FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

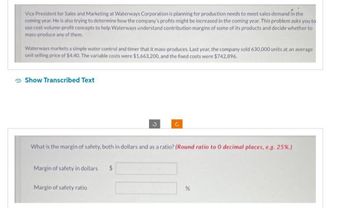

Transcribed Image Text:Vice President for Sales and Marketing at Waterways Corporation is planning for production needs to meet sales demand in the

coming year. He is also trying to determine how the company's profits might be increased in the coming year. This problem asks you to

use cost-volume-profit concepts to help Waterways understand contribution margins of some of its products and decide whether to

mass-produce any of them.

Waterways markets a simple water control and timer that it mass-produces, Last year, the company sold 630,000 units at an average

unit selling price of $4.40. The variable costs were $1,663,200, and the fixed costs were $742,896.

Show Transcribed Text

Margin of safety in dollars

What is the margin of safety, both in dollars and as a ratio? (Round ratio to 0 decimal places, e.g. 25%.)

Margin of safety ratio

3

$

Ć

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello, I need help solving this accounting problem.arrow_forwardAlyssa Stuart is thinking of starting a store that specializes in handmade Viennese style bentwood chairs. Before opening her store, Alyssa is curious about how her profit, revenue, and variable costs will change depending on the amount she charges for the chairs. Alyssa would like you to perform the work required for this analysis and has given you the data. Here are a few things to consider while you perform your analysis: Current competitive prices for Viennese style bentwood chairs are between $225 and $275 a chair. Variable costs will be either $100 or $150 a chair depending on the types of material Alyssa chooses to use. Fixed costs are $10,000 a month. Create an Excel file containing the following information: Alyssa's chairs - Price One Alyssa's chairs - Price Two Chair Price $ 225 Chair Price $ 275 Variable Cost per chair $ 125 Variable Cost per chair $ 150 Fixed Cost $ 10,000 Fixed Cost $…arrow_forwardBliss Bar is a company that sells deluxe chocolate and candy bars based in Illinois. The company is considering launching a new product line featuring protein bars coated with their deluxe chocolate flavors. Bliss Bar has spent $75,000 developing a new protein bar line as a part of the company’s product diversification plan. It also spent another $40,000 for market research on flavors to produce. Based on market research, Bliss Bar expects first year sales of 1,200,000 protein bars at a price of $2.45 per unit with an expected annual growth of 3% in sales volume each year of the six-year project. The variable costs per unit are $0.80, and the annual fixed costs are $30,000. Bliss Bar estimates that the net working capital will be 8% of next year’s sales. The launch of this new product line is expected to cannibalize the sales of an existing candy bar, Choco-O! by 10,000 units per year. Choco-O! is sold at a price of $2 per unit and has variable costs of $0.50 per unit. To expand…arrow_forward

- Whitcomb Foods is a small company in Oregon that packages and sells organic juices. Recently, a sales rep from one of the company's suppliers suggested that Whitcomb could increase its profitability by 50 percent if it introduced a second line of products, packaged dried fruit for snacks. The rep offered to do the analysis and show the company the assumptions made. When Whitcomb's management opened the spreadsheet sent by the sales rep, they noticed that there were several blank cells. In the meantime, the sales rep had taken a job with a competitor and told the managers at Whitcomb that "I can no longer advise you." Although they were not sure they should rely on the analysis, they asked you to see if you could reconstruct the sales rep's analysis. They had been considering this new business already and wanted to see if their analysis was close to that of an outside observer. Required: Complete the below table by filling in the blank cells. Note: Enter all amounts as positive values.…arrow_forwardCarl's Connection manufactures add-on products for the automobile industry. The manager at Carl's Connections has just been presented the opportunity to invest in two independent projects. The first is an air conditioner for the back seats of vans. The second opportunity is turbocharger for sedans. Withoud either investment, the company currently expects average assets for the coming year to be $28.9 million and expects operating income to be $4.335 million. Below is the expected cost for each investment and their expected operating income. It can be assumed that the outlay is the value of the asset. Air Conditioner TurboCharger Outlay $750,000.00 $600,000.00 Operating Income $90,000.00 $82,080.00 Suppose the company sets a minimum required rate of return equal to 14%. Calculate the residual income for each of the following alternatives 1. Company RI, if only the air conditioner…arrow_forwardAlpesharrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardBliss Bar is a company that sells deluxe chocolate and candy bars based in Illinois. The company is considering launching a new product line featuring protein bars coated with their deluxe chocolate flavors. Bliss Bar has spent $75,000 developing a new protein bar line as a part of the company’s product diversification plan. It also spent another $40,000 for market research on flavors to produce. Based on market research, Bliss Bar expects to sell 1,200,000 protein bars at a price of $2.45 per unit over each of the next six years, with an expected annual growth of 3% in sales volume. The variable costs per unit are $0.80, and the annual fixed costs are $30,000. Bliss Bar estimates that the net working capital will be 8% of next year’s sales. Assume all net working capital will be recovered at the end of the project. The launch of this new product line is expected to cannibalize the sales of an existing candy bar, Choco-O! by 10,000 units per year. Choco-O! is sold at a price of $2 per…arrow_forwardWhitcomb Foods is a small company in Oregon that packages and sells organic juices. Recently, a sales rep from one of the company's suppliers suggested that Whitcomb could increase its profitability by 50 percent if it introduced a second line of products, packaged dried fruit for snacks. The rep offered to do the analysis and show the company the assumptions made. When Whitcomb's management opened the spreadsheet sent by the sales rep, they noticed that there were several blank cells. In the meantime, the sales rep had taken a job with a competitor and told the managers at Whitcomb that "I can no longer advise you." Although they were not sure they should rely on the analysis, they asked you to see if you could reconstruct the sales rep's analysis. They had been considering this new business already and wanted to see if their analysis was close to that of an outside observer. Required: Complete the below table by filling in the blank cells. Note: Enter all amounts as positive values.…arrow_forward

- Pain is Good Company manufactures a line of premium hot sauces. The company’s managers would like to increase the operating income generated from its best selling sauce Rajin’ Cajun. The product’s sales staff is doubtful that the current customer base would accept a price increase. However, they are confident that the product’s customer base can be expanded without incurring any additional costs. Management has concluded after consulting with key members of the product’s manufacturing and sales teams that all costs for the product line are currently at the lowest level possible. Given the following information for the Rajin’ Cajun line, what is management’s best option for increasing the product line’s operating income by $10,000? Sales Price . . . $5.00 Unit Fixed Cost at current sales volume . . . $0.50 Total Variable Costs at current sales volume . . . $8,750 Current Sales Volume . . . 5,000 units A. Eliminate fixed costs and decrease variable cost per…arrow_forwardMarigold There produces a variety of soy products from soybeans and has just finished its first year of operations. Michael, the product manager, wants to evaluate the profitability of each product. Michael knows the process works essentially like this: the soybeans are processed in the company's manufacturing facility at a cost of $434,000, yielding both soy oil and soymeal. The soy oil can then be processed further into mayonnaise, while the soymeal can be processed further into animal feed. The quantities produced and sales values at the split-off point are as follows. 13,200 pounds 46,800 pounds Quantity of soy oil Quantity of soymeal Sales price of soy oil Sales price of soy meal $38.00 per pound $1.50 per pound (a) Using the physical quantities method, allocate the joint costs to the soy oil and the soymeal. (Round proportion to 2 decimal places, e.g. 0.25 and final answers to O decimal places, e.g. 5,125.) Allocated joint costs Soy Oil SA $ Soymeal $arrow_forwardplease answer with complete solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education