FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

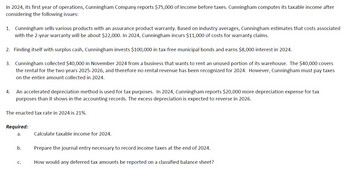

Transcribed Image Text:In 2024, its first year of operations, Cunningham Company reports $75,000 of income before taxes. Cunningham computes its taxable income after

considering the following issues:

1. Cunningham sells various products with an assurance product warranty. Based on industry averages, Cunningham estimates that costs associated

with the 2-year warranty will be about $22,000. In 2024, Cunningham incurs $11,000 of costs for warranty claims.

2. Finding itself with surplus cash, Cunningham invests $100,000 in tax-free municipal bonds and earns $8,000 interest in 2024.

3. Cunningham collected $40,000 in November 2024 from a business that wants to rent an unused portion of its warehouse. The $40,000 covers

the rental for the two years 2025-2026, and therefore no rental revenue has been recognized for 2024. However, Cunningham must pay taxes

on the entire amount collected in 2024.

An accelerated depreciation method is used for tax purposes. In 2024, Cunningham reports $20,000 more depreciation expense for tax

purposes than it shows in the accounting records. The excess depreciation is expected to reverse in 2026.

The enacted tax rate in 2024 is 21%.

Required:

a.

Calculate taxable income for 2024.

b.

Prepare the journal entry necessary to record income taxes at the end of 2024.

C.

How would any deferred tax amounts be reported on a classified balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tacit or implicit knowledge, is personal, experiential, context-specific, and hard to formalize and communicate. True Falsearrow_forwardAssume that you accept the following ethical rule: “Failure to tell the whole truth is wrong.” In the textbook illustration about Santos’s problem with Ellis’s instructions, (a) what would this rule require Santosto do and (b) why is an unalterable rule such as this classified as an element of imperative ethical theory?arrow_forwardExercise 1 (Simple Rate of Return Method) The management of Ann Gee MicroBrew is considering the purchase of an automated bottling machine for P80,000. The machine would replace an old piece of equipment that costs P33,000 per year to operate. The new machine would cost P10,000 per year to operate. The old machine currently in use could be sold now for a scrap value of P5,000. The new machine would have a useful life of 10 years with no salvage value. Required: Compute the simple rate of return on the new automated bottling machine.arrow_forward

- discuss how critical thinking skills will make you less likely to be influenced by arguments that are based on fallacies and faulty reasoning.arrow_forwardProvide best Answer As per posible fastarrow_forwardCritically evaluate how the breach of ethics by auditors could contribute to expand the audit expectation gap. Your report should include/address the following concerns: 1. Introduce/analyze ethical aspect of auditors and audit expectation gap. 2. Critically examine how different threats to ethics enlarge the audit expectation gap. 3. Propose ways to minimize the threats to ethics and thus the expectation gap of audits. 4. Determine the current developments and future direction of ethical aspects of auditors, and explain how such developments contribute to safeguard the audit profession as a concluding remarks. Include a cover page, an executive summary, a table of contents and references. You may include an appendix if necessary.arrow_forward

- Karen finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forwardSome accountants argue that the receiving department should be eliminated. Discuss the objective of eliminating the receiving function. What accounting/audit problems need to be resolved.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

- It says they answers are wrong from your example.arrow_forwardSelect the best answer for each of the follwing items and give reasons for your choice. a. Which of the following best describes the relationship between assurance services and attest services? (1) While attest services involved financial data, assurance services involve nonfinancial data (2) While attest services require objectivity, assurance services do not require objectivity (3) All attest services require independence. (4) Attest and assurance services are different terms referring to the same types of servicesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education