not needed. Use a 365-day year to compute interest. Round interest

calculations to the nearest dollar. Sixth Reserve Bank's accounting period ends on December 31. (Record debits first, then credits. Exclude explanations from journal

entries. Ignore leap years. Use a 365-day year to compute interest on notes stated in days. For notes stated in months, use the number of months when

calculating interest.)

Begin with the transactions for 2025.

Apr. 1: Loaned $16,000 to Ohkay Co. Received a six-month, 4% note.

Date

Accounts

Apr. 1, 2025

Note Receivable-Ohkay Co.

Cash

Oct. 1: Collected the Ohkay Co. note at maturity.

Date

Accounts

Oct 1, 2025

Cash

Note Receivable Ohkay Co.

Interest Revenue

Dec. 1: Loaned $12,000 to Wilma, Inc. on a 120-day, 5% note.

Date

Accounts

Dec. 1, 2025 Note Receivable-Wilma, Inc.

Cash

Dec. 31: Accrued interest revenue on the Wilma, Inc. note.

Date

Dec. 31, 2025 Interest Receivable

Interest Revenue

Cash

Interest Payable

Accounts

Interest Receivable

Interest Revenue

Note Receivable-Ohkay Co

Note Receivable-Wilma, Inc.

Debit

Credit

16,000

16,000

Debit

Credit

16.320

16.000

320

Debit

Credit

12,000

12,000

Debit

Credit

50.96

50.96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education