FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Flint Inc. had the following

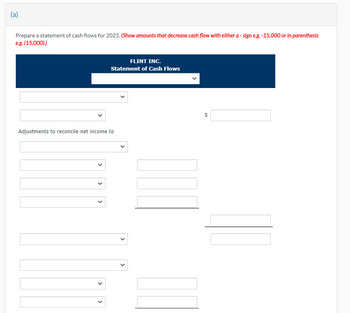

Transcribed Image Text:(a)

Prepare a statement of cash flows for 2025. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis

e.g. (15,000).)

Adjustments to reconcile net income to

>

<

FLINT INC.

Statement of Cash Flows

>

69

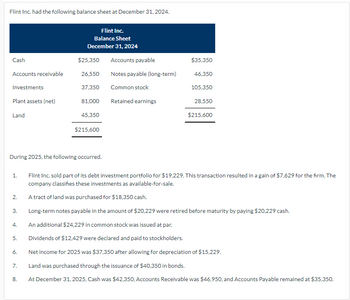

Transcribed Image Text:Flint Inc. had the following balance sheet at December 31, 2024.

Cash

Accounts receivable

Investments

Plant assets (net)

Land

1.

2.

During 2025, the following occurred.

3.

4.

5.

6.

7.

Flint Inc.

Balance Sheet

December 31, 2024

8.

$25,350

26,550

37,350

81,000 Retained earnings

45,350

$215,600

Accounts payable

Notes payable (long-term)

Common stock

$35,350

46,350

105,350

28,550

$215,600

Flint Inc. sold part of its debt investment portfolio for $19,229. This transaction resulted in a gain of $7,629 for the firm. The

company classifies these investments as available-for-sale.

A tract of land was purchased for $18,350 cash.

Long-term notes payable in the amount of $20,229 were retired before maturity by paying $20,229 cash.

An additional $24,229 in common stock was issued at par.

Dividends of $12,429 were declared and paid to stockholders.

Net income for 2025 was $37,350 after allowing for depreciation of $15,229.

Land was purchased through the issuance of $40,350 in bonds.

At December 31, 2025, Cash was $42,350, Accounts Receivable was $46,950, and Accounts Payable remained at $35,350.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare an unclassified

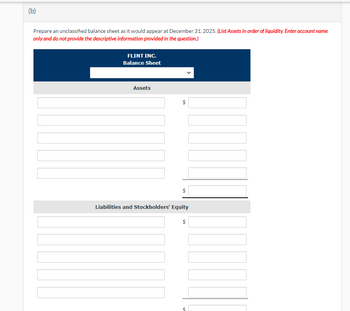

Transcribed Image Text:(b)

Prepare an unclassified balance sheet as it would appear at December 31, 2025. (List Assets in order of liquidity. Enter account name

only and do not provide the descriptive information provided in the question.)

FLINT INC.

Balance Sheet

Assets

$

$

Liabilities and Stockholders' Equity

$

tA

$

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare an unclassified

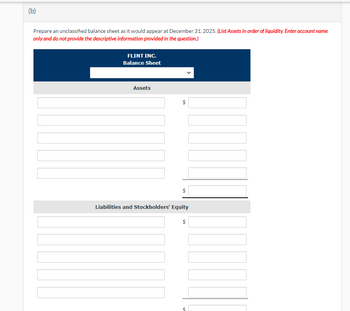

Transcribed Image Text:(b)

Prepare an unclassified balance sheet as it would appear at December 31, 2025. (List Assets in order of liquidity. Enter account name

only and do not provide the descriptive information provided in the question.)

FLINT INC.

Balance Sheet

Assets

$

$

Liabilities and Stockholders' Equity

$

tA

$

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Below are three independent scenarios concerning the GST account balance and the effect on the Statement of Financial Position in the previous year (2023) and the current year (2024). SFP as at 31/3/2023 Scenario 1 GST liability of $267 Scenario 2 GST asset of $267 Scenario 3 GST asset of $267 SFP as at 31/3/2024 GST asset of $769 GST asset of $769 GST liability of $769 Required: Correctly insert the opening and closing balances into the three independent GST general ledger accounts provided in the answer booklet. Balance each of the three GST general ledger accounts and insert the opening balance for 1 April 2024.arrow_forwardAllianze Ltd has the following data information as of 30 June 2022: Current assets of $ 6,970 Net fixed assets of $18,700 Current liabilities of $4,570 Long term debts of $9,490. Required: Calculate shareholders’ equity and prepare a balance sheet for the company for the period.arrow_forwardThe comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 116 $ 95 Accounts receivable 136 140 Short-term investment 47 14 Inventory 137 135 Land 102 125 Buildings and equipment 695 530 Less: Accumulated depreciation (193 ) (140 ) $ 1,040 899 Liabilities Accounts payable $ 40 $ 48 Salaries payable 2 6 Interest payable 8 5 Income tax payable 5 10 Notes payable 0 33 Bonds payable 296 230 Shareholders’ Equity Common stock 390 330 Paid-in capital—excess of par 187 165…arrow_forward

- Hancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forwardK McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forwardComparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2024 2023 2022 Balance at beginning of year $ 6,970,692 $ 5,584,452 $ 5,694,552 Net income (loss) 3,315,700 2,310,900 (110,100) Deductions: Stock dividend (35,400 shares) 249,000 Common shares retired, September 30 (140,000 shares) 219,660 Common stock cash dividends 896,950 705,000 0 Balance at end of year $ 9,140,442 $ 6,970,692 $ 5,584,452 At December 31, 2021, paid-in capital consisted of the following: Common stock, 1,910,000 shares at $1 par $ 1,910,000 Paid in capital—excess of par 7,490,000 No preferred stock or potential common shares were outstanding during any of the periods shown. Required: Compute Renn-Dever’s earnings per share as it would have appeared in income statements for the…arrow_forward

- Sonic Corporation recorded current assets of $345,200 and current liabilities of $318,650 for year 2020. Compute for Sonic's working capital for the year. Select one: a. $663,850 b. $26,550 O C. 92% d. 1.08arrow_forwardcarrow_forwardProblem 17-2A (Algo) Ratios, common-size statements, and trend percer [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 2021 $546,242 328,838 217,404 77,566 49,162 126,728 90,676 16,866 $ 73,810 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income KORBIN COMPANY Comparative Balance Sheets December 31 2020 $ 418,466 263,634 2021 % 154,832 57,748 36,825 94,573 60, 259 12,353 $ 47,906 % $61,141 0 113,547…arrow_forward

- Following are selected balance sheet accounts of Sheffield Bros. Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Selected balance sheet accounts Assets Accounts receivable Property, plant, and equipment Accumulated depreciation-plant assets Liabilities and stockholders' equity. Bonds payable Dividends payable Common stock, $1 par Additional paid-in capital Retained earnings Depreciation Gain on sale of equipment Net income Additional information: 1. 2. 3. (a) (b) (c) (d) 2020 $34,000 Proceeds from the sale of equipment. Cash dividends paid. 278,500 (176,300 ) (168,400) 2020 Redemption of bonds payable. $49,000 8,000 22,100 9,100 104,600 Selected income statement information for the year ended December 31, 2020: Sales revenue $154,400 38,100 2019 14,700 $24,100 30,900 249,400 2019 $45,900 5,100 18,900 3,000…arrow_forwardByrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forwardSplish Brothers Limited had the following statement of financial position for the current year, 2023: Current assets Investments Property, plant, and equipment Intangible assets Other assets SPLISH BROTHERS LIMITED Statement of Financial Position December 31, 2023 1. 2. $125,020 80,840 199,280 30,080 35,720 $470,940 Current liabilities Long-term liabilities Shareholders' equity $91,180 159,800 219,960 The following additional information is available and provides information regarding errors in classification which need to be corrected: to $470,940 Current Assets include the following: bank account with an overdraft balance of $14,100; inventory with a FIFO cost of $81,780 and a net realizable value of $79,900; accounts receivable of $62,040 less allowance for expected credit losses of $2,820. Investments include the following: a mortgage receivable from parent company $56,400, due in 2028; FV-NI investments held for trading with a cost of $9,400 and a fair value of $11,280; FV-OCI…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education