SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Solve this financial accounting question not use ai and chatgpt

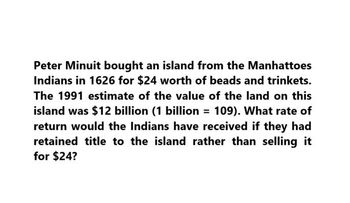

Transcribed Image Text:Peter Minuit bought an island from the Manhattoes

Indians in 1626 for $24 worth of beads and trinkets.

The 1991 estimate of the value of the land on this

island was $12 billion (1 billion = 109). What rate of

return would the Indians have received if they had

retained title to the island rather than selling it

for $24?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve this pleasearrow_forwardPleaseeee help me with the problem formulaarrow_forwardQ3. In 1990 an anonymous private collector purchased a painting by Picasso entitled Angel Fernandezde Soto for $4,450,000. The painting was done in 1900 and valued then at $1800. If the painting wasowned by the same family until its sale in 1990, what is the interest rate they receive on the $1800investment?arrow_forward

- Vijayarrow_forward1. Miss Bae provided information to the government, which led the capture andseizure of smuggled goods with FMV of P 20, 000, 000. If the governmentdestroyed the goods seized because these are regarded as harmful to health,how much cash reward would Ms. Bae receive? 2.In 200A, Mr. Rosario acquired his principal residence for P6,000,000. He soldit to Mr. Dela Cruz for P12,000,000 in 200D. Within 30 days, he wrote the BIR fortax exemption because he intends to use the entire sales proceeds to purchase anew principal residence. How much is the basis of the new residence for taxationpurposes if he actually acquired for P15,000,000?arrow_forwardKey Corp. plans to replace a production machine that was acquired several years ago. Acquisition cost is P450,000 with salvage value of P50,000. The machine being considered is worth P800,000 and the supplier is willing to accept the old machine at a trade-in value of P60,000. Should the company decide not to acquire the new machine, it needs to repair the old one at a cost of P200,000. Tax-wise, the trade-in transaction will not have any implication but the cost to repair is tax-deductible. The effective corporate tax rate is 35% of net income subject to tax. For purposes of capital budgeting, the net investment in the new machine is * A. P540,000 B. P610,000 C. P660,000 D. P800,000 Other:arrow_forward

- Abbott exchanges land in a transaction that lacks commercial substance. The net book value of the land exchanged is $50,000. In exchange Abbott receives land with a fair value of $60,000 and $20,000 in cash. What is the gain that Abbott should recognize?arrow_forwardCase B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $520,000 and a fair value of $740,000. Kapono paid $54,000 cash to complete the exchange. The exchange has commercial substance. Required: What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that…arrow_forwardPlease I’m confused about this case and questionarrow_forward

- Pelé Corp. owns a popular convenience store in Washington state. Messi Corp. is hoping to purchase the store from Pelé for $8,500,000. Messi has identified the land and building have a fair value of $7,000,000 while inventory has a fair value of $700,000. Because of the store’s popularity, excellent customer service, and customer loyalty, Messi is willing to pay $800,000 above the fair value of the assets acquired in the purchase. If Pelé Corp. decides it will not accept anything less than $8,500,000, which Messi Corp. agrees to pay, how is the excess $800,000 payment accounted for? Excess Contributed Capital Plant, & Equipment Property, Plant, & Equipment Accumulated Deprecitation Accumulated Deprecitationarrow_forwardBell International estimates that a $10 million loss will occur if a foreign government expropriates some company property. Expropriation is considered reasonably possible. How should Bell report the loss contingency? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) The contingency is acrrued The contingency is not accrued This is a gain contingency This is a loss contingency It is probable that the confirming event will occur The contingency can be reasonably estimated A disclosure note should describe the contingency None of thesearrow_forwardThe Tuvok Company exchanged an old asset with a $125,700 tax basis and a $155,000 FMV for a new asset with a $147,250 FMV. Assume that this transaction is a like-kind exchange. Write all numbers with a comma, but no dollar sign (example: 130,000). a. For the exchange to occur (and be nontaxable), how much boot (if any) does Tuvok needs to receive? b. Calculate the gain realized: Calculate the gain recognized: c. Calculate the basis of the new asset for Tuvok: d. Assume the transaction is not a like-kind exchange and is a taxable transaction. Calculate the gain realized: Calculate the gain recognized:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT