FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't give image format

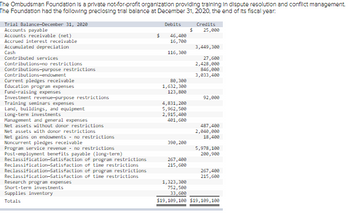

Transcribed Image Text:The Ombudsman Foundation is a private not-for-profit organization providing training in dispute resolution and conflict management.

The Foundation had the following preclosing trial balance at December 31, 2020, the end of its fiscal year:

Trial Balance-December 31, 2020

Accounts payable

Accounts receivable (net)

Accrued interest receivable

Accumulated depreciation

Cash

Contributed services

Contributions-no restrictions

Contributions-purpose restrictions

Contributions-endowment

Current pledges receivable

Education program expenses

Fund-raising expenses

Investment revenue-purpose restrictions

Training seminars expenses

Land, buildings, and equipment

Long-term investments

Management and general expenses

Net assets without donor restrictions

Net assets with donor restrictions

Net gains on endowments no restrictions

Noncurrent pledges receivable

Program service revenue no restrictions

Post-employment benefits payable (long-term)

Reclassification-Satisfaction of program restrictions

Reclassification-Satisfaction of time restrictions

Reclassification-Satisfaction of program restrictions

Reclassification-Satisfaction of time restrictions

Research program expenses.

Short-term investments

Supplies inventory

Totals

Debits

$ 46,400

16,700

116,300

80,300

1,632,300

123,800

4,831, 200

5,962,500

2,915,400

401,600

390, 200

267,400

215,600

Credits

$ 25,000

3,449,300

27,600

2,428,000

846,000

3,033,400

92,000

487,400

2,040,000

18,400

5,978,100

200,900

267,400

215,600

1,323,300

752,500

33,600

$19,109,100 $19,109,100

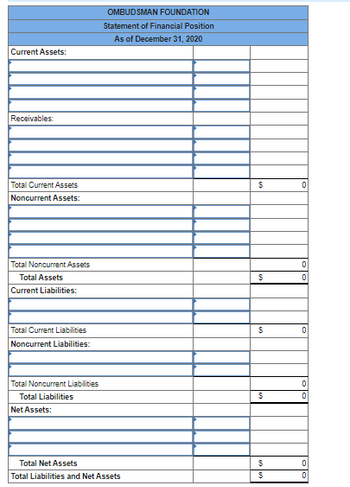

Transcribed Image Text:Current Assets:

Receivables:

Total Current Assets

Noncurrent Assets:

Total Noncurrent Assets

Total Assets

Current Liabilities:

Total Current Liabilities

Noncurrent Liabilities:

Total Noncurrent Liabilities

Total Liabilities

Net Assets:

OMBUDSMAN FOUNDATION

Statement of Financial Position

As of December 31, 2020

Total Net Assets

Total Liabilities and Net Assets

$

$

$

$

$

$

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education