FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

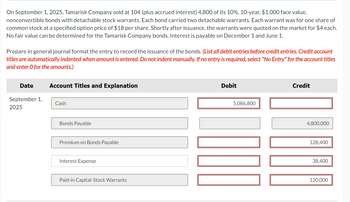

Transcribed Image Text:On September 1, 2025, Tamarisk Company sold at 104 (plus accrued interest) 4,800 of its 10%, 10-year, $1,000 face value,

nonconvertible bonds with detachable stock warrants. Each bond carried two detachable warrants. Each warrant was for one share of

common stock at a specified option price of $18 per share. Shortly after issuance, the warrants were quoted on the market for $4 each.

No fair value can be determined for the Tamarisk Company bonds. Interest is payable on December 1 and June 1.

Prepare in general journal format the entry to record the issuance of the bonds. (List all debit entries before credit entries. Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts.)

Date

September 1,

2025

Account Titles and Explanation

Cash

Bonds Payable

Premium on Bonds Payable

Interest Expense

Paid-in Capital-Stock Warrants

Debit

5,086,800

MI

Credit

4,800,000

128,400

38,400

120,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please proper solution no plagiarism pleasearrow_forwardConcord Hills Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 5% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 3% when the bonds were issued at a price of 109. Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable accountarrow_forwardPlease don't provide answer in image format thank youarrow_forward

- iRequirements 1. Journalize Andersen Brothers's transactions related to the bonds for 2018. 2. Journalize the entry required on the Thomson bonds maturity date. (Assume the last interest payment has already been recorded.) Print Donearrow_forwardOn September 30, 2012, Cullumber Company issued 10% bonds with a par value of $460,000 due in 20 years. They were issued at 98 and were callable at 105 at any date after September 30, 2017. Because Cullumber Company was able to obtain financing at lower rates, it decided to call the entire issue on September 30, 2018, and to issue new bonds. New 9% bonds were sold in the amount of $780,000 at 102; they mature in 20 years. Cullumber Company uses straight-line amortization. Interest payment dates are March 31 and September 30.arrow_forwardOwearrow_forward

- On 31 December 20X7, a company has the following bond on the statement of financial position: Bond payable, 7%, interest due semi-annually on 31 Dec. and 3e June; maturity date, 30 June 20X11 Premium on bonds payable $5,600,000 47,040 $5,647,040 On 28 February 20X8, 20% of the bond was retired for $1,232,000 plus accrued interest to 28 February. Interest was paid on this date only for the portion of the bonds that were retired. Premium amortization was recorded on this date in the amount of $450, representing amortization on the retired debt only.arrow_forwardRedemption of Bonds Payable On December 31, a $1,950,000 bond issue on which there is an unamortized discount of $70,500 is redeemed for $1,908,400. Required: Journalize the redemption of the bonds. Refer to the chart of accounts for the exact wording of the account titles. JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4arrow_forwardRedemption of Bonds Payable A $880,000 bond issue on which there is an unamortized premium of $84,000 is redeemed for $823,000. Journalize the redemption of the bonds. If an amount box does not require an entry, leave it blank. 1000arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardeBook Reporting Issuance and Retirement of Long-Term Debt On the basis of the details of the following bonds payable and related discount accounts, indicate the items to be reported in the Financing Activities section of the statement of cash flows, assuming no gain or loss on retiring the bonds: ACCOUNT Bonds Payable Jan. Date June Item Debit 1980 Retire bonds 76,000 Jan. Item Date 30 ACCOUNT Discount on Bonds Payable 1 June 30 Dec. 31 2 Issue bonds Retire bonds Balance Issue bonds Print Item Item Balance Retire bonds Issue bonds Amortize discount Amortization of discount Debit Check My Work 2 more Check My Work uses remaining. 15,300 Credit 228,000 Credit 6,080 1,320 ACCOUNT NO. Debit Section of Statement of Cash Flows Balance Debit Credit ACCOUNT NO. 380,000 304,000 532,000 Balance 17,100 11,020 26,320 25,000 Credit Added or Deducted $ Amount Previous Nextarrow_forwardA $535,000 bond issue on which there is an unamortized discount of $43,000 is redeemed for $467,000. Journalize the redemption of the bonds. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education