FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

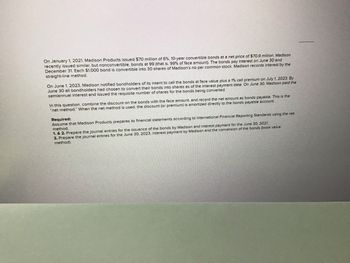

Transcribed Image Text:On January 1, 2021, Madison Products issued $70 million of 6%, 10-year convertible bonds at a net price of $70.9 million. Madison

recently issued similar, but nonconvertible, bonds at 99 (that is, 99% of face amount). The bonds pay interest on June 30 and

December 31. Each $1,000 bond is convertible into 30 shares of Madison's no par common stock. Madison records interest by the

straight-line method.

On June 1, 2023, Madison notified bondholders of its intent to call the bonds at face value plus a 1% call premium on July 1, 2023. By

June 30 all bondholders had chosen to convert their bonds into shares as of the interest payment date. On June 30, Madison paid the

semiannual interest and issued the requisite number of shares for the bonds being converted.

In this question, combine the discount on the bonds with the face amount, and record the net amount as bonds payable. This is the

"net method." When the net method is used, the discount (or premium) is amortized directly to the bonds payable account.

Required:

Assume that Madison Products prepares its financial statements according to International Financial Reporting Standards using the net

method.

1. & 2. Prepare the journal entries for the issuance of the bonds by Madison and interest payment for the June 30, 2021.

the June 30, 2023, interest payment by Madison and the conversion of the bonds (book value

3. Prepare the journal entries

method).

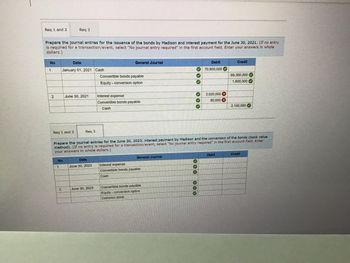

Transcribed Image Text:Req 1 and 2

Prepare the journal entries for the issuance of the bonds by Madison and interest payment for the June 30, 2021. (If no entry

is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole

dollars.)

No

1

2

Req 1 and 2

Req 3

Date

January 01, 2021

No

1

2

June 30, 2021

Req 3

Cash

Date

June 30, 2023

June 30, 2023

General Journal

Convertible bonds payable

Equity-conversion option

Interest expense

Convertible bonds payable

Cash

General Journal

Prepare the journal entries for the June 30, 2023, interest payment by Madison and the conversion of the bonds (book value

method). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter

your answers in whole dollars.)

Interest expense

Convertible bonds payable

Cash

✓

✓

✔

Convertible bonds payable

Equity-conversion option

Common stock

000

Debit

70,900,000✔

000 000

2,020,000 x

80.000 x

Credit

Debit

69,300,000

1,600,000✔

2,100,000

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 1, 2020, Judice Company issued 400 $1,000 bonds at 104. Each bond was issued with two detachable stock warrants. Shortly after issuance, the bonds were selling at 106, and the fair value of the warrants was $40 each. Prepare the entry to record the issuance of the bonds and warrants.arrow_forwardHow to calculate the issue price of the bonds with normal calculator?arrow_forwardOn January 1, 2025, Concord Corporation issued $500,000 of 7% bonds, due in 10 years. The bonds were issued for $537.196, and pay interest each July 1 and January 1. The effective-interest rate is 6%. Prepare the company's journal entries for (a) the January 1 issuance. (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Concord uses the effective interest method. (Round answers to 0 decimal places, eg, 38,548. If no entry is required, select "No Entry for the account titles and enter O for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually List all debit entries before credit entries) No. (4) Date Account Titles and Explanation Debit Credarrow_forward

- On January 1, 2016, Cooper Corporation issued $800,000 of 12.5% bonds due January 1, 2023, at 102. The bonds pay interest semiannually on June 30 and December 31. Each $1,000 bond carried 10 warrants which allowed the acquired to exchange 1 share of $10 par common stock for $50. Sometime after the bonds were issued the bonds were quoted at 98 ex-rights and each individual warrant was quoted at $5. Subsequently, on April 30, 2017, 2,000 rights were exercised. Required: 1. Prepare the journal entry to record the bond issue. 2. Prepare the journal entries on April 30, 2017, to record the exchange of the warrants for common shares.arrow_forwardThe Gorman Group issued $930,000 of 11% bonds on June 30, 2021, for $1,009,794. The bonds were dated on June 30 and mature on June 30, 2041 (20 years). The market yield for bonds of similar risk and maturity is 10%. Interest is paid semiannually on December 31 and June 30. Required: 1.to3. Prepare the journal entries to record their issuance by The Gorman Group on Jun 30, 2021, interest on December 31, 2021, and interest on June 30, 2022 (at the effective rate). Record the issuance of the bond on June 30, 2021. Record the interest on December 31, 2021 (at the effective rate). Record the interest on June 30, 2022 (at the effective rate).arrow_forwardABC Co. issued 1.000 convertible bonds at the beginning of 2019. The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of Rp1.000 per bond (the total proceeds received from issuance of the bonds are Rp1.000.000). Interest is payable annually at December 31. Each bond is convertible into 250 ordinary shares with a par value of Rp1. The market rate of interest on similar non-convertible debt is 9 percent. On December 31, 2020, ABC wishes to reduce its annual interest cost. The company agrees to pay the holder of its convertible bonds an additional Rp40.000 if they will convert. Assuming conversion occurs, ABC’s journal entry to record the conversion will include all of the following, except:arrow_forward

- please help mearrow_forwardOn January 1, 2024, Madison Products issued $45 million of 8%, 10-year convertible bonds at a net price of $45.5 million. ■ Madison recently issued similar, but nonconvertible, bonds at 99 (that is, 99% of face amount). . The bonds pay interest on June 30 and December 31. • Each $1,000 bond is convertible into 30 shares of Madison's no par common stock. • Madison records interest by the straight-line method. ⚫ On June 1, 2026, Madison notified bondholders of its intent to call the bonds at face value plus a 1% call premium on July 1, 2026. ■ By June 30, all bondholders had chosen to convert their bonds into shares as of the interest payment date. ⚫ On June 30, Madison paid the semiannual interest and issued the requisite number of shares for the bonds being converted. Required: Assume that Madison Products prepares its financial statements according to International Financial Reporting Standards using the net method. 1. & 2. Prepare the journal entries for the issuance of the bonds by…arrow_forwardWaldron Corporation issued $900,000 of 16%, 10-year bonds payable on January 1, 2022. The market interest rate at the date of issuance was 14%, and the bonds pay interest semiannually (on June 30 and December 31). Waldron Corporation's year-end is June 30. Read the requirements 1. Using the PV function in Excel, calculate the issue price of the bonds. (Round your answer to the nearest whole dollar) The issue price of the bonds is Requirements 1. Using the PV function in Excel, calculate the issue price of the bonds. 2. Prepare an effective-interest amortization table for the bonds through the first three interest payments, Round amounts to the nearest dollar. 3. Record Waldron Corporation's issuance of the bonds on January 1, 2022, and payment of the first semiannual interest amount and amortization of the bond premium on June 30, 2022 Explanations are not required Print Donearrow_forward

- On January 1, 2015, Solis Co. issued its 10% bonds in the face amount of $3,000,000, which mature on January 1, 2020. The bonds were issued for $3,405,000 with a rate of 8% and market rate of 5.5%, resulting in bond premium of $405,000. Solis uses the effective - interest method of amortizing bond premium. Interest is payable quarterly. Record the appropriate journal entries if you knew that they made all the interest payments for 2015 and prepare the amortization schedule. [Hint: watch out for the payment dates].arrow_forwardOn December 1, 2021, Bramble Corp.issued 680 of its 8%, $1,000 bonds at 104. Attached to each bond was one detachable stock warrant entitling the holder to purchase 1 share of Bramble's common stock. On December 1, 2021, the market value of the bonds, without the stock warrants, was 97, and the market value of each stock purchase warrant was $50. The amount of the proceeds from the issuance that should be accounted for as the initial carrying value of the bonds payable would be $700,400 O $680,000 $672,533 $665,380arrow_forwardOn July 1, 2018, Mason & Beech Services issued $33,000 of 10% bonds that mature in five years. They were issued at par. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On December 31, 2018, what is the total amount paid to bondholders?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education