FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

- What will be the balance in the investment account on December 31, 20y4 under the equity method of accounting?

A. 152,000

B. 150,000

C. 159,200

D. 155,600

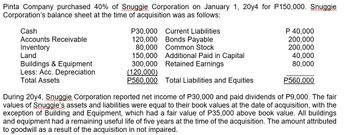

Transcribed Image Text:Pinta Company purchased 40% of Snuggie Corporation on January 1, 20y4 for P150,000. Snuggie

Corporation's balance sheet at the time of acquisition was as follows:

Cash

Accounts Receivable

Inventory

Land

Buildings & Equipment

Less: Acc. Depreciation

Total Assets

P30,000

120,000

80,000

Current Liabilities

Bonds Payable

Common Stock

150,000 Additional Paid in Capital

300,000 Retained Earnings

(120,000)

P560,000 Total Liabilities and Equities

P 40,000

200,000

200,000

40,000

80,000

P560,000

During 20y4, Snuggie Corporation reported net income of P30,000 and paid dividends of P9,000. The fair

values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the

exception of Building and Equipment, which had a fair value of P35,000 above book value. All buildings

and equipment had a remaining useful life of five years at the time of the acquisition. The amount attributed

to goodwill as a result of the acquisition in not impaired.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Examus student.use.examus.net/?ridban=1&sessi. ACCT101 FEX_2021_2_Male e18 Stockholders' equity consists of: 96 18 - 34 a. Long-term assets 11 18c Contributed capital and 95abe18 b. 95 par value 95abe18 C. Retained earnings and cash d. 95abe18ce33 Contributed capital and retained earnings Sabe18ce 33 95abe18ce33 95a 95abe18ce33 96abe18ce33 95abe18ce33 MacBook Pro F3 000 000 F4 つ 4 F5 F6 50 F7 67 & DII 7 V FS 8 A 9 9 个 IIarrow_forward#6 Item Prior year Current year Accounts payable 8,182.00 7,768.00 Accounts receivable 6,011.00 6,766.00 Accruals Cash Common Stock COGS Current portion long-term debt Depreciation expense Interest expense Inventories Long-term debt 1,022.00 1,542.00 ??? ??? 11,535.00 12,370.00 12,726.00 18,265.00 4,989.00 5,013.00 2,500 2,833.00 733 417 4,158.00 4,820.00 14,080.00 14,452.00 Net fixed assets 51,720.00 54,916.00 Notes payable 4,306.00 9,860.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,006.00 29,332.00 Sales 35,119 47,524.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year? Submit Answer format: Number: Round to: 0 decimal places.arrow_forwardQuestion 6 (this question has 2 parts) Gordon Industries Ltd has provided you with the following information: 2019 2020 2021 Debt to Equity 10.5% 23.4% 36.2% Gross Profit margin 30.2% 36.5% 35.3% Net profit margin 19.5% 17.6% 13% Return on Equity 15.1% 17.5% 16.2% Asset Turnover (times) 0.71 0.82 1.41 Return on Assets 13.8% 14.4% 18.3% Interest coverage ratio 4 times 3 times 2.5 times a) Advise Gordon Industries of the relationship between Return on Assets, Asset Turnover and Net Profit Margin. Comment on the profitability position of Gordon and any advice you consider relevant. b) Advise the shareholders of Gordon Industries on the financial structure of the company.arrow_forward

- PE.17-03B Current Position Analysis The following items are reported on a company's balance sheet: Cash Marketable securities Accounts receivable (net) Inventory Accounts payable Determine (a) the current ratio and (b) the quick ratio. Round your answers to one decimal place. a. Current ratio $210,000 120,000 110,000 160,000 200,000 b. Quick ratioarrow_forwardSh4arrow_forward9. What is the capital balance of Tak at December 31, 20x2? 28 A a. P180,000 b. P170,000 c. P165,000 d. Not given SIXOS mot and 100 to stile si 10. What is the capital balance of Gu at December 31, 20x2? a. P220,000 b. P215,000 c. P200,000 d. Not given 007 0902 3 nevig Vo ordub juongoro att mi to side odd ei four we 17 000.08 I s 000.079 000/03/1 8arrow_forward

- Under US GAAP ABC Company has provided the following information related to its investment in marketable equity securities: MARKETABLE VALUES COST. YEAR 2 YEAR 1 Trading $150,000. $155,000. $100,000 Available for sale $150,000. 130,000. $120,000 Based on the above information provided, what amount should ABC Company report in earnings Year 2?arrow_forwardd. mutual agency for stockholders 20. Stockholders' equity a. is usually equal to cash on hand b. is shown on the income statement c. includes paid-in capital and liabilities d. includes retained earnings and paid-in capita blec bisearrow_forwardQuestion 10 of 25 Based on the following data, what is the amount of working capital? Accounts payable Accounts receivable Cash Intangible assets Inventory Long-term investments Long-term liabilities Short-term investments Notes payable (short-term) Property, plant, and equipment Prepaid insurance $404240 O $411680 > O $458800 $79360 141360 86800 124000 171120 198400 248000 99200 69440 1661600 2480arrow_forward

- 2) Calculate the change in Working Capital given the following: 2021 2020 A/R 240 A/P 185 A/R 255 A/P 165 INV 210 Int/P 145 INV 225 Int/P 155 W/C 2021 W/C 2020 Change in Working Capital =arrow_forwardEB12. LO 5.3 Using the following Balance Sheet summary information, calculate for the two years presented: A. working capital B. current ratio Current assets Current liabilities 12/31/2018 $366,500 120,000 12/31/2019 $132,000 141,500arrow_forwardFinancial statement analysis 2. Given below are the summarized accounts of Belper Ltd for the past five years. These the basis for the questions which follow. Summarized profit and loss accounts of Belper Ltd Sales Cost of sales Trading profit Depreciation Interest Net profit before tax Taxation Net profit after tax Extraordinary items Dividends Retained profits Retained at start of year Retained at end of year Fixed assets Freehold land and buildings Leasehold land and buildings Plant and machinery Total gross fixed assets Depreciation freehold Depreciation leasehold Depreciation plant, etc. Total depreciation Net fixed assets Intangible fixed assets Goodwill Investments Patents and trade marks Current assets Stock Debtors Bank and cash Current liabilities Creditors Taxation Dividends Bank loans and overdraft 19X4 Net current assets £000 Financed by Ordinary share capital Share premium account Retained profits Revaluation reserves 93,930 81,750 12,180 1,023 2,727 8,430 2,517 5,913…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education