FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

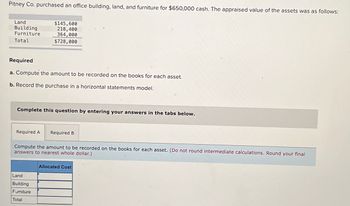

Transcribed Image Text:Pitney Co. purchased an office building, land, and furniture for $650,000 cash. The appraised value of the assets was as follows:

Land

Building

Furniture

Total

$145,600

218,400

364,000

$728,000

Required

a. Compute the amount to be recorded on the books for each asset.

b. Record the purchase in a horizontal statements model.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final

answers to nearest whole dollar.)

Land

Building

Furniture

Total

Allocated Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diego Company paid $186,000 cash to acquire a group of items consisting of land appraised at $53,000 and a building appraised at $159,000. Allocate total cost to these two assets and prepare an entry to record the purchase. Complete this question by entering your answers General Total Cost Journal Allocate total cost to these two assets. Percent of Total Apportioned Cost Land Building Totalsarrow_forwardDaarrow_forwardThe financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of Under Armour, Inc. are presented in Appendix C. Click here to view Appendix C. The complete annual report, including the notes to the financial statements, is available at the company's website. (b) What conclusions concerning the management of plant assets can be drawn from these data? 1. 2. 3. Return on assets Profit margin Asset turnover Columbia Sportswear Company 12.0% 9.8% 1.22 times Under Armour, Inc. -1.1% -0.9% 1.26 timesarrow_forward

- Braxton Company purchased printing equipment at a cost of $24,000. The monthly depreciation on the equipment is $400. As of December 31, 2011, the balance in Accumulated Depreciation is $9,600. The book value of the equipment reported on the December 31, 2011 balance sheet will be a.$24,000 b.$23,600 c.$14,400 d.$9,600arrow_forwardanswer quicklyarrow_forwardA truck was purchased via a bank loan for a cost of $75,000 with an estimated life of 10 years and a residual value of $1,000.Prepare the journal entries to record the purchase of the vehicle andprepare a journal entry for 1 month of depreciationarrow_forward

- Trinkle Company made several purchases of long-term assets during the year. The details of each purchase are presented here. New Office Equipment 1. List price: $42,600; terms: 2/10, n/30; paid within the discount period. 2. Transportation-in: $880. 3. Installation: $400. 4. Cost to repair damage during unloading: $630. 5. Routine maintenance cost after eight months: $150. Basket Purchase of Copier, Computer, and Scanner for $52,500 with Fair Market Values 1. Copier, $23,421. 2. Computer, $12,027. 3. Scanner, $27,852. Land for New Warehouse with an Old Building Torn Down 1. Purchase price, $83,800. 2. Demolition of building, $4,760. 3. Lumber sold from old building, $1,780. 4. Grading in preparation for new building, $7,900. 5. Construction of new building, $279,000.arrow_forwardDetermining Fixed Asset's Book Value The balance in the equipment account is $3,100,000, and the balance in the accumulated depreciation—equipment account is $1,581,000. a. What is the book value of the equipment?$fill in the blank 1 b. Does the balance in the accumulated depreciation account mean that the equipment's loss of value is $1,581,000? , because depreciation is an allocation of the of the equipment to the periods benefiting from its use.arrow_forwardCan you show me step by step this one too? 13. ABC Inc. purchased a truck on January 1, 2018 for $40,000. The truck had an estimated life of six years and anestimated salvage value of $4,000. ABC uses the straight-line method to depreciate the asset. On July 1, 2020, the truck was sold for $14,000 cash. A. Determine the effect on the accounting equation upon recording the depreciation for 2018. Assets = Liabilities + Stockholders’ Equity Revenues – Expenses =Net Income B. Calculate the gain or loss on the sale of the asset.arrow_forward

- Answer it correctly and typed answer please. I ll rate.arrow_forwardA truck costing S72,000 has accumulated depreciation of $48,000. The truck is sold for $8,500. The journal entry to record this transaction is to: O A. debit Cash for $8,500, debit Truck for $72,000, credit Accumulated Depreciation - Truck for $48,000 and credit Gain on Disposal for S32,500. O B. debit Cash for $15,500, debit Truck for $72,000, credit Accumulated Depreciation - Truck for $48,000, and credit Gain on Disposal for $8,500. OC. debit Accumulated Depreciation - Truck for $48,000, and credit Truck for $48,000. O D. debit Cash for $8,500, debit Accumulated Depreciation - Truck for $48,000, debit loss on Disposal for $15,500 , and credit Truck for $72,000.arrow_forwardSullivan Ranch Corporation has purchased a new tractor. The following information is given: $150,000 $10,000 Cost: Estimated Residual: Estimated Life in years: Estimated Life in hours: Actual Hours: Year 1 Year 2 Year 3 Year 4 4 1200 Required: 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN function to calculate Depreciation Expense and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) Year 1 2 360 270 350 220 3 4 Total Depreciation Schedule-Straight-Line Method End of year amounts Depreciatio Depreciatio n Expense n SULLIVAN RANCH CORPORATION Book Valuearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education