FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Proctoring Enabled: Chapter 4 Required Homework (G... i

1

Mc

Graw

Hill

Pizza Hut is an American multinational restaurant chain and international franchise founded in 1958. For the year ending December 31,

2024, Pizza Hut had income from continuing operations before taxes of $1,380,000 before considering the following transactions and

events. Please note that all of the items described below are before taxes and the amounts should be considered material.

1. In Nov 2024, Pizza Hut sold its Allnatural Alternative restaurant chain that qualified as a component of an entity. Pizza Hut had

adopted a plan to sell the Allnatural Alternative chain in May 2024. The income from operations of the chain from January 1,

2024, through November was $178,000 and the loss on sale of the chain's assets was $336,000.

2. In 2024, Pizza Hut sold one of its six factories, where pizza dought is made, for $1,560,000. At the time of the sale, the factory

had a book value of $1,280,000. The factory was not considered a component of the entity.

3. In 2022, Pizza Hut's accounting department omitted the annual adjustment for patent amortization expense of $138,000. The

error was not discovered until December 2024.

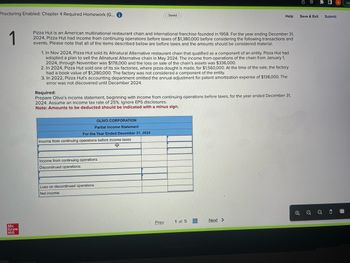

OLIVO CORPORATION

Partial Income Statement

For the Year Ended December 31, 2024

Saved

Required:

Prepare Olivo's income statement, beginning with income from continuing operations before taxes, for the year ended December 31,

2024. Assume an income tax rate of 25%. Ignore EPS disclosures.

Note: Amounts to be deducted should be indicated with a minus sign.

Income from continuing operations before income taxes

+

Income from continuing operations

Discontinued operations:

Loss on discontinued operations

Net income

Help

Prev

1 of 5

Next >

Save & Exit Submit

Q

0 [...

Up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zugar Company is domiciled in a country whose currency is the dinar. Zugar begins 2020 with three assets: cash of 27,200 dinars, accounts receivable of 81,800 dinars, and land that cost 218,000 dinars when acquired on April 1, 2019. On January 1, 2020, Zugar has a 168,000 dinar note payable, and no other liabilities. On May 1, 2020, Zugar renders services to a customer for 138,000 dinars, which was immediately paid in cash. On June 1, 2020, Zugar incurred a 118,000 dinar operating expense, which was immediately paid in cash. No other transactions occurred during the year. Currency exchange rates for 1 dinar follow: April 1, 2019 $0.51 = 1 dinar January 1, 2020 0.54 = 1 May 1, 2020 0.55 = 1 June 1, 2020 0.57 = 1 December 31, 2020 0.59 = 1 Assume that Zugar is a foreign subsidiary of a U.S. multinational company that uses the U.S. dollar as its reporting currency. Assume also that the dinar is the subsidiary’s functional currency. What is the translation…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardOMG is in a country which has a capital gains tax, conducted the following transactions: a. Purchased a building in February 2018 for $26,000,000. In March 2019, the company spent $2,000,000 to install solar panels for electricity in the building. The building was sold for $28,500,000 in 2021. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,500,000. b. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle was sold in 2021 for $4.5 million. c. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021 for $10 million. d. Purchased a government bond for $5,000,000 in 2018 and sold it for $7,500,000 in 2021. The company is entitled to an Annual Exemption of $500,000. Capital losses as of 1 January 2021 were $1,500,000. Calculate the capital gains tax in 2021, assuming a capital gains tax of 15%.arrow_forward

- Isaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2021, Isaac had $676 million in sales of this type. Scheduled collections for these sales are as follows: 2021 $ 83 million 2022 137 million 2023 129 million 2024 162 million 2025 165 million $ 676 million Assume that Isaac has a 25% income tax rate and that there were no other differences in income for financial statement and tax purposes. Ignoring operating expenses, what deferred tax liability would Isaac report in its year-end 2021 balance sheet?arrow_forwardi have completed this in excel but would like to compare my answersarrow_forwardJackie Company is an FIRB-registered enterprise. Following is its financial performance for a five-year period. Assume all are earned/incurred evenly for each year. Assuming it is a Tier 1 domestic enterprise which started its commercial operation at Quezon City in September 1, 2026, how much is its income tax payable for 2035 assuming the use of SCIT and that it relocated to Cagayan in 2031?arrow_forward

- prodigy Inc. has been carrying on a business since 2008. On November 1, 2023, Prodigy Inc. acquires a franchise for $31,000. The franchise has a limited life of 12 years. What is the maximum amount of CCA that Prodigy Inc. can claim for its taxation year that ends December 31, 2022? Assume that no designation will be made for immediate expensing. Round your answer to the nearest cent.\\narrow_forwardVen Company is a retailer. In 2019, its before-tax net income for financial reporting purposes was $600,000. This included a $150,000 gain from the sale of land held for several years as a possible plant site. The cost of the land was $100,000, the contract price for the sale was $250,000, and the company col-lected $120,000 in the year of sale. The income per books also included $90,000 from a 24-month service contract entered into in July 2018 (the customer paid $180,000 in advance for this contract). The addition to the allowance for uncol-lectible accounts for the year was $70,000, and the actual accounts written off totaled $40,000. Make the necessary adjustments to the before taxable income per books to com-pute Ven’s taxable income for the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education