FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

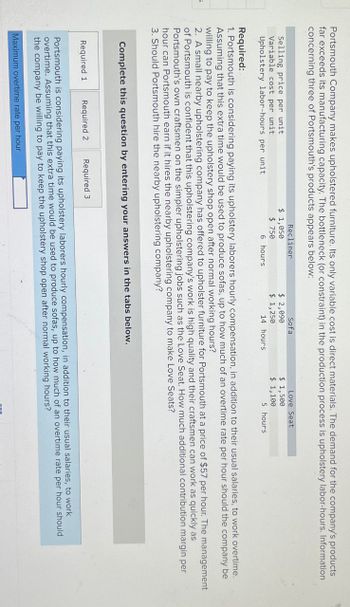

Transcribed Image Text:Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products

far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information

concerning three of Portsmouth's products appears below:

Recliner

Sofa

Love Seat

Selling price per unit

$ 1,050

Variable cost per unit

Upholstery labor-hours per unit

$ 750

$ 2,090

$ 1,250

$ 1,500

$ 1,100

6 hours

14 hours

5 hours

Required:

1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime.

Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be

willing to pay to keep the upholstery shop open after normal working hours?

2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $57 per hour. The management

of Portsmouth is confident that this upholstering company's work is high quality and their craftsmen can work as quickly as

Portsmouth's own craftsmen on the simpler upholstering jobs such as the Love Seat. How much additional contribution margin per

hour can Portsmouth earn if it hires the nearby upholstering company to make Love Seats?

3. Should Portsmouth hire the nearby upholstering company?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work

overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should

the company be willing to pay to keep the upholstery shop open after normal working hours?

Maximum overtime rate per hour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required 1 Required 2 Recliner $ 1,462 $ 850 Required 3 Maximum overtime rate per hour 9 hours Sofa $ 2,060 $ 1,400 Required: 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $52 per hour. The management of…arrow_forwardThe constraint at Pickrel Corporation is time on a particular machine. The company makes three products that use this machine. Data concerning those products appear below: 9. VD JT SM Selling price per unit Variable cost per unit Minutes on the constraint $344.85 $415.40 $119.32 $270.18 $310.88 $ 91.96 Sklpped 5.70 6.70 1.90 Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be emphasized. (Round your Intermedlate calculations to 2 declmal places.) Multiple Cholce JT, SM, VD JT. VD, SM VD, SM, JT SM, VD, JT Mc Graw < Prev 9 of 9 Next 68°F Mostly cloudy Type here to search DELLarrow_forwardDavis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company's normal volume of 6,000 units per month are shown in the following table. Unit manufacturing costs Variable materials Variable labor Variable overhead Fixed overhead Total unit manufacturing costs Unit marketing costs Variable Fixed Total unit marketing costs Total unit costs. $ 41 66 16 51 16 61 $ 174 77 $ 251 Unless otherwise stated, assume that no connection exists between the situation described in each question; each is independent. Unless otherwise stated, assume a regular selling price of $408 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the question itself. Required: a. Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the price were cut from $408 to $363 per unit. Assuming that the cost behavior patterns implied by the data in the…arrow_forward

- Subject: acountingarrow_forwardEstela Company produces skateboards and scooters. Their per unit selling prices and variable costs follow. Skateboards require 2 machine hours per unit. Scooters require 3 machine hours per unit. Selling price per unit Skateboards $ 200 Scooters) $ 400 120 310 Variable costs per unit (a) Compute the contribution margin per unit (b) Compute the contribution margin per machine hour (a) Contribution margin pet und Contion margm per machine hour Skateboards Scootersarrow_forwardThe Rosa model of Mohave Corporation is currently manufactured as a very plain umbrella with no decoration. The company is considering changing this product to a much more decorative model by adding a silk-screened design and embellishments. A summary of the expected costs and revenues for Mohave's two options follows: Estimated demand Estimated sales price Estimated manufacturing cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Additional development cost Rosa Umbrella 29,000 units $31.00 $ 21.50 4.50 3.50 6.00 $ 35.50 Decorated Umbrella 29,000 units $ 41.00 $ 23.50 7.00 5.50 6.00 $ 42.00 $ 12,000 Required: 1. Determine the increase or decrease in profit if Mohave sells the Rosa Umbrella with the additional decorations. 2. Should Mohave add decorations to the Rosa umbrella? 3-a.Suppose the higher price of the decorated umbrella is expected to reduce estimated demand for this product to 27,000 units.…arrow_forward

- Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required 1 Required 2 Required 3 Recliner $ 1,184 $ 800 Complete this question by entering your answers in the tabs below. Additional contribution margin per hour Required: 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for…arrow_forwardAnswerarrow_forwardPortsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required: Recliner Sofa Love Seat $ 1,254 $ 750 $ 2,065 $ 1,250 $ 1,350 $ 900 9 hours 13 hours 5 hours 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $50 per hour. The management of Portsmouth is…arrow_forward

- Any manufacturing company has costs which include fixed costs such as plant overhead, product design, setup, and promotion; and variable costs that depend on the number of items produced. The revenue is the amount of money received from the sale of its product. The company breaks even if the revenue is equal to the cost. A company manufactures dog leashes that sell for $18.13, including shipping and handling. The monthly fixed costs (advertising, rent, etc.) are $22,920 and the variable costs (materials, shipping, etc.) are $9.78 per leash. How many leashes must be produced and sold each month for the company to break even? leashes. Round to the nearest leash.arrow_forwardSurf Company can sell all of the two surfboard models it produces, but it has only 400 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $200 for Glide and $300 for Ultra. (e) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Complete this question by entering your answers in the tabs below. Required A Required B Compute the contribution margin per direct labor hour for each product. Contribution margin per direct labor hour Glide Ultra Required B > Darrow_forwardPina Colada Racers makes bicycles. It has always purchased its bicycle tires from the Ivanhoe Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials Direct labor Variable manufacturing overhead Total relevant cost $8 $4 The company's fixed expenses would increase by $63,000 per year if managers decided to make the tire. (a1) Calculate total relevant cost to make or buy if the company needs 10,300 tires a year. Make $7 $ Buyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education