FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

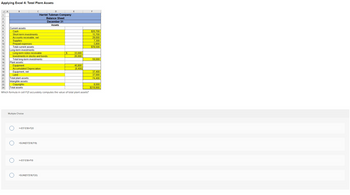

Transcribed Image Text:Applying Excel 4: Total Plant Assets

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

A

B

Current assets

Cash

Short-term investments

Accounts receivable, net

Supplies

Prepaid expenses

Total current assets.

Long-term investments

Land

www.

Long-term notes receivable

Investments in stocks and bonds

Total long-term investments

Plant assets:

Equipment

Accumulated Depreciation

Equipment, net

Total plant assets

Intangible assets:

Multiple Choice

с

=+E17-E18+F20

=SUM(E17,E18,F19)

=+E17-E18+F19

D

Harriet Tubman Company

Balance Sheet

December 31

Assets

Copyrights

Total assets

Which formula in cell F21 accurately computes the value of total plant assets?

=SUM(E17,E18,F20)

$

E

33,000

26,000

46,800

(9,400)

F

$20.700

15,700

29,000

7,300

5,800

$78,500

59,000

37,400

37,000

74,400

8,000

$219,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- eek 1 Statement Matching Amortization JORN BART Accounts Payable R Cash Receipts Land Net Cash Depreciation Expense Net Income Purchased Office Equipment Cash Payments Equipment Cost of Goods Sold Dividends Paid Current Assets Interest Expense Cash From Investing Activities Balance of Retained Earnings Allowance for Doubtful Accounts Cash & Cash Equivalents Accounts Receivable Current Liabilities ㅂㅇㄹ F6 A F7 & J 2⁰ Balance Sheet 8 F8 * Income Statement F9 prt sc F10 C Cash Flow Statement home F11 ㅅ end Retained Earnings Statement F12 (4) J insertarrow_forwardPart 6 Attempt 4/5 for 7 pts. What is the present value of the cash flow from assets from year 2 to 20 (ignoring the one for year 21 for now) (in $ million)? 0+ decimals Submitarrow_forwardAssets Current assets Cash and cash equivalents Accounts receivable, net Supplies Other current assets Total current assets Property and equipment Accumulated depreciation Net property and equipment Goodwill Deferred charges Other Total assets Liabilities and equity Current liabilities Accounts payable Accrued liabilities Current maturities of long-term debt Total current liabilities Operating lease liabilities non-current Long-term debt Other non-current liabilities Total liabilities Total liabilities Common stock Cummulative dividends Retained earnings Other Total equity Total liabilities and equities Revenue, net Operating charges Salaries, wages, and benefits Other operating expenses Supplies expense Depreciation and amortization Lease and rental expense Total operating charges Income from operations Interest expense, net Other (income) expense, net Income before income taxes Provision for income taxes Net income $61,268 1,560,847 Cost of debt (%) Cost of equity (%) Weighted…arrow_forward

- Asaparrow_forwardPlease do not give solution in image format thankuarrow_forwardDecrease in Accrued Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Net Cash Provided by (Used for) Investing Activities Help me solve this Demodocs example esc Get more help -arrow_forward

- Selected accounts from Gregor Company's adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Note: On the company's balance sheet, accumulated depreciation is subtracted from equipment, accumulated amortization is subtracted from patents, and accumulated depletion is subtracted from silver mine. Common stock Retained earnings Patents Cash Land Equipment Silver mine Current assets Plant assets Total plant assets Intangible assets Tatal intensible anta $ 47,000 Accounts payable 17,000 Accumulated depreciation-Equipment 6,800 Notes payable (due in 9 years) 7,400 Goodwill 44,000 Accumulated depletion-Silver mine 34,000 Accumulated amortization-Patents 29,000 GREGOR COMPANY Balance Sheet December 31 Assets 0 0 0 0 $ 3,400 25,600 25,000 6,400 5,800 3,800arrow_forwardSOLVE STEP BY STEP IN DIGITAL FORMAT According to the Asset Allocation (AA) formula and the following data: Benchmark weight Market Eurostoxx 50 (RV) German bonds (RF) Cash Calculate: Wallet weight 70% 7% 23% 60% 30% 10% The excess of financial assets The contribution or gain of the financial asset 5.81% 1.45% 0.48% Market profitabilityarrow_forwardageNOWv2/Online teach x CengageNOWv2| Online teachin x M (no subject) - morganmcgrew4@ x keAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator3D&inprogress%3Dfalse eBook Reporting Land Transactions on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1. Balance 1,013,000 Purchased for cash 304,000 1,317,000 Mar. 12 Oct. Sold for $167,000 143,000 1,174,000 4 Section of Statement of Amount Cash Flows Added or Deducted Item Mar. 12: Purchase of fixed asset Oct. 4: Sale of fixed asset Gain on sale of fixed asset (assume the indirect method) %24 %24arrow_forward

- Interest expense Paid-in capital Accumulated depreciation Notes payable (long-term) Rent expense Merchandise inventory Accounts receivable Depreciation expense Land Retained earnings Cash Cost of goods sold Equipment Income tax expense Accounts payable Net sales $ 5,400 17,200 4,800 53,000 11,700 124,000 41,500 2,400 37,000 152,500 28,000 238,000 28,000 57,000 31,000 400,000 Required: a. Calculate the difference between current assets and current liabilities for Gary's TV at December 31, 2022. b. Calculate the total assets at December 31, 2022. c. Calculate the earnings from operations (operating income) for the year ended December 31, 2022. d. Calculate the net income (or loss) for the year ended December 31, 2022. e. What was the average income tax rate for Gary's TV for 2022? f. If $27,500 of dividends had been declared and paid during the year, what was the January 1, 2022, balance of retained earnings?arrow_forward23. The installation expenses for a new machinery will be debited to A. O Cash A/c B. ○ Profit & Loss A/c C. O Machinery A/c D. O Installation expenses A/carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education