FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

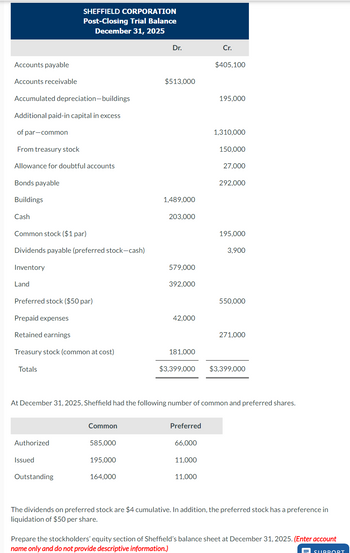

Transcribed Image Text:Accounts payable

Accounts receivable

Accumulated depreciation-buildings

Additional paid-in capital in excess

of par-common

From treasury stock

Allowance for doubtful accounts

Bonds payable

Buildings

Cash

Common stock ($1 par)

Dividends payable (preferred stock-cash)

Inventory

Land

SHEFFIELD CORPORATION

Post-Closing Trial Balance

December 31, 2025

Preferred stock ($50 par)

Prepaid expenses

Retained earnings

Treasury stock (common at cost)

Totals

Authorized

Issued

Outstanding

Common

585,000

195,000

Dr.

164,000

$513,000

1,489,000

203,000

579,000

392,000

42,000

181,000

$3,399,000

Preferred

66,000

11,000

Cr.

$405,100

At December 31, 2025, Sheffield had the following number of common and preferred shares.

11,000

195,000

1,310,000

150,000

27,000

292,000

195,000

3,900

550,000

271,000

$3,399,000

The dividends on preferred stock are $4 cumulative. In addition, the preferred stock has a preference in

liquidation of $50 per share.

Prepare the stockholders' equity section of Sheffield's balance sheet at December 31, 2025. (Enter account

name only and do not provide descriptive information.)

SURRORT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need some help with the stockholders equity section of my balance sheet. I have attached images of my spreadsheets (Balance sheet and inputs). I need to understand how to calculate the Paid-in capital in Excess of Common Stock and the Tresury Stock fields. My answer keeps getting bounced back.arrow_forwardFor a recent 2-year period, the balance sheet of Bramble Company showed the following stockholders' equity data at December 31 (in millions). Additional paid-in capital Common stock Retained earnings Treasury stock Total stockholders' equity Common stock shares issued Common stock shares authorized Treasury stock shares (a) Answer the following questions. 2025 Par value of common stock $ $900 663 7,200 1,764 221 500 2024 36 $810 654 $6,999 $5,878 5,310 896 218 500 28 1. What is the par value of the common stock? (Round par value to 2 decimal places, e.g. 3.15.)arrow_forwardLocate and download Gap Inc.’s 2020 Annual Report (for fiscal year 2/2/20-1/30/21) https://investors.gapinc.com/financial-information/default.aspx Shareholder’s Equity At 2/1/20: How many shares of common stock are: (a) authorized _______________ (b) issued _______________ (c) outstanding _______________ How many shares of preferred stock are: (a) authorized _______________ (b) issued _______________ (c) outstanding _______________ What was the amount of dividends paid to shareholders during 2020? _______________arrow_forward

- ! Required information [The following information applies to the questions displayed below.] National League Gear has two classes of stock authorized: 4%, $20 par preferred, and $5 par value common. The following transactions affect stockholders' equity during 2024, National League's first year of operations: February 2 February 4 June 15 August 15 November 1 Issue 1.4 million shares of common stock for $29 per share.. Issue 540,000 shares of preferred stock for $23 per share. Purchase 140,000 shares of its own common stock for $24 per share. Resell 105,000 shares of treasury stock for $39 per share. Declare a cash dividend on its common stock of $1.40 per share and a $432,000 (4 of par value) cash dividend on its preferred stock payable to all stockholders of record on November 15. (Hint: Dividends are not paid on treasury stock.) November 30 Pay the dividends declared on November 1. Required: 1. Record each of these transactions. (If no entry is required for a transaction/event,…arrow_forwardCH Sunland Corporation had the following information in its financial statements for the years ended 2025 and 2026: Cash dividends for the year 2026 $4700 Net income for the year 2026 97700 Market price of stock, 12/31/25 10 Market price of stock, 12/31/26 12 12 Common stockholders' equity, 12/31/25 1008000 Common stockholders' equity, 12/31/26 1192000 Outstanding shares, 12/31/26 100400 Preferred dividends for the year 2026 14000 What is the rate of return on common stock equity for Sunland Corporation for the year ended 12/31/2026? 7.6% O 6.6% 8.9% 07.0% eTextbook and Media W X SPM DELL 78°F Sunnyarrow_forwardIn 2021, Western Transport Company entered into the treasury stock transactions described below. In 2019, Western Transport had issued 130 million shares of its $1 par common stock at $13 per share. Required:Prepare the appropriate journal entry for each of the following transactions: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) On January 23, 2021, Western Transport reacquired 10 million shares at $16 per share. On September 3, 2021, Western Transport sold 5 million treasury shares at $17 per share. On November 4, 2021, Western Transport sold 5 million treasury shares at $14 per share.arrow_forward

- Question-based on, "calculate earnings". I have tried but no answer.arrow_forwardHansabenarrow_forwardSunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000. (a) Your answer is correct. Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. Allocation to preferred stock Allocation to common stock A 2021 4,800 0 LA 2022 7,000 6,600 2023 7,000 22,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education