FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

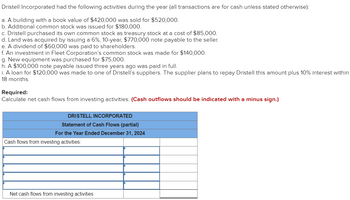

Transcribed Image Text:Dristell Incorporated had the following activities during the year (all transactions are for cash unless stated otherwise):

a. A building with a book value of $420,000 was sold for $520,000.

b. Additional common stock was issued for $180,000.

c. Dristell purchased its own common stock as treasury stock at a cost of $85,000.

d. Land was acquired by issuing a 6%, 10-year, $770,000 note payable to the seller.

e. A dividend of $60,000 was paid to shareholders.

f. An investment in Fleet Corporation's common stock was made for $140,000.

g. New equipment was purchased for $75,000.

h. A $100,000 note payable issued three years ago was paid in full.

i. A loan for $120,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within

18 months.

Required:

Calculate net cash flows from investing activities. (Cash outflows should be indicated with a minus sign.)

DRISTELL INCORPORATED

Statement of Cash Flows (partial)

For the Year Ended December 31, 2024

Cash flows from investing activities:

Net cash flows from investing activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Line following information applies to the questions displayed below.j The following transactions apply to Park Company for Year 1: 1. Received $31,000 cash from the issue of common stock. 2. Purchased inventory on account for $143,000. 3. Sold inventory for $172,500 cash that had cost $105,500. Sales tax was collected at the rate of 8 percent on the inventory sold. 4. Borrowed $24,000 from First State Bank on March 1, Year 1. The note had a 8 percent interest rate and a one-year term to maturity. 5. Paid the accounts payable (see transaction 2). 6. Paid the sales tax due on $153,500 of sales. Sales tax on the other $19,000 is not due until after the end of the year. 7. Salaries for the year for one employee amounted to $28,000. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income tax withheld was $5,300. 8. Paid $2,600 for warranty repairs during the year. 9. Paid $12,000 of other operating expenses during the year. 10. Paid a…arrow_forwardAssume the following: Lomo Engineering Company had the following transactions: Jan-01 Issued capital stock for $965,000. Jan-01 Purchased a Packaging Equipment for $20,000. Jan-01 Purchased an Insurance Policy (1 year) for $30,000. Jan-03 Purchased a Machine, paying $15,000 in cash and issuing a note of $20,000. Jan-05 Purchased $28,000 of inventory on account. Jan-07 Sold inventory costing $6,000 for $50,000 on account. Jan-11 Paid $2,000 for inventory purchased on account (from Jan-05). Jan-15 Collect $12,550 of accounts receivable from customers (from Jan-07). Jan-17 Paid utility bills totaling $1,500. Jan-23 Paid wages for $13,000. Jan-25 Collect $8,000 in bank interest. Jan-30 Paid $12,590 due to income taxes. Required: Record the above transactions in General Journal (Journal Entries). Record the transactions in General Ledger format (T-Accounts). Prepare a…arrow_forwardKen Young and Kim Sherwood organized Reader Direct as a corporation; each contributed $52,675 cash to start the business and received 4,300 shares. The store completed its first year of operations on December 31, 2020. On that date, the following financial items for the year were determined: cash on hand and in the bank, $49,150, amounts due from customers from sales of books, $28,850, property and equipment, $54,750, amounts owed to publishers for books purchased, $8,900; one-year note payable to a local bank for $4,200. No dividends were declared or paid to the shareholders during the year. Required: 1. Complete the balance sheet at December 31, 2020: Total assets Assets READER DIRECT Balance Sheet At December 31, 2020 $ Total liabilities Liabilities Shareholders' equity Total shareholders equity 0 Total llabilities & shareholders' equity $ 0 0arrow_forward

- United Resources Company obtained a charter from the state in January of this year. The charter authorized 200,000 shares of common stock with a par value of $3. During the year, the company earned $475,000. Also during the year, the following selected transactions occurred in the order given: a. Sold 84,000 shares of the common stock in an initial public offering for $13 per share. b. Repurchased 26,000 shares of the previously issued shares for $16 per share and is holding them as treasury stock. c. Resold 6,000 shares of treasury stock for $19 per share. Required: Prepare the stockholders' equity section of the balance sheet at the end of the year. Note: Amounts to be deducted should be indicated with a minus sign. Stockholders' equity: Contributed capital: Common stock UNITED RESOURCES COMPANY Additional paid-in capital Balance Sheet (Partial) At December 31, This year Total contributed capital $ 84,000 $ 84,000 Retained earnings Treasury stockarrow_forwardASSETS Current assets: Cash MANGO INC.. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue. Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities. Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity Assume that the following transactions fin $ 14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $ 30,563 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638arrow_forwardam. 76.arrow_forward

- Pronghorn Corporation purchased from its stockholders 5,400 shares of its own previously issued stock for $275,400. It later resold 2,160 shares for $54 per share, then 2,160 more shares for $49 per share, and finally 1,080 shares for $43 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation I (To record purchase from stockholders.) (To record sales of shares at $54 per share.) (To record sales of shares at $49 per share.) Debit Creditarrow_forwardA company issues 20,000 common shares for $15 each. Later in the year, the same company issues another 35,000 common shares for $27 each. Two weeks later, it repurchases 5,000 shares for 19 per share. The entry to record the repurchase would be which of the following? Debit Cash for $95,000 & Contributed Capital - Retirement of Common Shares for $18,200, credit Common Shares for $113,200. Debit Common Shares for $95,000 & Retained Earnings for $18,200, credit Cash for $113,200. Debit Common Shares for $95,000, credit Cash for $95,000. Debit Common Shares for $113,200, credit Contributed Capital - Retirement of Common Shares for $18,200 & Cash for $95,000.arrow_forward7. On January 3, Russet Corporation purchased 2,250 shares of the company's $3 par value common stock as treasury stock, paying cash of $11 per share. On January 30, Russet Corporation sold 1,400 shares of the treasury stock for cash of $14 per share. Journalize these transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the purchase of the treasury stock. Date Jan. 3 Accounts and Explanation Debit Creditarrow_forward

- The following transactions occurred last year at Jost Company: Issuance of shares of the company’s own common stock $170,000 ; Dividends paid to the company’s own shareholders $7,000; Dividends received from investments in other companies’ shares $4,000; Interest paid on the company’s own bonds $11,000; Repayment of principal on the company’s own bonds $40,000; Proceeds from sale of the company’s used equipment $23,000; Purchase of land $120,000 . Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be: a.$112,000 b. $123,000 c. $375,000 d. $19,000arrow_forwardSudoku Company issues 19,000 shares of $6 par value common stock in exchange for land and a building. The land is valued at $238,000 and the building at $373,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building.arrow_forwardAssume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020): Borrowed $18,279 from banks due in two years. Purchased additional investments for $22,200 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,584 in cash and signed a short-term note for $1,422. Issued additional shares of common stock for $1,481 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,021 for $19,021 cash. Declared $11,138 in dividends to be paid at the beginning of the next fiscal year. Prepare a classified balance sheet for Orange at September 26, 2020, based on these transactions. please complete this with working and show how did you get the number with other work answer in text thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education