FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

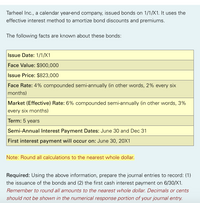

Transcribed Image Text:Tarheel Inc., a calendar year-end company, issued bonds on 1/1/X1. It uses the

effective interest method to amortize bond discounts and premiums.

The following facts are known about these bonds:

Issue Date: 1/1/X1

Face Value: $900,000

Issue Price: $823,000

Face Rate: 4% compounded semi-annually (in other words, 2% every six

months)

Market (Effective) Rate: 6% compounded semi-annually (in other words, 3%

every six months)

Term: 5 years

Semi-Annual Interest Payment Dates: June 30 and Dec 31

First interest payment will occur on: June 30, 20X1

Note: Round all calculations to the nearest whole dollar.

Required: Using the above information, prepare the journal entries to record: (1)

the issuance of the bonds and (2) the first cash interest payment on 6/30/X1.

Remember to round all amounts to the nearest whole dollar. Decimals or cents

should not be shown in the numerical response portion of your journal entry.

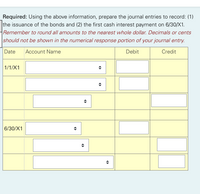

Transcribed Image Text:Required: Using the above information, prepare the journal entries to record: (1)

the issuance of the bonds and (2) the first cash interest payment on 6/30/X1.

Remember to round all amounts to the nearest whole dollar. Decimals or cents

should not be shown in the numerical response portion of your journal entry.

Date

Account Name

Debit

Credit

1/1/X1

6/30/X1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diaz Company issued bonds with a face value of $180,000 on January 1, Year 1. The bonds had a stated interest rate of 7 percent and a five-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. The straight- line method is used for amortization. Required a. Use a financial statements model to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company's financial statements. b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1. c. Determine the amount of interest expense reported on the Year 1 income statement. d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2 e. Determine the amount of interest expense reported on the Year 2 income statement. Complete…arrow_forwardOn January 1, Crane Company issued $5400000, 9% bonds for $5095000. The market rate of interest for these bonds is 10%. Interest is payable annually on December 31. Crane uses the effective-interest method of amortizing bond discount. At the end of the first year, Crane should report unamortized bond discount of $270500. $251000. $254050. $281500.arrow_forwardOn 10/1/X1, Openshaw, Inc issued $1,000,000 of bonds at a price of 98. Assuming the bonds have a 3-year term and bear interest at an annual stated rate of 6% payable semi-annually. What is the 12/31/X1 adjusting journal entry to record interest (using the straight line method?) а. Interest Expense $66,667 Interest Payable 60,000 Bond Premium 6,667 Interest Expense $16,667 Interest Payable 15,000 Bond Discount 1,667 C. Interest Expense $66,667 Interest Payable 60,000 Bond Discount 6,667 d. Interest Expense $16,667 Interest Payable 15,000 Bond Premium 1,667 d O Oarrow_forward

- Montana Inc. issued $900,000 of 12-year bonds with a stated rate of 8% when the market rate was 9%. The bonds pay interest semi-annually. Assume that the bonds were issued for $883,386. Prepare an amortization table for the first three payments. Semiannual Interest Period Semiannual Interest Expense Semiannual Interest Payment Amortization of Discount Ending Carrying Value 1 2 3 PLEASE NOTE: All dollar amounts will be rounded to whole dollars using "$" and commas as needed (i.e. $12,345).arrow_forwardOn January 1, $980,000, 5-year, 10% bonds were issued for $950,600. Interest is paid semiannually on January 1 and July 1. If the issuing company uses the straight-line method to amortize a discount on bonds payable, the semiannual amortization amount isarrow_forwardOn January 1, 20x8, James Corporation issued $500,000, 10%, 5-year bonds, at 98. The bonds pay semiannual interest on January 1 and July 1. The company uses the straight-line method of amortization and has a calendar year end. The journal entry on December 31, 20x8, would include which of the following? Select one: a. Credit to Bonds Interest Payable for $26,000 b. Credit to Bonds Interest Payable for $25,000 c. Debit to Discount on Bonds Payable for $25,000 d. Credit to Discount on Bonds Payable for $25,000arrow_forward

- Diaz Company issued bonds with a $149,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a 10-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 97. The straight-line method is used for amortization. Required a. Use a financial statements model like the one shown next to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company's financial statements. Note: Use + for increase or for decrease. In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activity, and FA for financing activity. Not all cells require input. Effect of Transactions on Financial Statements Event Number Assets Balance Sheet Liabilities Income Statement Stockholders' Equity Revenue Expense Net Income Statement of Cash Flows 1. 2.…arrow_forwardOn May 1, Saxophone Corp. issued $300,000, 9%, 10-year bonds for $281,307 when the market rate was 10%. Required: Prepare the general journal entry for the first semiannual interest payment and bond discount amortization on November 1, using the effective interest method.arrow_forwardOn January 1, Year 1, Denver Company issued bonds with a face value of $89,000, a stated rate of interest of 9%, and a 5-year term to maturity. The bonds were sold at 103. Denver uses the straight-line method to amortize bond discounts and premiums. What is the amount of interest expense during Year 1? Multiple Choice O оо $8,544 $8,010 $8,250 $7,476arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education