FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

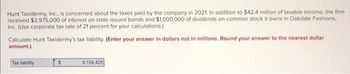

Transcribed Image Text:Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $42.4 million of taxable income, the firm

received $2,975,000 of interest on state-issued bonds and $1,000,000 of dividends on common stock it owns in Oakdale Fashions,

Inc. (Use corporate tax rate of 21 percent for your calculations.)

Calculate Hunt Taxidermy's tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar

amount.)

Tax liability

$

9,154,425

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $7.5 million of taxable income, the firm received $614,000 of interest on state-issued bonds and $340,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy’s tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Calculate Hunt Taxidermy’s average tax rate. (Round your answer to 2 decimal places.) Calculate Hunt Taxidermy’s marginal tax rate.arrow_forwardThe Dakota Corporation had a 2021 taxable income of $20,000,000 from operations after all operating costs but before (1) interest charges of $3,800,000, (2) dividends received of $320,000, (3) dividends paid of $2,200,000, and (4) income taxes (the firm’s tax rate is 21 percent).a. Calculate Dakota’s income tax liability. (Round your answer to the nearest dollar amount.) With a marginal and average tax rate of 21% The income tax liability is NOT 3,469,200arrow_forwardXYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. XYZ corporation Income statement For current year Book Income Revenue from sales $ 40,000,000 Cost of Goods Sold (27,000,000) Gross profit $ 13,000,000 Other income: Income from investment in corporate stock 300,0001 Interest income 20,0002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,0003 Miscellaneous income 50,000 Gross Income $ 13,369,000 Expenses: Compensation (7,500,000)4 Stock option compensation (200,000)5 Advertising (1,350,000) Repairs and Maintenance (75,000) Rent (22,000) Bad Debt expense (41,000)6 Depreciation (1,400,000)7 Warranty expenses (70,000)8 Charitable donations (500,000)9 Meals (all at restaurants) (18,000) Goodwill impairment (30,000)10…arrow_forward

- Full Tax Co. is incorporated and tax resident in Barbados. The audited financial statements for Full Tax Co. for year-end December 31, 2022, show an accounting profit after tax of $5,500,000 after charging the following: Depreciation $1,500,000 Tax for the year $500,000 Property Tax $900,000 Interest Expense $15,000 Preference Dividends $40,000 Legal Fees $1,110,000 Insurance $750,000 Bad Debts $40,000 Foreign Travel $20,000 Repairs and Maintenance $1,500,000 General Expense $600,000 Other information 1. Property Tax of $600,000 was paid for the property on which the company’s factory is located; $300,000 for the office premises and $100,000 for the director’s home. 2. The insurance was paid for the factory and office premises. 3. The bad debt expense includes a general provision of $10,000 and a specific provision of $30,000. 4. The company paid interim ordinarily dividends totaling $100,000. 5. Repairs and Maintenance include for $500,000 removing the office ceramic floor…arrow_forwardBb.73.arrow_forwardFor the year ended 30 June, BBNT Pty Ltd, a lawn mower manufacturer, reported an operating (accounting) profit of $750,000. The company does not elect to be taxed as a SBE taxpayer. In coming to this profit figure, the financial accountant had taken into account the following items. Please explain the income tax implications for each of the items. You are NOT required to compute the amount of capital allowance. $30,000 has been claimed as a deduction being the amortisation of goodwill arising from the acquisition of a business two years earlier. A provision has been raised for future warranties equal to 2% of sales. During the year, the sales amounted to $5 million. Depreciation on the buildings was $50,000. However, for tax purposes, only $25,000 is tax deductible. The company spent $75,000 on legal expenses opposing an application by Heavy Mowers Pty Ltd to extend its patent on a brand of mower. If the patent was not extended, then BBNT could produce a similar mower. The company…arrow_forward

- Tennis Pro is headquartered in Virginia. Assume it has a state income tax base of $240,000 after making the appropriate adjustments. Of this amount, $60,000 was non-business income.The non- business income included the following: $8,000 of dividend income, $15,000 of interest income, $37,000 of royalty income for an intangible used in Maryland. Tennis Pro has the following sales, payroll and property factors: Virginia Maryland Sales 40% 20% Payroll 80% 5% Property 90% 5% Assume that Virginia uses an equally weighted three-factor formula. Assuming a Virginia corporate tax rate of 6 percent, what is Tennis Pro's Virginia state tax liability? (Round your answer to the nearest whole number.)arrow_forwardOMG is in a country which has a capital gains tax, conducted the following transactions: a. Purchased a building in February 2018 for $26,000,000. In March 2019, the company spent $2,000,000 to install solar panels for electricity in the building. The building was sold for $28,500,000 in 2021. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,500,000. b. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle was sold in 2021 for $4.5 million. c. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021 for $10 million. d. Purchased a government bond for $5,000,000 in 2018 and sold it for $7,500,000 in 2021. The company is entitled to an Annual Exemption of $500,000. Capital losses as of 1 January 2021 were $1,500,000. Calculate the capital gains tax in 2021, assuming a capital gains tax of 15%.arrow_forwardThe Dakota Corporation had a 2021 taxable income of $21,000,000 from operations after all operating costs but before (1) interest charges of $3,900,000, (2) dividends received of $330,000. (3) dividends paid of $2,250,000, and (4) income taxes (the firm's tax rate is 21 percent). a. Calculate Dakota's income tax liability. (Round your answer to the nearest dollar amount.) Income tax liability Iarrow_forward

- In 2020, Garner Grocers had taxable income of -$2,000,000. The corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. In 2021, Garner has taxable income of $1,000,000. What is the amount of taxes the company paid in 2021? O a. $500,000 Ob. $750,000 O c. $1,500,000 O d. $0 O e. $250,000arrow_forwardIn 2020, Appalachian Airlines had taxable income of -$3,000,000. In 2021, the company has taxable income of $5,000,000 and its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. How much will the company pay in taxes in 2021? O a. $1,500,000 O b. $750,000 O c. $0 O d. $1,250,000 Oe. $500,000arrow_forwardMatador Company is preparing its 2022 financial statements. Matador's bookkeeper has determined Income from Continuing Operations (ICO) but is not certain this number is accurate. Matador has a corporate tax rate of 30%. Use the following information to determine the adjustments, if any, to ICO. (Hint: if you are adjusting ICO, should the adjustments be pre-tax or net of tax?) If you need to increase ICO, enter your answer as a positive number; for instance: 3000 If you need to decrease ICO, enter your answer as a negative number; for instance: -3000 If you determine no change is needed to ICO; enter 0. Put your answers in the provided boxes. 1) During 2022, Matador declared preferred dividends of $70,000, paid $90,000 for dividends, and received $135,000 for dividends on available-for-sale equity securities. The bookkeeper did not include any of these when calculating ICO. Determine the adjustment to ICO. Matador has a corporate tax rate of 30%. 2) Over the past 4 years, Matador has…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education