FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:**Question 5.2**

Calculate the total weighted average contribution margin per unit if Dog Access sells its products based on the sales mix of 80% Large doors and 20% Small doors. **NOTE:** Enter only the number of dollars, do not enter the dollar, "$", symbol. Therefore if your answer is "$10", enter only "10".

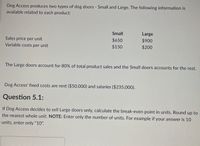

Transcribed Image Text:**Dog Access Production Information**

Dog Access produces two types of dog doors - Small and Large. The following information is available related to each product:

| | Small | Large |

|---------------------------|-------|-------|

| **Sales price per unit** | $650 | $900 |

| **Variable costs per unit** | $150 | $200 |

- The Large doors account for 80% of total product sales, and the Small doors account for the rest.

- Dog Access' fixed costs are rent ($50,000) and salaries ($235,000).

**Question 5.1:**

If Dog Access decides to sell Large doors only, calculate the break-even point in units. Round up to the nearest whole unit.

**NOTE:** Enter only the number of units. For example, if your answer is 10 units, enter only "10".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your Company sells 3 products, A, B and C that use the same company, facility and resources. Details are below: A Average monthly units sold 10,000 2,000 8,000 Sales price per unit 2,000 1,000 5,000 Variable cost per unit 1,500 500 3,000 Total break even units are 1,000. 1. Calculate: i. Quantity and value of units of each A, B and C at breakeven Fixed cost based on the data given above ii. 2. Without making further calculations, explain that if fixed cost increases by 10% what impact would this have on the break-even point?arrow_forwardPlease help me with show all calculation thankuarrow_forwardPierson Pet Products produces two models of dog beds: Basic and Custom. Price, cost and expected sales volume data for the two models are as follows: Selling price per bed Variable cost per bed Expected sales (beds) The total fixed costs for the company are $403,200. Basic $24.00 $ 17.00 66,000 Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. c. If the product sales mix were to change to three Basic beds for each Custom bed, what would be the new break-even volume? Required A Required B Complete this question by entering your answers in the tabs below. Custom $ 59.00 $38.00 44,000 Basic beds Custom beds Required C Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. Note: In your computations, round up the total units to break-even to the nearest whole number and round other intermediate…arrow_forward

- Please do not give solution in image format thankuarrow_forwardRundle Corporation sells products for $28 each that have variable costs of $11 per unit. Rundle's annual fixed cost is $404,600. Mc Graw Hill mou Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Break-even point in units Break-even point in dollarsarrow_forwardMia Enterprises sells a product for $90 per unit. The variable cost is $40 per unit, while fixed costs are $75,000. Determine the:a. Break-even point in sales units fill in the blank 1 of 2 unitsb. Determine the break-even point in sales units if the selling price increased to $100 per unit $ per unit fill in the blank 2 of 2 unitsarrow_forward

- Sarafine, Inc. sells a single product for $25. Variable costs are $12 per unit and fixed costs total $130,000 at a volume level of 5,000 units. Assuming that fixed costs do not change, Sarafine's break-even sales would be: Mutiple Choice $210.000. $250.000. $350.000 $530.000 None of the answers is comectarrow_forwardThe Atlantic Company sells a product with a break-even point of 4,369 sales units. The variable cost is $65 per unit, and fixed costs are $144,177. Determine the unit sales price. Round answer to nearest whole number.$fill in the blank 1 Determine the break-even point in sales units if the company desires a target profit of $39,204. Round answer to the nearest whole number.fill in the blank 2 unitsarrow_forwardGladstorm Enterprises sells a product for $50 per unit. The variable cost is $32 per unit, while fixed costs are $16,200. Determine the following: Round your answers to the nearest whole number. a. Break-even point in sales units fill in the blank 1 units b. Break-even point in sales units if the selling price increased to $62 per unit fill in the blank 2 unitsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education