FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

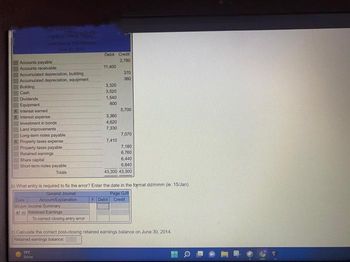

Transcribed Image Text:Accounts payable

Accounts receivable

HE

Accumulated depreciation, building

Accumulated depreciation, equipment

Building

Cash

Dividends

Equipment

X Interest earned

X Interest expense

Investment in bonds

Land improvements

Long-term notes payable

X Property taxes expense

Property taxes payable

Retained earings

Share capital

Short-term notes payable

Totals

Datu

30 Jun Income Summary

Retainod Earnings

Debit Credit

2,780

correct closing entry error

19″C

Sunny

11,400

3,320

3,520

1,540

800

3,360

4,620

7,330

7,410

370

360

5,700

b) What entry is required to fix the error? Enter the date in the format dd/mmm (ie. 15/Jan).

General Joumal

Account/Explanation

Page GJ8

7,070

7,180

6,760

6,440

6,640

43,300 43,300

F Debit Credit

c) Calculate the correct post-closing retained earnings balance on June 30, 2014.

Retained earnings balance:

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardDetermine if an asset, liability, cash inflow, or cash outflow:arrow_forwardA company borrows as follows: amortiza oustanding t interest instalment tion amount 0 0 301.386 0 3.000.000 1 90.000 301.386 211.386 2.788.614 2 83.658 301.386 217.728 2.570.886 3 77.127 301.386 224.260 2.346.626 4 70.399 301.386 230.987 2.115.639 5 63.469 301.386 237.917 1.877.722 6 56.332 301.386 245.055 1.632.667 7 48.980 301.386 252.406 1.380.261 8 41.408 301.386 259.978 1.120.282 9 33.608 301.386 267.778 852.505 10 25.575 301.386 275.811 576.693 11 17.301 301.386 284.085 292.608 12 8.778 301.386 292.608 Loan was requested on 31 October 2019 and instalments are monthly. It is requested: a. Make accounting entries for year finished 2019. b. If company were to make a full prepayment on 15 January 2020, how much would it have to pay? Make respective accounting entry(s). Note: Remember that, to transform monthly interest rate to fortnightly interest rate, following formula must be applied: (1 + i_monthly)^ = (1+i_fortnightly) c. If at the time of applying for credit, agreed term for…arrow_forward

- Assets Current assets Cash and cash equivalents Accounts receivable, net Supplies Other current assets Total current assets Property and equipment Accumulated depreciation Net property and equipment Goodwill Deferred charges Other Total assets Liabilities and equity Current liabilities Accounts payable Accrued liabilities Current maturities of long-term debt Total current liabilities Operating lease liabilities non-current Long-term debt Other non-current liabilities Total liabilities Total liabilities Common stock Cummulative dividends Retained earnings Other Total equity Total liabilities and equities Revenue, net Operating charges Salaries, wages, and benefits Other operating expenses Supplies expense Depreciation and amortization Lease and rental expense Total operating charges Income from operations Interest expense, net Other (income) expense, net Income before income taxes Provision for income taxes Net income $61,268 1,560,847 Cost of debt (%) Cost of equity (%) Weighted…arrow_forwardPlease don't give image formatarrow_forwardss.arrow_forward

- Cash Accounts Receivable, Net Inventory Property, Plant and Equipment, net Total Assets Accounts Payable Mortgage Payable Common Stock, par $5 Retained Earnings Total Liabilities and Owners' Equity Sales for the year Cost of Goods Sold Net Income for the year 2021 25 65 50 140 280 50 100 90 40 280 4. Calculate the earnings per share. Show work. A. $3.00 B. $4.00 $100 C. $2.00 D. $2.50 50 36 2. Using horizontal analysis, what is the change in inventory? A. 35% increase B. 35% decrease C. 25% increase D. 25% decrease Using the information above, answer the following questions. 1. Using vertical analysis, what percentage is Mortgage Payable for year 2021? Show work. A. 34.23% B. 35.71% C. 40% D. 36.71% 3. Calculate the Accounts Receivable Turnover. Show work A. 1.6 times B. 1.6% C. 1.8 times D. 1.8% 2020 30 60 40 155 285 60 110 90 25 285arrow_forwardiiarrow_forwardSelected accounts from Gregor Company's adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Note: On the company's balance sheet, accumulated depreciation is subtracted from equipment, accumulated amortization is subtracted from patents, and accumulated depletion is subtracted from silver mine. Common stock Retained earnings Patents Cash Land Equipment Silver mine Current assets Plant assets Total plant assets Intangible assets Tatal intensible anta $ 47,000 Accounts payable 17,000 Accumulated depreciation-Equipment 6,800 Notes payable (due in 9 years) 7,400 Goodwill 44,000 Accumulated depletion-Silver mine 34,000 Accumulated amortization-Patents 29,000 GREGOR COMPANY Balance Sheet December 31 Assets 0 0 0 0 $ 3,400 25,600 25,000 6,400 5,800 3,800arrow_forward

- Need Help with Statement Matchingarrow_forwardUnder what section of the Statement of Cash Flows would you report the purchase of an long-term intangible asset such as a patent for cash? O Investing O Bonds O Leases O Financing O Notes: Noncash activity O Operating ASUS f5 f6 f7 [X f9 f10 f11 %24 & 4 7. 8 R Y U G H. 5 F. 图arrow_forwardQuestion 10 of 25 Based on the following data, what is the amount of working capital? Accounts payable Accounts receivable Cash Intangible assets Inventory Long-term investments Long-term liabilities Short-term investments Notes payable (short-term) Property, plant, and equipment Prepaid insurance $404240 O $411680 > O $458800 $79360 141360 86800 124000 171120 198400 248000 99200 69440 1661600 2480arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education