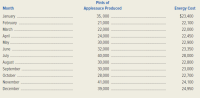

Jonathan Macintosh is a highly successful Pennsylvania orchardman who has formed his own company to produce and package applesauce. Apples can be stored for several months in cold storage, so applesauce production is relatively uniform throughout the year. The recently hired controller for the firm is about to apply the high-low method in estimating the company’s energy cost behavior. The following costs were incurred during the past 12 months:

Required:

1. Use the high-low method to estimate the company’s energy cost behavior and express it in equation form.

2. Predict the energy cost for a month in which 26,000 pints of applesauce are produced.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 3 steps with 2 images

- Marvel Parts, Inc., manufactures auto accessories. One of the company’s products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,035 hours each month to produce 2,070 sets of covers. The standard costs associated with this level of production are: Total Per Setof Covers Direct materials $ 31,878 $ 15.40 Direct labor $ 6,210 3.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,347 2.10 $ 20.50 During August, the factory worked only 500 direct labor-hours and produced 1,700 sets of covers. The following actual costs were recorded during the month: Total Per Setof Covers Direct materials (5,000 yards) $ 25,500 $ 15.00 Direct labor $ 5,440 3.20 Variable manufacturing overhead $ 4,080 2.40 $ 20.60 At…arrow_forwardZurgot Inc. has just organized a new division to manufacture and sell specially designed computer tables, using select hardwoods. The division's monthly costs are shown in the schedule below: Manufacturing costs: Variable costs per unit: Direct materials Variable manufacturing overhead Fixed manufacturing overhead costs (total) Selling and administrative costs: Variable Fixed (total) Units produced Units sold Zurgot regards all of its workers as full-time employees, and the company has a long-standing no-layoff policy. Furthermore, production is highly automated. Accordingly, the company includes its labour costs in its fixed manufacturing overhead. The tables sell for $489 each. During the first month of operations, the following activity was recorded: a. Absorption costing b. Variable costing 4,770 3,550 $ 192 13 $ $438,840 Cost of goods sold: 10% of sales Required: 1. Compute the unit product cost under each of the following costing method. Unit Product Cost $333,900 2. Prepare an…arrow_forwardMarigold There produces a variety of soy products from soybeans and has just finished its first year of operations. Michael, the product manager, wants to evaluate the profitability of each product. Michael knows the process works essentially like this: the soybeans are processed in the company's manufacturing facility at a cost of $434,000, yielding both soy oil and soymeal. The soy oil can then be processed further into mayonnaise, while the soymeal can be processed further into animal feed. The quantities produced and sales values at the split-off point are as follows. 13,200 pounds 46,800 pounds Quantity of soy oil Quantity of soymeal Sales price of soy oil Sales price of soy meal $38.00 per pound $1.50 per pound (a) Using the physical quantities method, allocate the joint costs to the soy oil and the soymeal. (Round proportion to 2 decimal places, e.g. 0.25 and final answers to O decimal places, e.g. 5,125.) Allocated joint costs Soy Oil SA $ Soymeal $arrow_forward

- I need help with all four questions please.arrow_forwardHorton Manufacturing Incorporated produces blinds and other window treatments for residential homes and offices. The owner is concerned about the maintenance costs for the production machinery because maintenance costs for the previous fiscal year were higher than he expected. The owner has asked you to assist in estimating future maintenance costs to better predict the firm's profitability. Together, you have determined that the best cost driver for maintenance costs is machine hours. The data from the previous fiscal year for maintenance costs and machine hours follow: Month Maintenance Costs Machine Hours $ 2,695 2,740 2,790 2,890 2,925 3,025 2,935 1 2 3 4 56789012 10 11 2,975 2,850 2,640 2,660 2,960 Maintenance cost 1,620 1,730 1,745 1,795 1,790 1,890 1,810 1,845 1,835 1,480 1,690 1,495 Required: 1. Use the high-low method to estimate the fixed and variable portions for maintenance costs. (In your calculations, round "slope (uni variable cost)" to 4 decimal places. Enter the "slope…arrow_forwardA process control manager is considering two robots to improve materials-handling capacity in the production of rigid shaft couplings that make dissimilar drive components. Robot X has a first cost of $92,000, an annual M&O cost of $31,000, and $40,000 salvage value, and it will improve revenues by $96,000 per year. Robot Y has a first cost of $146,000, an annual M&O cost of $28,000, and $47,000 salvage value, and it will increase revenues by $124,000 per year. The company's MARR is 37% per year, and it uses a 3-year study period for economic evaluations. Calculate the incremental ROR, and identify the robot the manager should select. The incremental ROR is %. The manager should select robot: (Click to select) (Click to select) Yarrow_forward

- Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the costs of its customizable telescopes. Barbara wondered if it would be better to switch to a normal costing system, as she had heard a number of people talking about that at an industry conference she attended the previous month. Since Metlock has a highly machine-intensive operation, machine hours are used as its MOH cost driver. Here are the costs and other MOH information Barbara is analyzing: Budgeted MOH cost Actual MOH cost Budgeted machine hours Actual machine hours $426,240 Actual MOH rate $ 419,040 Determine the actual MOH rate and the budgeted MOH rate Metlock would have used last year under actual costing and normal costing, respectively. (Round answers to 2 decimal places, e.g. 52.75.) Budgeted MOH rate $ 96,000 108,000 /machine hour /machine hourarrow_forwardRobo-Lawn is a lean manufacturer of robotic lawn mowers. The company budgets $800,000 of conversion costs and 10,000 production hours for this year. The manufacturing of each mower requires 5 production hours and $250 of raw materials. During a recent quarter, the company produced 600 mowers and sold 580 mowers. Each mower is sold for $1,000. Required: 1. Compute the conversion cost rate per mower. 2. Prepare journal entries to record (a) purchase of raw materials on credit, (b) applied conversion costs to production, (c) sale of 580 mowers on credit, and (d) cost of goods sold and finished goods inventory. I just need help on D. It needs Cost of goods sold, Finished goods inventory, and Work in process inventory.arrow_forwardCurrent Attempt in Progress Sandhill Fiber Company is the creator of Y-Go, a technology that weaves silver into its fabrics to kill bacteria and odor on clothing while managing heat. Y-Go has become very popular in undergarments for sports activities. Operating at capacity, the company can produce 1,065,000 Y-Go undergarments a year. The per unit and the total costs for an individual garment when the company operates at full capacity are as follows. Per Undergarment Total Direct materials $1.92 $2,44,800 Direct labor 0.43 457,950 Variable manufacturing overhead 1.02 1,086,300 Fixed manufacturing overhead Variable selling expenses 1.53 1,629,450 0.37 394,050 Totals $5.27 $5,612,550 The U.S.Army has approached Sandhill Fiber and expressed an interest in purchasing 249,000 Y-Go undergarments for soldiers in extremely warm climates. The Army would pay the unit cost for direct materials, direct labor, and variable manufacturing overhead costs. In addition, the Army has agreed to pay an…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education