Principles Of Marketing

17th Edition

ISBN: 9780134492513

Author: Kotler, Philip, Armstrong, Gary (gary M.)

Publisher: Pearson Higher Education,

expand_more

expand_more

format_list_bulleted

Question

Please ans these 2 paragraph

Since meena hasent advertised very heavily.....

Keon is also thinking of expanding from Google to social media....

Transcribed Image Text:52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

4G

B

21:33 Is

с

D

E

F

After Keon mentions that he has a mechanic friend, Bill, who would be looking at the cars before any

deal was finalized, Meena admits that one of the limos needs a $3,000 repair. She has been considering

selling the vehicle as is and upgrading to an oversized luxury limousine. When Keon asked if she had an

idea how high the as-is price may be, Meena hesitated and said she wasn't sure. Keon described the

issue to Bill and he advised that a $30,000 price was a reasonable in the current market.

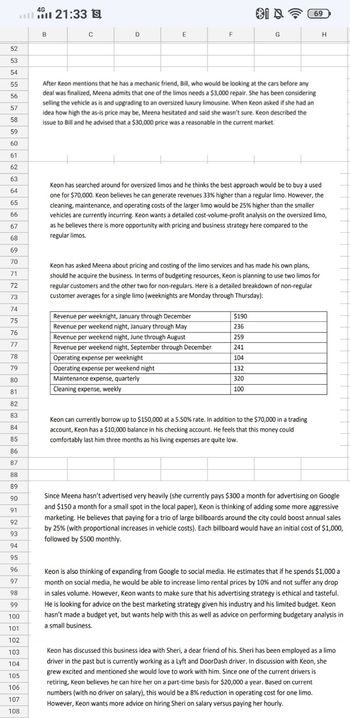

Revenue per weeknight, January through December

Revenue per weekend night, January through May

Revenue per weekend night, June through August

Revenue per weekend night, September through December

Operating expense per weeknight

Operating expense per weekend night

Maintenance expense, quarterly

Cleaning expense, weekly

81669

Keon has searched around for oversized limos and he thinks the best approach would be to buy a used

one for $70,000. Keon believes he can generate revenues 33% higher than a regular limo. However, the

cleaning, maintenance, and operating costs of the larger limo would be 25% higher than the smaller

vehicles are currently incurring. Keon wants a detailed cost-volume-profit analysis on the oversized limo,

as he believes there is more opportunity with pricing and business strategy here compared to the

regular limos.

Keon has asked Meena about pricing and costing of the limo services and has made his own plans,

should he acquire the business. In terms of budgeting resources, Keon is planning to use two limos for

regular customers and the other two for non-regulars. Here is a detailed breakdown of non-regular

customer averages for a single limo (weeknights are Monday through Thursday):

G

$190

236

259

241

104

132

320

100

H

Keon can currently borrow up to $150,000 at a 5.50% rate. In addition to the $70,000 in a trading

account, Keon has a $10,000 balance in his checking account. He feels that this money could

comfortably last him three months as his living expenses are quite low.

Since Meena hasn't advertised very heavily (she currently pays $300 a month for advertising on Google

and $150 a month for a small spot in the local paper), Keon is thinking of adding some more aggressive

marketing. He believes that paying for a trio of large billboards around the city could boost annual sales

by 25% (with proportional increases in vehicle costs). Each billboard would have an initial cost of $1,000,

followed by $500 monthly.

Keon is also thinking of expanding from Google to social media. He estimates that if he spends $1,000 a

month on social media, he would be able to increase limo rental prices by 10% and not suffer any drop

in sales volume. However, Keon wants to make sure that his advertising strategy is ethical and tasteful.

He is looking for advice on the best marketing strategy given his industry and his limited budget. Keon

hasn't made a budget yet, but wants help with this as well as advice on performing budgetary analysis in

a small business.

Keon has discussed this business idea with Sheri, a dear friend of his. Sheri has been employed as a limo

driver in the past but is currently working as a Lyft and DoorDash driver. In discussion with Keon, she

grew excited and mentioned she would love to work with him. Since one of the current drivers is

retiring, Keon believes he can hire her on a part-time basis for $20,000 a year. Based on current

numbers (with no driver on salary), this would be a 8% reduction in operating cost for one limo.

However, Keon wants more advice on hiring Sheri on salary versus paying her hourly.

Transcribed Image Text:2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

4G

B

21:33 Is

F

8169

G

D

Group Case: Keon's Limousines

Keon has just graduated from college with a business management degree. Through part-time work and

trading stocks, he has amassed significant savings which he is considering investing in a small business

venture.

Historically, Keon has earned a 9% annual return on his investments, but he realizes that he can't expect

the same results with full-time employment or entrepreneurship. He hopes to earn 5.50% a year going

forward, should he decide to leave $70,000 invested in a relatively safe investment portfolio.

As a result of his trading success, Keon has been offered a job as a junior analyst at a major investment

management firm. The job would pay $60,000 to start, with a promotion expected in a year. At that

point, the salary would increase to $72,000, followed by steady $2,000 increases annually.

Keon, who has always been interested in limousines, has heard about a unique opportunity to purchase

an existing business from a retiring founder. Meena is seeking $200,000 for her business. She owns four

limousines, originally purchased for $80,000 each six years ago.

In addition to the vehicles, Keon would get a list of regular customers from Meena. Keon has some

experience with valuing goodwill (a common accounting term) and he believes that 60 customers

spending an average of $250 per month should be valued at the net present value of the next three

years of cashflows. Keon also believes he can increase the rates of these steady customers by 4% a year

(first increase immediately) without losing any of their business.

In a brief conversation with Keon, Meena mentioned that she is using the straight-line depreciation

method with an estimated life of twenty years and salvage value of $2,000, so $200,000 is really a

bargain. Keon is skeptical about this and wants more details on depreciating luxury cars. He wants

advice on best depreciation practices and the impact different methods can have.

After Keon mentions that he has a mechanic friend, Bill, who would be looking at the cars before any

deal was finalized, Meena admits that one of the limos needs a $3,000 repair. She has been considering

selling the vehicle as is and upgrading to an oversized luxury limousine. When Keon asked if she had an

idea how high the as-is price may be, Meena hesitated and said she wasn't sure. Keon described the

issue to Bill and he advised that a $30,000 price was a reasonable in the current market.

After Keon mentions that he has a mechanic friend, Bill, who would be looking at the cars before any

deal was finalized, Meena admits that one of the limos needs a $3,000 repair. She has been considering

selling the vehicle as is and upgrading to an oversized luxury limousine. When Keon asked if she had an

idea how high the as-is price may be, Meena hesitated and said she wasn't sure. Keon described the

issue to Bill and he advised that a $30.000 price was a reasonable in the current market

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Learn about Tide’s “#TideAd” social media campaign on YouTube bysearching for advertisements that use the hashtag. Which of the 4Ecomponents does this campaign leverage?arrow_forward4.Select one advertisement for a global product (i.e., a product that is marketed in more than one country). 1. Describe the four types of segmentation strategies (i.e., demographic, psychographic, geographic, and behavioral) 2. Explain which types of segmentation strategy are used in the advertisements and why 3. Evaluate how effectively the advertisement utilizes creative strategyarrow_forward

Recommended textbooks for you

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education,

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education, MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education

MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Principles Of Marketing

Marketing

ISBN:9780134492513

Author:Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:Pearson Higher Education,

Marketing

Marketing

ISBN:9781259924040

Author:Roger A. Kerin, Steven W. Hartley

Publisher:McGraw-Hill Education

Foundations of Business (MindTap Course List)

Marketing

ISBN:9781337386920

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:Cengage Learning

Marketing: An Introduction (13th Edition)

Marketing

ISBN:9780134149530

Author:Gary Armstrong, Philip Kotler

Publisher:PEARSON

Contemporary Marketing

Marketing

ISBN:9780357033777

Author:Louis E. Boone, David L. Kurtz

Publisher:Cengage Learning