FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

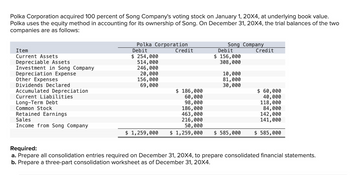

Transcribed Image Text:Polka Corporation acquired 100 percent of Song Company's voting stock on January 1, 20X4, at underlying book value.

Polka uses the equity method in accounting for its ownership of Song. On December 31, 20X4, the trial balances of the two

companies are as follows:

Item

Current Assets

Depreciable Assets

Investment in Song Company

Depreciation Expense

Other Expenses

Dividends Declared

Accumulated Depreciation

Current Liabilities

Long-Term Debt

Common Stock

Retained Earnings

Sales

Income from Song Company

Polka Corporation

Debit

$ 254,000

514,000

246,000

20,000

156,000

69,000

Credit

Song Company

Debit

$ 156,000

308,000

10,000

81,000

30,000

Credit

$ 60,000

40,000

118,000

84,000

142,000

141,000

$ 186,000

60,000

98,000

186,000

463,000

216,000

50,000

$ 1,259,000 $ 1,259,000 $ 585,000 $ 585,000

Required:

a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements.

b. Prepare a three-part consolidation worksheet as of December 31, 20X4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Johannes Inc. acquired 80 percent of Corner Brook Ltd. common shares on January 1, Year 4, for $744,000. At that date, the fair value of the non-controlling Interest was $186,000. Corner Brook's balance sheet contained the following amounts at the time of the combination: Cash Accounts Receivable Inventory Construction Work in Progress Other Assets (net) Total Assets 66,000 140,000 40,000 Accounts Payable $ 106,000 Bonds Payable 610,000 950,000 Common Shares ($10 par value) Retained Earnings 400,000 530,000 450,000 $1,646,000 $ 1,646,000 Total Liabilities & Equities During each of the next three years, Corner Brook reported net income of $120,000 and paid dividends of $60,000. On January 1, Year 6, Johannes sold 8,800 of the Corner Brook shares for $260,000 in cash. Johannes used the equity method in accounting for its ownership of Corner Brook. Required: (a) Compute the balance in the Investment account reported by Johannes on January 1, Year 6, before its sale of shares. (Omit $ sign…arrow_forwardOn the 1/01/x3, J Group acquired 2 025 000 of the 4 500 000 ordinary R1 shares in Entity PA for R5 695 000. At acquisition, PA had retained earnings of R1 400 000. When preparing the J Group's consolidated financial statements for the year end date of 31/12/x3, accountants at the group entity are working with the following information: In the x3 financial year, Entity PA made a profit after tax of R 1 230 000; In the x3 financial year, PA paid a dividend totaling R45 000 to its shareholders; At the end of the x3 financial year, the group's investment in PA is found to have impaired by R94 000. Based on this information, calculate the group's investment in associate figure, in its consolidated financial statements dated 31/12/x3.arrow_forwardOn the 1/01/x3, J Group acquired 2 025 000 of the 4 500 000 ordinary R1 shares in Entity PA for R5 695 000. At acquisition, PA had retained earnings of R1 400 000. When preparing the J Group's consolidated financial statements for the year end date of 31/12/x3, accountants at the group entity are working with the following information: In the x3 financial year, Entity PA made a profit after tax of R 1 230 000; In the x3 financial year, PA paid a dividend totaling R45 000 to its shareholders; At the end of the x3 financial year, the group's investment in PA is found to have impaired by R94 000. Based on this information, calculate the group's investment in associate figure, in its consolidated financial statements dated 31/12/x3.arrow_forward

- Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $52,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows: Item Current Assets Depreciable Assets Investment in Spirited Company Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company $ Proud Corporation Debit 255,000 518,000 133,280 23,000 148,000 53,000 Credit $ 200,000 63,000 127,880 193,000 277,000 231,000 38,400 $1,130,280 $1,130,280 Spirited Company Credit Debit $169,000 311,000 13,000 85,000 25,400 $603,400 $ 78,000 43,000 192,400 87,000…arrow_forwardJam Ltd acquired all the equity in Cab Ltd on 31 December 20X4 for $360 000. At the control date, the equity of Cab was recorded as Paid-up capital of $260 000 and Retained profits of $30 000. The purchase price was based on the agreed fair values of Cab's identifiable assets and liabilities on that date. The following items were not at fair value in Cab's financial statements on the control date. Inventory Property (Cost of $250 000, Accumulated depreciation of $40 000) Carrying amount ($) 32 000 210 000 Fair value ($) 24 000 252 000 Other information: • Both Cab and the group entity account for its property by the cost model, and apply straight-line depreciation to the property. The property in Cab Ltd is expected to have a remaining life of 21 years from 31 December 20X4, and no residual value. Cab sold goods to Jam for $5,000 during FY20X5, the cost of these inventories was 4,000. All these inventories were still on hand by Jam by 31 December 20X5, the year-end. . Required: Prepare…arrow_forwardOn January 1, 2019, Monica Company acquired 80 percent of Young Company's outstanding common stock for $744,000. The fair value of the noncontrolling interest at the acquisition date was $186,000. Young reported stockholders' equity accounts on that date as follows: Common stock-$10 par value Additional paid-in capital Retained earnings In establishing the acquisition value, Monica appraised Young's assets and ascertained that the accounting records undervalued a building (with a five-year remaining life) by $90,000. Any remaining excess acquisition-date fair value was allocated to a franchise agreement to be amortized over 10 years. $ 300,000 50,000 450,000 During the subsequent years, Young sold Monica inventory at a 20 percent gross profit rate. Monica consistently resold this merchandise in the year of acquisition or in the period immediately following. Transfers for the three years after this business combination was created amounted to the following: Year 2019 2020 2021 Transfer…arrow_forward

- On January 1, 2010, A Corporation acquired 80% of ordinary shares of G Company at fair value of net assets acquired. All assets of G company are fairly valued except for a blue office equipment with book value of P2,100,000 and fair value of P1,400,000. On June 30, 2010, G Company sold the said blue office equipment to A Corporation at a selling price of P3,000,000. On June 30, 2010, the remaining useful life of the blue equipment is 3 years. On October 1, 2010, A Corporation sold a 2-year-old red office equipment to G Company for P2,800,000 at a gain of P400,000. On October 1, 2010, the remaining useful life of the red equipment is 4 years. What is the consolidated book value of equipment on December 31, 2010, respectively? Ans. 3,250,000 (Show solution)arrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, fr $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies Included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation. Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Professor Corporation $ 50,300 90,000 Scholar Corporation $21,000 44,000 130,000 75,000 60,000 30,000 410,000 250,000 (150,000) (80,000) 102,200 $ 692,500 $340,000 $ 152,500 $ 35,000 250,000 180,000 80,000 40,000 210,000 85,000 $ 692,500 $340,000 At the date of the business combination, the book values of Scholar's assets and liabilities approximated fair value except for Inventory, which had a fair value of $81,000, and…arrow_forwardOn January 1 Criquet Co. acquired an interest in the Tamlee Co. for $500,000. At December 31, Tamlee Co. declared and paid a cash dividend of $50,000 and reported a net income of $160,000. REQUIRED: Prepare the journal entries for the Criquet Co. under each of the independent circumstances: 1. Criquet Co. acquires a 10% interest in the Tamlee Co. 2. Criquet Co. acquires a 25% interest in the Tamlee Co.arrow_forward

- Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisitior fair value of the noncontrolling Interest was equal to 25 percent of Saul's book value. The balance sheets of the two companies fc January 1, 20X1, are as follows: Cash Accounts Receivable. Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Saul Corporation Total Assets PENNY MANUFACTURING COMPANY Balance Sheet January 1, 20x1 Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Total Assets $ 231,500 Accounts Payable 75,000 Bonds Payable. 113,000 Common Stock 618,000 Additional Paid-In Capital (139,000) Retained Earnings 233,250 $ 1,131,758 Total Liabilities and Equities $ 159,750 380,000 181,000 31,000 380,000 $ 1,131,750 SAUL CORPORATION Balance Sheet January 1, 20x1 $ 61,000 Accounts Payable 115,000 Bonds Payable 193,000 Common Stock ($10 par) 618,000 Additional Paid-In Capital (239,000)…arrow_forwardPeanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $310,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $345,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 174,000 181,000 211,000 353,700 206,000 707,000 187,000 41,000 220,000 89.000 $2,369,700 Credit $450,000 63,000 188,000 492,000 313,900 789,000 73.800 $2,369,700 Snoopy Company Debit $ 87,000 82,000 76,000 95,000 188,000 120,000 9,000 27,000 34,000 $718,000 Credit $18,000 48,000 69,000 196,000 149,000 238,000 0 $718,000 Required: a. Prepare any equity…arrow_forwardGadubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education