Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello tutor can you please give correct answer?

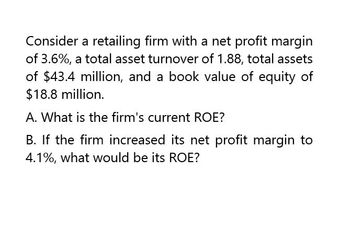

Transcribed Image Text:Consider a retailing firm with a net profit margin

of 3.6%, a total asset turnover of 1.88, total assets

of $43.4 million, and a book value of equity of

$18.8 million.

A. What is the firm's current ROE?

B. If the firm increased its net profit margin to

4.1%, what would be its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a retail firm with a net profit margin of 3.36%, a total asset turnover of 1.88, total assets of $45.5 million, and a book value of equity of $17.6 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.27%, what would be its ROE? c. If, in addition, the firm increased its revenues by 18% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forwardConsider a retail firm with a net profit margin of 3.93 %, a total asset turnover of 1.87, total assets of $42.3 million, and a book value of equity of $18.6 million.a. What is the firm's current ROE?b. If the firm increased its net profit margin to 4.58 %, what would be its ROE?c. If, in addition, the firm increased its revenues by 19 % (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forwardConsider a retail firm with a net profit margin of 3.71%, a total asset turnover of 1.78, total assets of $45.9 million, and a book value of equity of $18.5 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.60%, what would be its ROE? c. If, in addition, the firm increased its revenues by 21% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? a. What is the firm's current ROE? The firm's current ROE is %. (Round to one decimal place.)arrow_forward

- Consider a retail firm with a net profit margin of 3.94%, a total asset turnover of 1.84, total assets of $44.9 million, and a book value of equity of $18.3 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.83%, what would be its ROE? c. If, in addition, the firm increased its revenues by 23% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? **round to one decimal place**arrow_forwardConsider a retail firm with a net profit margin of 3.5%, a total asset turnover of 1.8, total assets of $44 million, and a book value of equity of $18 million.a. What is the firm’s current ROE?b. If the firm increased its net profit margin to 4%, what would its ROE be?c. If, in addition, the firm increased its revenues by 20% (while maintaining this higher profit margin and without changing its assets or liabilities), what would its ROE be?arrow_forwardConsider a retail firm with a net profit margin of 3.61 % a total asset turnover of 1.75, total assets of $43.3 million, and a book value of equity of $18.7 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.37 % what would be its ROE? c. If, in addition, the firm increased its revenues by 24 % (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forward

- Need answerarrow_forwardConsider a retail firm with a net profit margin of 3.15%, a total asset turnover of 1.82, total assets of $44.9 million, and a book value of equity of $17.4 million. c. If, in addition, the firm increased its revenues by 16% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forwardNeed answer with this accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT