Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer please

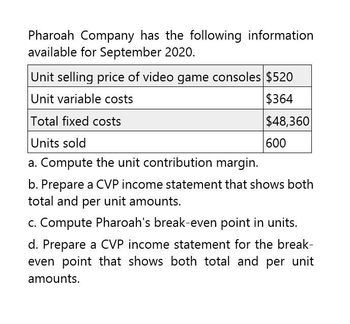

Transcribed Image Text:Pharoah Company has the following information

available for September 2020.

Unit selling price of video game consoles $520

Unit variable costs

Total fixed costs

Units sold

a. Compute the unit contribution margin.

$364

$48,360

600

b. Prepare a CVP income statement that shows both

total and per unit amounts.

c. Compute Pharoah's break-even point in units.

d. Prepare a CVP income statement for the break-

even point that shows both total and per unit

amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sheridan Company has the following information available for September 2020. Unit selling price of video game consoles Unit variable costs Total fixed costs Units sold Compute the unit contribution margin. Unit contribution margin eTextbook and Media $400 $320 eTextbook and dedic $25,600 600 Prepare a CVP income statement that shows both total and per unit amounts. SHERIDAN COMPANY CVP Income Statement For the Month Ended September 30, 2020 Total $ S Per Unitarrow_forwardCarla Vista Company has the following information available for September 2020. Unit selling price of video game consoles $400 Unit variable costs $240 Total fixed costs $54,400 Units sold 600 (a)Compute the unit contribution margin. Unit contribution margin $ (b)Prepare a CVP income statement that shows both total and per unit amounts. (c)Compute Carla Vista’ break-even point in units. Break-even point in units units (d)Prepare a CVP income statement for the break-even point that shows both total and per unit amounts.arrow_forwardPrepare CVP income statements. Olsen Company has the following information available for September 2019. Unit selling price of video game consoles $ 400 Unit variable costs $ 275 Total fixed costs $52,000 Units sold 600 Instructions (a) Compute the contribution margin per unit. (b) Prepare a CVP income statement that shows both total and per unit amounts.arrow_forward

- Norton, Inc. has the following information available for September 2020. Unit selling price of video game consoles 400 Unit variable costs 280 Total fixed costs 48,000 Units sold 500 Instructions (a) Prepare a CVP income statement that shows both total and per unit amounts. (b) Compute Norton's breakeven in units.arrow_forwardRequired: . Using the FIFO cost flow assumption, the gross profit for the year ended December 31, 2021 is:arrow_forwardBlossom Bucket Co., a manufacturer of rain barrels, had the following data for 2019. Sales 2,430 units Sales price $40 per unit Variable costs $20 per unit Fixed costs $21,870 (a)What is the contribution margin ratio? Contribution margin ratio % (b)What is the break-even point in dollars? Break-even point $ (c)What is the margin of safety in dollars and as a ratio? Margin of safety $ Margin of safety ratio % (d)If the company wishes to increase its total dollar contribution margin by 30% in 2020, by how much will it need to increase its sales if selling price per unit, variable price per unit and total fixed costs remain constant? Total increase in sales required: $arrow_forward

- Please help me with show all calculation thankuarrow_forwardSheridan Bucket Co., a manufacturer of rain barrels, had the following data for 2019. Sales 2,200 units Sales price $75 per unit Variable costs $45 per unit Fixed costs $18,480 What is the contribution margin ratio? Contribution margin ratio % What is the break-even point in dollars? Break-even point $ What is the margin of safety in dollars and as a ratio? Margin of safety $ Margin of safety ratio % If the company wishes to increase its total dollar contribution margin by 30% in 2020, by how much will it need to increase its sales if selling price per unit, variable price per unit and total fixed costs remain constant? Total increase in sales required: $arrow_forwardHudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin $2,912,000 2,184,000 728,000 567,000 $ 161,000 Fixed costs Pretax income If the company raises its selling price to $300 per unit. 1. Compute Hudson Co.'s contribution margin per unit. 2. Compute Hudson Co.'s contribution margin ratio. 3. Compute Hudson Co.'s break-even point in units. 4. Compute Hudson Co's break-even point in sales dollars. 1. Contribution margin per unit 2. Contribution margin ratio 3. Break-even point units 4. Break-even sales dollarsarrow_forward

- Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (11,000 units at $300 each) Variable costs (11,000 units at $240 each) Contribution margin $3,300, өөө 2,640,000 2$ 660,000 360,000 Fixed costs Pretax income $300,000 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 5% in 2020, what will be the company's pretax income? 3. Assume sales for 2020 decrease by 5%. Prepare a contribution margin income statement for 2020. Complete this question by entering your answers in the tabs below.arrow_forwardHudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin $2,912,000 2,184,000 728,000 567,000 $ 161,000 Fixed costS Pretax income 1. Assume Hudson Co. has a target pretax income of $170,000 for 2020. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2020, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forwardThe X Corp income statement resembles the following after 35,000 units were sold in 2020. Sales = $420,000 / $12 per unit Variable = $192,500 / $5.5 per unit Contribution Margin = $227,500 / $6.5 per unit Fixed Expense $110,000 Net Op Income $117,500 A. What is X Corp. breakeven point in units and dollars? B. What is X Corp. margin of safety in %, units, and dollars?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College