FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

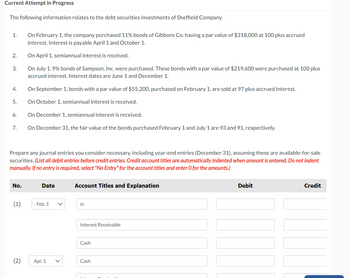

Transcribed Image Text:Current Attempt in Progress

The following information relates to the debt securities investments of Sheffield Company.

1.

2.

3.

4.

5.

6.

7.

No.

Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these are available-for-sale

securities. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

(1)

On February 1, the company purchased 11% bonds of Gibbons Co. having a par value of $318,000 at 100 plus accrued

interest. Interest is payable April 1 and October 1.

On April 1, semiannual interest is received.

On July 1, 9% bonds of Sampson, Inc. were purchased. These bonds with a par value of $219,600 were purchased at 100 plus

accrued interest. Interest dates are June 1 and December 1.

(2)

On September 1, bonds with a par value of $55,200, purchased on February 1, are sold at 97 plus accrued interest.

On October 1, semiannual interest is received.

On December 1, semiannual interest is received.

On December 31, the fair value of the bonds purchased February 1 and July 1 are 93 and 91, respectively.

Date

Feb. 1

Apr. 1

Account Titles and Explanation

in

Interest Receivable

Cash

Cash

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Falcon Company purchased 10% bonds with a face value of $200,000 at par plus accrued interest on April 1, Year 1. Interest on these bonds is payable June 30 and December 31. Falcon intends to hold the bonds until maturity in Year 3. The entry to record the acquisition of the bonds includes a debit to Investment in Trading Securities for $205,000. debit to Investment in Held-to-Maturity Debt Securities for $205,000. debit to Interest Income for $5,000. debit to Interest Receivable for $5,000.arrow_forwardOn January 1, Elias Corporation issued 10% bonds with a face value of $100,000. The bonds are sold for $97,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, 10 years from now. Elias records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 of the first year is a. $10,000 b. $3,000 C. $833 d. $10,300arrow_forwardon 7/2/Y1 Loch Ness, Inc. purchased 50 of the $1,000 face bonds issued by EBerry Corp. Loch Ness paid $1,000 for each bond. The EBerry Corp. bonds were trading at 108 on 12/31/Y1 and at 98 on 12/31/Y2. Loch Ness sold all 50 of the EBerry bonds on 7/1/Y3 for when the market price was 104. They prepare financial statements on December 31st each year. Prepare all the JE needed for Loch Ness's investment in EBerry. Show calculationarrow_forward

- The Wilfred Company sold 8% bonds, dated January 1, with a face amount of $90 million on January 1, year 1 to Rexton-Base Corporation. The bonds mature on December 31, year 10 (10 years). For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semiannually on June 30 and December 31. Prepare the journal entry to record interest revenue on June 30, year 1 (at the effective rate).arrow_forwardOn June 30, Jamison Company issued $2,500,000 of 10-year, 9% bonds, dated June 30, for $2,580,000. Present entries to record the following transactions. Issuance of bonds. (a) Payment of first semiannual interest on December 31 (record separate entry from premium (b) amortization). (C) Amortization by straight-line method of bond premium on December 31.arrow_forwardLevi Company issued $78,000 of 9% bonds on January 1 of the current year at face value. The bonds pay interest semiannually on January 1 and July 1. The bonds are dated January 1 and mature in 5 years on January 1. The total interest expense related to these bonds for the current year ending on December 31 is a. $3,510 b. $585 c. $7,020 d. $5,265arrow_forward

- On January 1, Jim Shorts Corporation issued bonds for $580 million. This bond issue was originally issued at premium. During the same year, $1,500,000 of the bond premium was amortized. On a statement of cash flows prepared using the indirect method, Jim Shorts Corporation should report: O that $1.5 million to be added to net income O An investing activity of $580 million. O A financing activity of $300 million. O that $1.5 million to be deducted from net incomearrow_forwardLevi Company issued $84,000 of 11% bonds on January 1 of the current year at face value. The bonds pay interest semiannually on January 1 and July 1. The bonds are dated January 1 and mature in 5 years on January 1. The total interest expense related to these bonds for the current year ending on December 31 is a. $4,620 b. $770 c. $6,930 d. $9,240arrow_forwardI. Metro Company purchased $500,000, 10%, 5-year bonds on January 1, 20x1, with interest payable on July 1 and January 1. The market interest rate (yield) was 8% for bonds of similar risk and maturity. The market value on December 31, 20x1 was $555,000 and all bonds were sold for $507,500 on January 1, 20x2 after the second payment. Required: compute the bond price on January 1, 20x1, prepare the amortization schedule and record journal entries on January 1, 20x1, July 1, 20x1, December 31, 20x1 and January 1, 20x2 assuming the bond investment is classified as available-for-sale security.arrow_forward

- Selected debt investment transactions for Easy A Inc., a retail business, are listed below. Easy A Inc. has a fiscal year ending on December 31. Year 1: Feb. 1 May 1 Jun. 1 Sept. 1 Oct. 1 Dec. 1 Dec. 31 Year 2: Mar. 1 Jun. 1 Sept. 1 Bought $35,000 of 6%, XYZ Co. 12-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on June 1 and December 1. Bought $200,000 of Simple Tree 5%, 20-year bonds at their face amount plus accrued interest of $2,500. The bonds pay interest semiannually on March 1 and September 1. Received semiannual interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Sold $15,000 of Simple Tree bonds at 102% plus accrued interest of $63. Received semiannual interest on the XYZ Co. bonds. Accrued $3,135 interest on the Simple Tree bonds. Accrued $175 interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Received semiannual interest on the XYZ Co. bonds. Received…arrow_forwardCrane Limited had $2.39 million of bonds payable outstanding and the unamortized premium for these bonds amounted to $44,600. Each $1,000 bond was convertible into 20 preferred shares. All bonds were then converted into preferred shares. The Contributed Surplus - Conversion Rights account had a balance of $21,500. Assume that the company follows IFRS. a. Assuming that the book value method was used, what entry would be made? Account Titles and Explanation Debit Credit b. Assume that Crane Ltd. offers $9,000 to induce early conversion. What journal entry would be made? Account Titles and Explanation Debit Creditarrow_forwardMead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 Sold all of the Johnson & Johnson bonds for $23,500. Sold all of the Mattel bonds for $35,850. April 15 July 5 July 22 August 19 Purchased Sara Lee notes for $13,500. Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara Lee notes for $9,750. November 1 Sold all of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education