FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

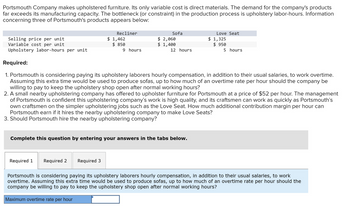

Transcribed Image Text:Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products

far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information

concerning three of Portsmouth's products appears below:

Selling price per unit

Variable cost per unit

Upholstery labor-hours per unit

Required 1 Required 2

Recliner

$ 1,462

$ 850

Required 3

Maximum overtime rate per hour

9 hours

Sofa

$ 2,060

$ 1,400

Required:

1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime.

Assuming this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be

willing to pay to keep the upholstery shop open after normal working hours?

2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $52 per hour. The management

of Portsmouth is confident this upholstering company's work is high quality, and its craftsmen can work as quickly as Portsmouth's

own craftsmen on the simpler upholstering jobs such as the Love Seat. How much additional contribution margin per hour can

Portsmouth earn if it hires the nearby upholstering company to make Love Seats?

3. Should Portsmouth hire the nearby upholstering company?

Complete this question by entering your answers in the tabs below.

12 hours

Love Seat

$ 1,325

$950

5 hours

Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work

overtime. Assuming this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the

company be willing to pay to keep the upholstery shop open after normal working hours?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Windu Enterprises uses a manufacturing process that is very labor intensive to manufacture its multicolored laser vegetable slicers. Windu is considering a change to a more automated manufacturing process. The cost structure information for Windu's options are listed below. Windu sells its only product for $25 per unit. Costs Fixed Manufacturing Costs Variable Manufacturing Cost per unit Current Method $180,000 $15 Automated Method $240,000 $13 Required. 1. Compute the breakeven points for both production methods 2. Compute the point of indifference for these two production methods (i.e. at what number of units of production will income be equal for both methods?) 3. Calculate the Operating Leverage Factor for both methods at the point of indifference + 4. If Windu's management intends to produce and sell 35,000 units, which production method should they use? 5. By how much per unit (nearest $.01) would the current method's variable cost need to decrease in order for management to be…arrow_forwardCordova manufactures three types of stained glass window, cleverly named Products A, B, and C. Information about these products follows: Sales price Variable costs per unit Fixed costs per unit Required number of labor hours Product A Product B Product C Cordova currently is limited to 50,000 labor hours per month. Required: Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour. (Round your answers to 2 decimal places.) Contribution Margin Product B Ⓒ Product C O Product A Product A Product B Product C $46.00 $56.00 $86.00 22.00 12.25 38.00 8.00 8.00 2.50 4.00 $ $ $ 8.00 1.50 14.67 CM per DL hour 13.12 CM per DL hour 15.25 CM per DL hour Which product would be Cordova's first choice to produce?arrow_forwardPiedmont Fasteners Corporation makes three different clothing fasteners in its manufacturing facility in North Carolina. All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an unacceptable number of customers. Data from the most recent period concerning these products appear below: Annual sales volume Velcro 101,800 Metal 203,600 Nylon 407,200 Unit selling price $ 1.65 $ 1.50 $ 0.85 Variable expense per unit $ 1.25 $ 0.70 Contribution margin per unit $ 0.40 $ 0.80 $ 0.25 $ 0.60 Total fixed expenses are $407,200 per period. Of the total fixed expenses, $20,000 could be avoided if the Velcro product is dropped, $80,000 if the Metal product is dropped, and $60,000 if the Nylon product is dropped. The remaining fixed expenses of $247,200 consist of common fixed expenses such as administrative salaries and rent on the factory building that could be avoided only by going out of business entirely. The company's managers would like…arrow_forward

- Subject: acountingarrow_forwardPortsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Recliner Sofa Love Seat Selling price per unit $ 1,158 $ 1,950 $ 1,400 Variable cost per unit $ 750 $ 1,300 $ 1,000 Upholstery labor-hours per unit 6 hours 13 hours 5 hours Required: Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $45 per hour. The management of…arrow_forwardPiedmont Fasteners Corporation makes three different clothing fasteners in its manufacturing facility in North Carolina. All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an unacceptable number of customers. Data from the most recent period concerning these products appear below: Annual sales volume Unit selling price Variable expense per unit Contribution margin per unit Velcro 101,800 $ 1.65 $ 1.25 $ 0.40 Metal 203,600 $ 1.50 $ 0.70 $ 0.80 Nylon 407, 200 $ 0.85 $ 0.25 $ 0.60 Total fixed expenses are $407,200 per period. Of the total fixed expenses, $20,000 could be avoided if the Velcro product is dropped, $80,000 if the Metal product is dropped, and $60,000 if the Nylon product is dropped. The remaining fixed expenses of $247,200 consist of common fixed expenses such as administrative salaries and rent on the factory building that could be avoided only by going out of business. The company's managers would like to…arrow_forward

- karan subject-Accountingarrow_forwardPortsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required 1 Required 2 Required 3 Recliner $ 1,184 $ 800 Complete this question by entering your answers in the tabs below. Additional contribution margin per hour Required: 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for…arrow_forwardPortsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required: Recliner Sofa Love Seat $ 1,254 $ 750 $ 2,065 $ 1,250 $ 1,350 $ 900 9 hours 13 hours 5 hours 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $50 per hour. The management of Portsmouth is…arrow_forward

- The Rosa model of Mohave Corporation is currently manufactured as a very plain umbrella with no decoration. The company is considering changing this product to a much more decorative model by adding a silk-screened design and embellishments. A summary of the expected costs and revenues for Mohave’s two options follows: Rosa Umbrella Decorated Umbrella Estimated demand 11,000 units 11,000 units Estimated sales price $ 9.00 $ 20.00 Estimated manufacturing cost per unit Direct materials $ 3.50 $ 5.50 Direct labor 1.50 4.00 Variable manufacturing overhead 0.50 2.50 Fixed manufacturing overhead 2.00 2.00 Unit manufacturing cost $ 7.50 $ 14.00 Additional development cost $ 11,000 Required: 1. Determine the increase or decrease in profit if Mohave sells the Rosa Umbrella with the additional decorations. 2. Should Mohave add decorations to the Rosa umbrella? 3-a.Suppose the higher price of the decorated umbrella is expected to…arrow_forward4. Prepare a trial balance using the balances in your general ledger accounts. 5. Prepare an income statement, statement of changes in equity, and balance sheet based on your trial balance. please answer all requirements with all working or skip/leave answer in text remember answer allarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education