FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

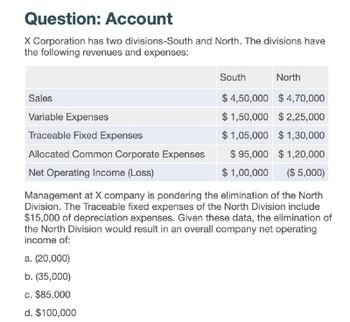

Transcribed Image Text:Question: Account

X Corporation has two divisions-South and North. The divisions have

the following revenues and expenses:

South

North

Sales

Variable Expenses

Traceable Fixed Expenses

Allocated Common Corporate Expenses

Net Operating Income (Loss)

$ 4,50,000 $4,70,000

$1,50,000

$2,25,000

$1,05,000 $ 1,30,000

$95,000 $ 1,20,000

$ 1,00,000 ($ 5,000)

Management at X company is pondering the elimination of the North

Division. The Traceable fixed expenses of the North Division include

$15,000 of depreciation expenses. Given these data, the elimination of

the North Division would result in an overall company net operating

income of:

a. (20,000)

b. (35,000)

c. $85,000

d. $100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Revenues Cost of sales Selling, General and Region I $ 1,209,000 454,500 433,500 Region II $ 1,659,000 814,500 643,500 Region III $ 2,259,000 1,144,500 863,500 Total Corporation $ 5,127,000 2,413,500 1,940,500 Administrative (all fixed) Corporate overhead Information on the division assets in the three regions of Lauderdale Corporation follows: Region I Region II $ 709,000 639,000 1,301,000 450,000 Region III Lauderdale Corporation has a cost of capital of 8.6 percent. Required: a. Compute residual income for the three regions. Ignore taxes. b. How have these regions performed?arrow_forwardDancel Company has the following information for its five business segments: Revenue to external Segment Intersegment revenue Segment assets customers A 20,000,000 2,000,000 25,000,000 B 5,000,000 500,000 5,000,000 C. 2,800,000 1,000,000 3,500,000 ID 1,200,000 200,000 1,500,000 E 1,000,000 250,000 1,000,000 How much is the minimum amount of external revenue that should be reported by the reportable segments? A. 22,500,000 B. 27,000.000 C. 49 500,000 D 6.600.00Oarrow_forwardPLS ANSWER AND SHOW SOLUTIONarrow_forward

- The following results are available for Division X and Y:Division X Division YProfit before interest and tax P185 000 P172, 000Capital employed P1, 540, 000 P1, 650, 000The cost of capital is 10%.Calculate and comment on the performance of the departments based on:a. Return on capital employed (4 marks)b. Residual incomarrow_forwardThe Cook Corporation has two divisions-East and West. The divisions have the following revenues and expenses. East West $ 489,500 258,500 $ 550,000 198,000 169,500 117,500 194,400. 141, 100 $ 65,000 $ (104,500) Sales Variable costs Traceable fixed costs Allocated common corporate costs. Net operating income (loss) The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be voided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in am verall company net operating income (loss) of: Multiple Choice O $(76,100) $(39,500) $65,000 $(104,500)arrow_forwardHaresharrow_forward

- EMBOSOM CHERISH Co. engages in five diversified operations namely, operations A, B, C, D, and E. Information on these segments are shown below: Profit (loss) 800 Segments Revenues Assets 3,200 40,000 A 3,200 400 8,000 B 200 40 4,000 600 80 8,000 D 800 280 24,000 8,000 1,600 84,000 Totals Additional information: a. For internal reporting purposes, segments A and B are considered as one operating segment. b. Segment E is considered as an operating segment for internal decision making purposes. c. Segments C and D have similar economic characteristics and share a majority of the aggregation criteria. 19. What are the reportable segments? а. А, В, С, D and E b. A, B and E c. A and B as one segment and E d. A and B as one segment, E, and C and D as one segmentarrow_forwardNonearrow_forwardSpartans Inc. has the following information for its two divisions: North and South North South Sales $6,000,000 $6,000,000 Expenses $3,800,000 $3,800,000 Oper. Income $2,200,000 $2,200,000 Taxes $660,000 $770,000 Taxable Inc. $1,540,000 $1,430,000 Invested Assets $13,000,000 $15,000,000 Spartans Inc. has a 10% hurdle rate. Calculate the following for each division: Return on Investment (ROI) North Division ________________ South…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education