FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

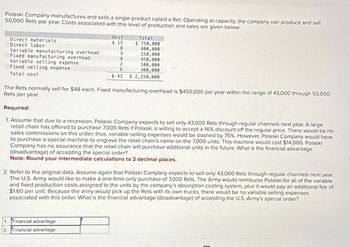

Transcribed Image Text:Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell

50,000 Rets per year. Costs associated with this level of production and sales are given below:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

Fixed selling expense

Total cost

Unit

$ 15

Total

$ 750,000

8

400,000

3

150,000

9

450,000

2

100,000

6

300,000

$ 43

$ 2,150,000

The Rets normally sell for $48 each. Fixed manufacturing overhead is $450,000 per year within the range of 43,000 through 50,000

Rets per year.

Required:

1. Assume that due to a recession, Polaski Company expects to sell only 43,000 Rets through regular channels next year. A large

retail chain has offered to purchase 7,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no

sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have

to purchase a special machine to engrave the retail chain's name on the 7,000 units. This machine would cost $14,000. Polaski

Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage

(disadvantage) of accepting the special order?

Note: Round your intermediate calculations to 2 decimal places.

2. Refer to the original data. Assume again that Polaski Company expects to sell only 43,000 Rets through regular channels next year.

The U.S. Army would like to make a one-time-only purchase of 7,000 Rets. The Army would reimburse Polaski for all of the variable

and fixed production costs assigned to the units by the company's absorption costing system, plus it would pay an additional fee of

$1.60 per unit. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses

associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

1. Financial advantage

2. Financial advantage

www

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 36,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 20 $ 720,000 Direct labor 10 360,000 Variable manufacturing overhead 3 108,000 Fixed manufacturing overhead 9 324,000 Variable selling expense 2 72,000 Fixed selling expense 6 216,000 Total cost $ 50 $ 1,800,000 The Rets normally sell for $55 each. Fixed manufacturing overhead is $324,000 per year within the range of 31,000 through 36,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 31,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by…arrow_forwardThe Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per year. Per unit costs to produce and sell one Hom at that activity level are: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense S $20 $10 $5 $7 O $23,200 decrease $27,000 Increase $50,800 Increase O $63,000 Increase $10 $8 The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 6,300 Homs next year at 20% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 30%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $10,800 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the…arrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 32,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 20 $ 640,000 Direct labor 6 192,000 Variable manufacturing overhead 3 96,000 Fixed manufacturing overhead 9 288,000 Variable selling expense 4 128,000 Fixed selling expense 6 192,000 Total cost $ 48 $ 1,536,000 The Rets normally sell for $53 each. Fixed manufacturing overhead is $288,000 per year within the range of 23,000 through 32,000 Rets per year. Required: Assume due to a recession, Polaski Company expects to sell only 23,000 Rets through regular channels next year. A large retail chain offered to purchase 9,000 Rets if Polaski will accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company…arrow_forward

- Ahrends Corporation makes 46,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost $ 14.30 23.90 3.00 28.30 $69.50 An outside supplier has offered to sell the company all of these parts it needs for $55.80 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $368,000 per year If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $24.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products What…arrow_forwardDengerarrow_forwardAhrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct materials Direct labor Variable manufacturing overhead. Fixed manufacturing overhead Unit product cost $ 17.80 19.00 1.00 17.10 $ 54.90 An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.…arrow_forward

- Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 32,000 Rets per year. Costs associated with this level of production and sales are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense Total cost Unit $ 15 6 3 5 160,000 4 128,000 192,000 6 $ 39 $ 1,248,000 Total $ 480,000 192,000 96,000 The Rets normally sell for $44 each. Fixed manufacturing overhead is $160,000 per year within the range of 25,000 through 32,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 25,000 Rets through regular channels next year. A large retail chain has offered to purchase 7,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company…arrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 50,000 Rets per year. Costs associated with this level of production and sales are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense Total cost Unit $ 20 Total $1,000,000 8 400,000 3 150,000 9 450,000 4 200,000 6 300,000 $50 $2,500,000 The Rets normally sell for $55 each. Fixed manufacturing overhead is $450,000 per year within the range of 41,000 through 50,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 41,000 Rets through regular channels next year. A large retail chain has offered to purchase 9,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education