FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

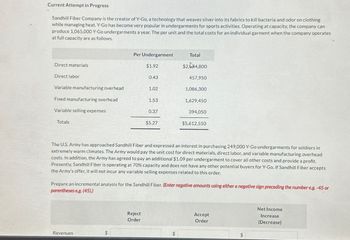

Transcribed Image Text:Current Attempt in Progress

Sandhill Fiber Company is the creator of Y-Go, a technology that weaves silver into its fabrics to kill bacteria and odor on clothing

while managing heat. Y-Go has become very popular in undergarments for sports activities. Operating at capacity, the company can

produce 1,065,000 Y-Go undergarments a year. The per unit and the total costs for an individual garment when the company operates

at full capacity are as follows.

Per Undergarment

Total

Direct materials

$1.92

$2,44,800

Direct labor

0.43

457,950

Variable manufacturing overhead

1.02

1,086,300

Fixed manufacturing overhead

Variable selling expenses

1.53

1,629,450

0.37

394,050

Totals

$5.27

$5,612,550

The U.S.Army has approached Sandhill Fiber and expressed an interest in purchasing 249,000 Y-Go undergarments for soldiers in

extremely warm climates. The Army would pay the unit cost for direct materials, direct labor, and variable manufacturing overhead

costs. In addition, the Army has agreed to pay an additional $1.09 per undergarment to cover all other costs and provide a profit.

Presently, Sandhill Fiber is operating at 70% capacity and does not have any other potential buyers for Y-Go. If Sandhill Fiber accepts

the Army's offer, it will not incur any variable selling expenses related to this order.

Prepare an incremental analysis for the Sandhill Fiber. (Enter negative amounts using either a negative sign preceding the number eg.-45 or

parentheses eg. (45).)

Revenues

Reject

Order

Accept

Order

$

$

Net Income

Increase

(Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Robo-Lawn is a lean manufacturer of robotic lawn mowers. The company budgets $800,000 of conversion costs and 10,000 production hours for this year. The manufacturing of each mower requires 5 production hours and $250 of raw materials. During a recent quarter, the company produced 600 mowers and sold 580 mowers. Each mower is sold for $1,000. Required: 1. Compute the conversion cost rate per mower. 2. Prepare journal entries to record (a) purchase of raw materials on credit, (b) applied conversion costs to production, (c) sale of 580 mowers on credit, and (d) cost of goods sold and finished goods inventory. I just need help on D. It needs Cost of goods sold, Finished goods inventory, and Work in process inventory.arrow_forwardSako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow: Selling price per unit on the intermediate market $ 136 Variable costs per unit $ 118 Fixed costs per unit (based on capacity) $ 8 Capacity in units 25,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $133 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits. Required: Assume the Audio Division sells only 20,000 speakers per year to outside customers. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers acquired from the Audio Division? What is the range of…arrow_forwardYardwork Tools Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are as follows: Expected annual sales of tools (in units) 660,000 Average selling price of tools $11 Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) 27,300 Current exchange rate 9,100 NTD = $1 Variable manufacturing costs $2.85 per unit Incremental annual fixed manufacturing costs associated with the new product line $310,000 Variable selling and distribution costsª $0.50 per unit Annual fixed selling and distribution costsª $250,000 ªSelling and distribution costs are the same regardless of whether the tools…arrow_forward

- Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow:Selling price per unit on the intermediate market $ 80Variable costs per unit $ 62Fixed costs per unit (based on capacity) $ 8Capacity in units 25,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $77 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits.Required: 1. Assume the Audio Division is selling 22,500 speakers per year to outside customers. A. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? B. From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers acquired from the Audio Division? C. What is the…arrow_forwardDetermining the Optimal Product Mix with One Constrained Resource Casual Essentials, Inc. manufactures two types of team shirts, the Homerun and the Goalpost, with unit contribution margins of $11 and $15, respectively. Regardless of type, each team shirts must be fed through a stitching machine to affix the appropriate team logo. The firm leases seven machines that each provides 1,000 hours of machine time per year. Each Homerun shirt requires 6 minutes of machine time, and each Goalpost shirt requires 30 minutes of machine time. Assume that there are no other constraints. Required: If required, round your answers to the nearest whole number. If an amount is zero, enter "0". 1. What is the contribution margin per hour of machine time for each type of team shirts? Contribution Margin Homerun $fill in the blank 1 Goalpost $fill in the blank 2 2. What is the optimal mix of team shirts? Optimal Mix Homerun fill in the blank 3 units Goalpost fill in the blank 4 units…arrow_forwardEach year, Giada Company produces 20,000 units of a component part used in tablet computers. An outside supplier has offered to supply the part for $1.39. The unit cost is: Direct materials $0.83 Direct labor 0.34 Variable overhead 0.13 Fixed overhead 2.55 Total unit cost $3.85 1. What are the alternatives for Giada Company? a. Make the part in house b.Buy the part externally c.Make the part in house or buy the part externally d.None 2. Assume that none of the fixed cost is avoidable. List the relevant cost(s) of internal production. a.Direct materials, direct labor and variable and fixed overhead b.Direct materials, direct labor and variable overhead c.Direct materials, direct labor and fixed overhead d.None List the relevant cost(s) of external purchase. a.Purchase price b.Sales price c.Material price d.None 3. Which alternative is more cost effective and by how much? a. Making the part in house b. Buying the part from the external supplier by $___________ 4. What if…arrow_forward

- Hawkins Audio Video, Inc. manufactures digital cameras. Hawkins is considering whether it should outsource production of a part used in the manufacturing of its cameras. 60,000 units of the part were made by Hawkins last year. At this production level, the company incurred the following direct product costs: Direct Materials $250,000 Direct Labor $104,000 Manufacturing Overhead incurred during the same period for production of the part is represented by the following cost behavior equation: y = $0.10x + $50,000. If the part were purchased from an outside supplier, 80% of the total fixed manufacturing overhead cost would continue, and the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional income from this other product would be $12,600 per year. A supplier has been identified who can sell the part to Hawkins at a price of $7.80 per unit. Which of…arrow_forwardCoram Audio makes wireless headphones. Each pair of headphones comes with a travel case. Since its founding. Coram has manufactured its own travel cases. Recently, Holmur Travel Gear (HTG), a local outfitter that manufactures and sells backpacks, tent cases, and so on, contacted Coram and proposed that they produce the headphone travel cases. Based on management experience, Coram's cost per travel case is as follows (based on annual production of 42,800 units). Direct materials Direct labor Variable overhead Fixed overhead Total $ 10.00 21.20 6.40 4.70 $ 42.30 HTG has offered to sell the case to Coram for $39 each. The total order would amount to 42,800 travel cases per year. Coram's management decides that they will make the switch to HTG cases if Coram can save at least $13,400 per year. Accepting the offer would eliminate annual fixed overhead of $81,320. Required: a. Prepare a schedule that shows the total differential costs. b. Should Coram continue to make the travel cases or buy…arrow_forwardVisnoarrow_forward

- Baird Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 9,000 and 15,000 trophies per year. The following cost data apply to various activity levels:arrow_forwardYoungstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $160,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $353 $253 $133 Unit variable cost (278) (207) (117) Unit contribution margin $ 75 $ 46 $ 16 Autoclave hours per unit 6 4 2 Total process hours per unit 12 8 6 Budgeted units of production 2,600 2,600 2,600 a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production. Large Medium Small Total Units…arrow_forwardWoodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 200,000 200,000 200,000 Installing parts Direct labor hours 20,000 20,000 16,000 Purchasing parts Number of orders 7,600 6,498 3,990 Additionally, the following activity cost data are provided: Material usage: $11 per specialized part used; $27 per commodity part; no fixed activity cost. Installing parts: $21 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $47,000 annual salary; each clerk is capable of processing 1,900…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education