Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

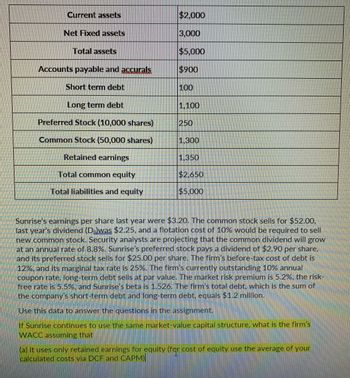

Transcribed Image Text:### Financial Overview of Sunrise Corporation

#### Balance Sheet Summary

**Assets:**

- **Current assets:** $2,000

- **Net fixed assets:** $3,000

- **Total assets:** $5,000

**Liabilities and Equity:**

- **Accounts payable and accruals:** $900

- **Short-term debt:** $100

- **Long-term debt:** $1,100

- **Preferred stock (10,000 shares):** $250

- **Common stock (50,000 shares):** $1,300

- **Retained earnings:** $1,350

- **Total common equity:** $2,650

- **Total liabilities and equity:** $5,000

#### Key Financial Information

- **Earnings per share (EPS) last year:** $3.20

- **Current stock price:** $52.00

- **Last year's dividend (D₀):** $2.25

- **Flotation cost for new common stock:** 10%

- **Projected dividend growth rate:** 8.8%

- **Preferred stock dividend:** $2.90 per share

- **Preferred stock price:** $25.00 per share

#### Tax and Market Data

- **Firm’s before-tax cost of debt:** 12%

- **Marginal tax rate:** 25%

- **Long-term debt coupon rate:** 10%

- **Market risk premium:** 5.2%

- **Risk-free rate:** 5.5%

- **Sunrise’s beta:** 1.526

- **Total debt (short-term + long-term):** $1.2 million

#### Task

Determine the firm’s Weighted Average Cost of Capital (WACC) given the following assumptions:

- **Current market-value capital structure is used.**

- **Equity source is only retained earnings.**

- Use the average of calculated equity costs via Discounted Cash Flow (DCF) and Capital Asset Pricing Model (CAPM) methods.

This comprehensive financial outline will assist in conducting further analysis and computations relevant to corporate finance studies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- The owners' equity accounts for Vulcano International are shown here: Common stock ($1 par value) Capital surplus Retained earnings Total owners' equity a. Assume the company's stock currently sells for $47 per share and a stock dividend of 8 percent is declared. How many new shares will be distributed? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. New shares issued $ 80,000 200,000 660,000 $ 940,000 Show the new balance for each equity account. Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Common stock Capital surplus Retained earnings Total owners' equityarrow_forwardCurrent assets Net Fixed assets Total assets Accounts payable and accurals. Short term debt Long term debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $2,000 3,000 $5,000 $900 100 1,100 250 1,300 1,350 $2,650 $5,000 Sunrise's earnings per share last year were $3.20. The common stock sells for $52.00, last year's dividend (D.)was $2.25, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 8.8%. Sunrise's preferred stock pays a dividend of $2.90 per share, and its preferred stock sells for $25.00 per share. The firm's before-tax of debt is 12%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5.2%, the risk- free rate is 5.5%, and Sunrise's beta is 1.526. The firm's total debt, which is the sum of…arrow_forwardCurrent assets Net Fixed assets Total assets Accounts payable and accurals. Short term debt Long term debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $2,000 3,000 $5,000 $900 100 1,100 250 1,300 1,350 $2,650 $5,000 Sunrise's earnings per share last year were $3.20. The common stock sells for $52.00, last year's dividend (Do)was $2.25, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 8.8%. Sunrise's preferred stock pays a dividend of $2.90 per share, and its preferred stock sells for $25.00 per share. The firm's before-tax cost of debt is 12%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5.2%, the risk- free rate is 5.5%, and Sunrise's beta is 1.526. The firm's total debt, which is the…arrow_forward

- Preferred shares, $4.55 non-cumulative, 52,000 shares authorized and issued* $ 3,328,000 Common shares, 87,000 shares authorized and issued* 1,392,000 *All shares were issued during 2018. 2. Calculate the dividends paid per share to both the preferred and the common shares in 2020 assuming preferred shares are cumulative. (Round the final answers to 2 decimal places.)arrow_forwardhello please give answerarrow_forwardThe company with the common equity accounts shown here has declared a 12 percent stock dividend at a time when the market value of its stock is $59 per share. Common stock ($1 par value) $ 400,000 Capital surplus 1,572,000 Retained earnings 3,864,000 Total owners’ equity $ 5,836,000 Show the new equity account balances after the stock dividend distributionarrow_forward

- Based on the information given below on Harmony Incorporated calculate the following: 1) Net Income; 2) Change to Retained Earnings; 3) EPS; 4) Dividends Per Share: 5) Dividend Yield EBIT Interest expense Tax 25,000,000 40% Preferred shares outstanding&div 200,000 ($8 each) Common shares outstanding Dividend Payout ratio Current stock price 2,000,000 50% $30arrow_forwardThe market value balance sheet for Briggs Manufacturing is shown here. The company has declared a 20 percent stock dividend. The stock goes ex dividend tomorrow (the chronology for a stock dividend is similar to that for a cash dividend). There are 28,000 shares of stock outstanding. Market Value Balance Sheet Cash $ 181,000 Debt $ 353,800 Fixed assets 1,080,000 Equity 907,200 Total $ 1,261,000 Total $ 1,261,000 What will the ex-dividend price be?arrow_forwardHolland Corporation's annual report is as follows. March 31, 2023 March 31, 2024 Net Income $359,000 $438,500 Preferred Dividends 0 0 Total Stockholders' Equity $4,230,000 $5,252,000 Stockholders' Equity attributable to Preferred Stock 0 0 Number of Common Shares Outstanding 288,000 202,000 Based on the information provided, find the rate of return on common stockholders' equity on March 31, 2024. (Round your final answer two decimal places.)arrow_forward

- Identifying and Analyzing Financial Statement Effects of Cash Dividends On March 15, 2018, Bank of America issued 94,000 shares of 5.875% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series FF for $2.35 billion. Dividends are payable semiannually on or about March 15 and September 15. a. Assume the stock was issued at face value. What is the face value of each Series FF share? $ 25,000 b. What will be the total dividend for the year ended December 31, 2018, assuming that the number of shares remains unchanged? Enter answer in millions. Round answer to the nearest million. $ 110 × millionarrow_forwardGordon Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for $12.00 per share. Common Stock, $10 Par, 103,000 shares authorized, 58,000 shares issued and outstanding $580,000 Paid-in Capital in Excess of Par—Common 125,000 Retained Earnings 302,000 Total Stockholders' Equity $1,007,000 What would be the total stockholders' equity after a 15% common stock dividend?arrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 59 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $2,490,300 $2,110,600 Net income 532,000 432,300 Dividends: On preferred stock (7,000) (7,000) On common stock (45,600) (45,600) Retained earnings, December 31 $2,969,700 $2,490,300 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,055,050 $2,814,770 Cost of merchandise sold 1,160,700 1,067,840 Gross profit $1,894,350 $1,746,930 Selling expenses $610,240 $744,410 Administrative expenses 519,840 437,200 Total operating expenses $1,130,080 $1,181,610 Income from operations $764,270 $565,320 Other revenue and expense:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education