FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

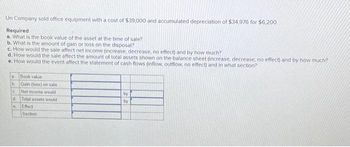

Transcribed Image Text:Un Company sold office equipment with a cost of $39,000 and accumulated depreciation of $34,976 for $6,200

Required

a. What is the book value of the asset at the time of sale?

b. What is the amount of gain or loss on the disposal?

c. How would the sale affect net income (increase, decrease, no effect) and by how much?

d. How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect) and by how much?

e. How would the event affect the statement of cash flows (inflow, outflow, no effect) and in what section?

a

b

C

d

C

Book value

Gain (loss) on sale

Net income would

Total assets would

Effect

Section

by

by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please use your own words to restate the ''total inventory'' and ''property/ plant/ equipment''. Should be the same length as the original one.arrow_forwardAssume a company’s beginning and ending balances in the Accumulated Depreciation account are $30,000 and $44,000, respectively. During the period the company sold one noncurrent asset that had an original cost of $8,000. The cash proceeds from the sale were $3,000 and the gain on the sale was $1,000. What is the amount of the depreciation charges that the company would include in the operating activities section of its statement of cash flows? Multiple Choice $18,000 $20,000 $24,000 $8,000arrow_forwardPitney Company purchased an office building, land, and furniture for $631,100 cash. The appraised value of the assets was as follows. Land Building Furniture Total $ 84,820 261,528 360,484 $ 706,832 Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model. c. Prepare the general journal entry to record the purchase.arrow_forward

- Pitney Company purchased an office building, land, and furniture for $728,100 cash. The appraised value of the assets was as follows. $ 138,630 195,713 481,128 $ 815,472 Land Building Furniture Total Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model. c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building Furniture Totalarrow_forwardDaarrow_forwardFrom page 7-1 of the VLN, acquisition cost would NOT include: A. Purchase price. B. Transportation cost to get the asset ready to be used. C. Sales taxes. D. Cost incurred to operate the asset.arrow_forward

- Patterson Company’s Depreciation Expense is $20,400 and the beginning and ending Accumulated Depreciation balances are $150,200 and $155,200, respectively. What is the cash paid for depreciation?arrow_forwardThe graph was not completed, For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank. A B C Useful Life 5 4 ??? Residual Value ????? 0 0 Asset Cost 25,000 0 0 Total Operating Hours 0 0 ???arrow_forwardA copy machine cost $39,000 when new and has accumulated depreciation of $25,000. Suppose Print Center sold the machine for $14,000. What is the result of this disposal transaction? OA. Gain of $14,000 OB. Loss of $25,000 OC. Loss of $14,000 D. No gain or lossarrow_forward

- An asset which costs $25,000 and has accumulated depreciation of $6,000 is sold for $11,000. What amount of gain or loss will be recognized when the asset is sold? a. A gain of $14,000 b. A loss of $14,000 c. A gain of $8,000 d. A loss of $8,000arrow_forwardTurp and Tyne Distillery sold a still with a cost of $19,000 and accumulated depreciation of $9,000 for $8,000 cash. This transaction would be reported as a........... a. An operating activity b. An investing activity c. A financial activity d. None of the abovearrow_forwardA fixed asset with a cost of $24,000 and accumulated depreciation of $21,600 is sold for $4,080. What is the amount of the gain or loss on the sale of the fixed asset? a. $1,680 loss b. $1,680 gain c. $2,400 loss Od. $2,400 gainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education