Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hardev

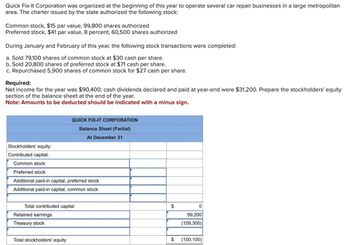

Transcribed Image Text:Quick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan

area. The charter issued by the state authorized the following stock:

Common stock, $15 par value, 99,800 shares authorized

Preferred stock, $41 par value, 8 percent, 60,500 shares authorized

During January and February of this year, the following stock transactions were completed:

a. Sold 79,100 shares of common stock at $30 cash per share.

b. Sold 20,800 shares of preferred stock at $71 cash per share.

c. Repurchased 5,900 shares of common stock for $27 cash per share.

Required:

Net income for the year was $90,400; cash dividends declared and paid at year-end were $31,200. Prepare the stockholders' equity

section of the balance sheet at the end of the year.

Note: Amounts to be deducted should be indicated with a minus sign.

Stockholders' equity:

Contributed capital:

QUICK FIX-IT CORPORATION

Balance Sheet (Partial)

At December 31

Common stock

Preferred stock

Additional paid-in capital, preferred stock

Additional paid-in capital, common stock

Total contributed capital

Retained earnings

Treasury stock

Total stockholders' equity

$

0

59,200

(159,300)

$ (100,100)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wingra Corporation was organized in March. It is authorized to issue 500,000 shares of $100 par value 8% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forwardPaydirt Limestone, Incorporated was organized several years ago and was authorized to issue 3,000,000 shares of $40 par value 9% preferred stock. It is also authorized to issue 3,750,000 shares of $2 par value common stock. In its fifth year, the corporation has the following transactions: Journalize the transactions.arrow_forwardCopper Corporation was organized in May. It is authorized to issue 50,000,000 shares of $200 par value 7% preferred stock. It is also authorized to issue 75,000,000 shares of $5 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forward

- The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forwardEllaJane Corporation was organized several years ago and was authorized to issue 4,000,000 shares of $50 par value 6% preferred stock. It is also authorized to issue 1,750,000 shares of $1 par value common stock. In its fifth year, the corporation has the following transactions: Journalize the transactions.arrow_forwardAnslo Fabricating, Inc. is authorized to issue 10,000,000 shares of $5 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forward

- Quick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock: Common stock, $20 par value, 98,100 shares authorized Preferred stock, $47 par value, 8 percent, 60,500 shares authorized During January and February of this year, the following stock transactions were completed: a. Sold 78,700 shares of common stock at $40 cash per share. b. Sold 20,000 shares of preferred stock at $77 cash per share. c. Repurchased 4,900 shares of common stock for $24 cash per share. Required: Net income for the year was $90,600; cash dividends declared and paid at year-end were $30,900. Prepare the stockholders' equity section of the balance sheet at the end of the year. Note: Amounts to be deducted should be indicated with a minus sign. Stockholders' equity: Contributed capital: QUICK FIX-IT CORPORATION Balance Sheet (Partial) At December 31arrow_forwardQuick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock: Common stock, $19 par value, 99,500 shares authorized Preferred stock, $46 par value, 8 percent, 60,000 shares authorized During January and February of this year, the following stock transactions were completed: a. Sold 79,300 shares of common stock at $38 cash per share. b. Sold 20,100 shares of preferred stock at $72 cash per share. c. Bought 4,300 shares of common stock from a current stockholder for $22 cash per share. Required: Net income for the year was $91,300; cash dividends declared and paid at year-end were $30,800. Prepare the stockholders' equity section of the balance sheet at the end of the year. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardQuick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock: Common stock, $19 par value, 98,300 shares authorized Preferred stock, $45 par value, 8 percent, 60,400 shares authorized During January and February of this year, the following stock transactions were completed: Sold 78,800 shares of common stock at $38 cash per share. Sold 20,100 shares of preferred stock at $75 cash per share. Repurchased 4,000 shares of common stock for $20 cash per share. Required: Net income for the year was $90,600; cash dividends declared and paid at year-end were $30,200. Prepare the stockholders' equity section of the balance sheet at the end of the year. Note: Amounts to be deducted should be indicated with a minus sign. QUICK FIX-IT CORPORATION Balance Sheet (Partial) At December 31 Stockholders’ equity: Contributed capital:…arrow_forward

- Quick Fix-It Corporation was organized at the beginning of this vear to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock Common stock, $16 par value, 98,500 shares authorized Preferred stock, $43 par value, 8 percent, 60,900 shares authorized During January and February of this year, the following stock transactions were completed: a. Sold 79,300 shares of common stock at $32 cash per share. b. Sold 20,600 shares of preferred stock at $76 cash per share. c. Bought 6,000 shares of common stock from a current stockholder for $10 cash per share. Required: Net income for the year was $90,100; cash dividends declared and paid at year-end were $31,100. Prepare the stockholders' equity section of the balance sheet at the end of the year. (Amounts to be deducted should be indicated with a minus sign.) QUICK FIX-IT CORPORATION Balance Sheet (Partial) At December 31, This year Stockholders' equity: Contributed…arrow_forwardNanjiarrow_forwardShelby Corporation was organized in January to operate an air-conditioning sales and service business. The charter issued by the state authorized the following capital stock Common stock, $1 par value, 200,000 shares. Preferred stock. $10 par value, 6 percent. 50,000 shares. During January and February, the following stock transactions were completed a Collected $676,000 cash and issued 26,000 shares of common stock b Issued 18,000 shares of preferred stock at $36 per share, collected in cash Net income for the year was $56.000 cash dividends declared and paid at year-end were $10,000 Required: Prepare the stockholders' equity section of the balance sheet at December 31 Contributed Capital Common Stock Preferred Stock Answer is complete but not entirely correct. SHELBY CORPORATION Balance Sheet (Partial) At December 31 Stockholders' Equity Additional Paid-In Capital, Common Stock Additional Pad-In Capital, Preferred Stock Total Contributed Capital Retained Earnings Total Stockholders'…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning