FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

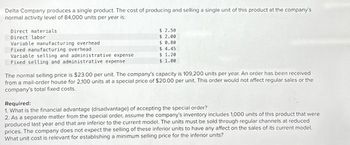

Transcribed Image Text:Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's

normal activity level of 84,000 units per year is:

Direct materials

Direct labor

Variable manufacturing overhead.

Fixed manufacturing overhead

Variable selling and administrative expense

Fixed selling and administrative expense

$ 2.50

$ 2.00

$ 0.80

$ 4.45

$ 1.20

$ 1.00

The normal selling price is $23.00 per unit. The company's capacity is 109,200 units per year. An order has been received

from a mail-order house for 2,100 units at a special price of $20.00 per unit. This order would not affect regular sales or the

company's total fixed costs.

Required:

1. What is the financial advantage (disadvantage) of accepting the special order?

2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were

produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced

prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model.

What unit cost is relevant for establishing a minimum selling price for the inferior units?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 105,600 units per year is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses The normal selling price is $19.00 per unit. The company's capacity is 123,600 units per year. An order has been received from a mail- order house for 1,500 units at a special price of $16.00 per unit. This order would not affect regular sales or the company's total fixed costs. $ 1.80 $3.00 $ 0.60 $4.25 $ 1.80 $2.00 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels…arrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60,000 units per year is: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs. $ 5.10 $ 3.80 $ 1.00 $ 4.20 $ 1.50 $ 2.40 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior…arrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 86,400 units per year is: Direct materials Direct labor. Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $1.50 $ 2.00 $0.90 $ 5.15 $1.10 $ 1.00 The normal selling price is $20.00 per unit. The company's capacity is 102,000 units per year. An order has been received from a mail- order house for 1,300 units at a special price of $1700 per unit. This order would not affect regular sales or total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, sume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior…arrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 87,600 units per year is: Direct materials Direct labor Variable manufacturing overhead Fixed nanufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $2.40 5 3.00 5 0.80 $ 4.15 $ 1.70 $ 2.00 The normal selling price is $22.00 per unit. The company's capacity is 120,000 units per year. An order has been received from a mail- order house for 2,700 units at a special price of $19.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantege (disadvantage) of accepting the special order?arrow_forwardUrmilabenarrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 36,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 20 $ 720,000 Direct labor 10 360,000 Variable manufacturing overhead 3 108,000 Fixed manufacturing overhead 9 324,000 Variable selling expense 2 72,000 Fixed selling expense 6 216,000 Total cost $ 50 $ 1,800,000 The Rets normally sell for $55 each. Fixed manufacturing overhead is $324,000 per year within the range of 31,000 through 36,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 31,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by…arrow_forward

- The Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per year. Per unit costs to produce and sell one Hom at that activity level are: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense S $20 $10 $5 $7 O $23,200 decrease $27,000 Increase $50,800 Increase O $63,000 Increase $10 $8 The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 6,300 Homs next year at 20% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 30%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $10,800 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the…arrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company’s normal activity level of 106,800 units per year is: Direct materials $ 1.70 Direct labor $ 3.00 Variable manufacturing overhead $ 0.80 Fixed manufacturing overhead $ 4.95 Variable selling and administrative expenses $ 1.60 Fixed selling and administrative expenses $ 2.00 The normal selling price is $23.00 per unit. The company’s capacity is 133,200 units per year. An order has been received from a mail-order house for 2,200 units at a special price of $20.00 per unit. This order would not affect regular sales or total fixed costs. As a separate matter from the special order, assume the company’s inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior units to affect regular sales. What unit cost is relevant for establishing…arrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 32,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 20 $ 640,000 Direct labor 6 192,000 Variable manufacturing overhead 3 96,000 Fixed manufacturing overhead 9 288,000 Variable selling expense 4 128,000 Fixed selling expense 6 192,000 Total cost $ 48 $ 1,536,000 The Rets normally sell for $53 each. Fixed manufacturing overhead is $288,000 per year within the range of 23,000 through 32,000 Rets per year. Required: Assume due to a recession, Polaski Company expects to sell only 23,000 Rets through regular channels next year. A large retail chain offered to purchase 9,000 Rets if Polaski will accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company…arrow_forward

- Vishnuarrow_forwardGEM Limited has a single product Flicks. The company normally produces and sells 80,000 units of Flicks each year at a price of $240 per unit. The company’s unit costs at this level of activity are as follow: Direct material. $57.00Direct labour 60.00 Variable manufacturing overhead. 16.80 Fixed manufacturing overhead 30.00Variable selling and administrative costs 10.20 Fixed selling and administrative costs 27.00 Total unit cost $201.00 GEM has sufficient capacity to produce 100 000 units of Flicks a year without any increase in fixed manufacturing overhead. Required: GEM has an opportunity to sell 10 000 units to an overseas customer. Import duties and other special costs associated with this order would total $42 000. The only selling costs that would be associated with the order would be a shipping cost of $9.00 per unit. What would be the minimum acceptable unit price for GEM to consider this…arrow_forwardK Felipe's Mexican Restaurant incurred salaries expense of $70,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $23,000 is subject to unemployment tax. Also, the company provides the following benefits for employees: health insurance (cost to the company, $2,000), life insurance (cost to the company, $400), and retirement benefits (cost to the company. 8% of salaries expense). i (Click the icon to view payroll tax rate information.) Read the requirements. More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 earned per employee; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned per employee; SUTA: 5.4% on first $7,000 earned per employee. Date Print Done Requirement 1. Journalize…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education