FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:PS

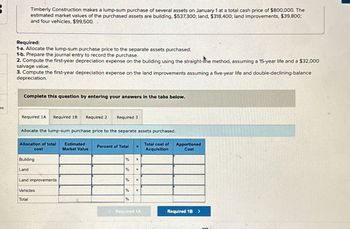

Required:

1-a. Allocate the lump-sum purchase price to the separate assets purchased.

1-b. Prepare the journal entry to record the purchase.

2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000

salvage value.

Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $800,000. The

estimated market values of the purchased assets are building, $537,300; land, $318,400; land improvements, $39,800;

and four vehicles, $99,500.

3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance

depreciation.

Complete this question by entering your answers in the tabs below.

Required 1A

Allocate the lump-sum purchase price to the separate assets purchased.

Allocation of total

cost

Building

Land

Required 1B Required 2

Land improvements

Vehicles

Total

Required 3

Estimated

Market Value

Percent of Total

%

%

%

%

%

x

X

X

(Required 1A

Total cost of

Acquisition

Apportioned

Cost

Required 1B >

www

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3) Glenmore Reservoir Corporation paid $4,000,000 in a lump-sum purchase of land, a building, and equipment. The payment consisted of $1,500,000 cash and a note payable for the balance. An appraisal indicated the following fair values at the time of the purchase: Land $ 1,600,000 Bullding 2,500,000 Equipment 500,000 Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).arrow_forwardRahularrow_forwardhelp me pleasearrow_forward

- LAR Corp. purchased a commercial range by paying cash of $13,500. The range's fair value on the date of the purchase was $14,000. The company incurred $600 in transportation costs, $400 installation fees, and paid $500 annual insurance on the equipment. For what amount will LAR record the range? Select one: a. $14,500 b. $15,500 c. $13,500 d. $15,000 e. $14,000arrow_forwardTimberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000. The estimated market values of the purchased assets are building, $514,100; land, $329,800; land improvements, $48,500; and four vehicles, $77,600. Allocate the lump-sum purchase price to the separate assets purchased.arrow_forwardLexington Garden Supply paid $160,000 for a group purchase of land, building, and equipment. At the time of the acquisition, the land had a market value of $85,000, the building $51,000, and the equipment $34,000. Journalize the lump-sum purchase of the three assets for a total cost of $160,000, the amount for which the business signed a note payable. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Creditarrow_forward

- Pitney Company purchased an office building, land, and furniture for $631,100 cash. The appraised value of the assets was as follows. Land Building Furniture Total $ 84,820 261,528 360,484 $ 706,832 Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model. c. Prepare the general journal entry to record the purchase.arrow_forwardTurpen Corporation purchased a large forest for $13,000,000 on January 1, 2023. Turpen Corporation estimates that 4,000,000 board feet (BF) of Sumber can be harvested, After 10 years, Turpen Corporation will sell the land and expects it to be worth $3,000,000 Required al Prepare the journal entry to record the purchase of the forest Do not enter dollar.sions.or.commes in the input boxes Date: Account Title and Explanation Debit Record the purchase of the forest b) Calculate the depletion rate for each board foot to be extracted Round your answers to 2 decimal places. Unit Cost Der board foot = Dec 31 c) During the current year, the company harvested and sold 500,000 board feet. Prepare the journal entry to record the harvesting on December 31, 2023 Bound your answers to the nearest whole number. Date Account Title and Explanation Record depletion for the year • Credit Debit Creditarrow_forwardPitney Company purchased an office building, land, and furniture for $728,100 cash. The appraised value of the assets was as follows. $ 138,630 195,713 481,128 $ 815,472 Land Building Furniture Total Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model. c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building Furniture Totalarrow_forward

- Rodriguez Company pays $358,020 for real estate with land, land improvements, and a building. Land is appraised at $164,000; land improvements are appraised at $82,000; and the building is appraised at $164,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers Required 1 Required 2 Allocate the total cost among the three assets. (Round answers to 2 decimal places.) Appraised Value Percent of Total Appraised Value x Total Cost of = Apportioned Acquisition Cost Land Land improvements Building Totals Required 2arrow_forwardCarver Incorporated purchased a building and the land on which the building is situated for a total cost of $972,500 cash. The land was appraised at $257, 226 and the building at $861, 149. Required a. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. b. Would the company recognize a gain on the purchase? c. Record the purchase in a horizontal statements model. d. Record the purchase in general journal format.arrow_forwardRodriguez Company pays $347,490 for real estate with land, land improvements, and a building. Land is appraised at $189,000; land improvements are appraised at $63,000; and the building is appraised at $168,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. Note: Round your "Apportioned Cost" answers to 2 decimal places. Appraised Value Percent of Total Appraised Value x Total Cost of Acquisition = Apportioned Cost Land $ 189,000 45% Land improvements 63,000 15% Building 168,000 40% Totals $ 420,000 100% 0.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education