FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

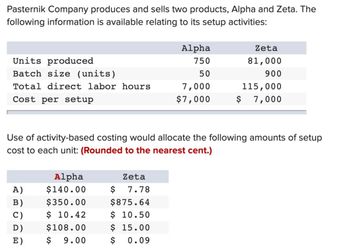

Transcribed Image Text:Pasternik Company produces and sells two products, Alpha and Zeta. The

following information is available relating to its setup activities:

Units produced

Batch size (units)

Total direct labor hours

Cost per setup

A)

B)

C)

D)

E)

Alpha

$140.00

$350.00

$ 10.42

$108.00

$ 9.00

Zeta

$ 7.78

Alpha

750

50

Use of activity-based costing would allocate the following amounts of setup

cost to each unit: (Rounded to the nearest cent.)

$875.64

$ 10.50

$ 15.00

$ 0.09

7,000

$7,000

Zeta

81,000

900

115,000

$ 7,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your Company makes three products in a single facility. These products have the following unit product costs: Product A Product B Product C Direct material $26.00 $26.00 $27.00 Direct labor 15.00 17.00 16.00 Variable manufacturing overhead 4.00 5.00 6.00 Fixed manufacturing overhead 21.00 28.00 23.00 Unit cost $66.00 $76.00 $72.00 Additional data concerning these products are listed below: Product A Product B Product C Mixing minutes per unit 3 2 2.5 Selling price per unit $76.00 $90.00 $84.00 Variable selling cost per unit $4.00 $3.00 $5.00 Monthly demand in units 1,500 3,000 4,000 The mixing machines are potentially the constraint in the production facility. A total of 18,000 minutes is available per month on these machines. Direct labor is a variable cost in this company. Required: How many minutes of mixing machine time would be required to satisfy demand for all three products?arrow_forwardWildhorse Company accumulated the following standard cost data concerning product I-Tal. Direct materials per unit: 2.50 pounds at $4.40 per pound Direct labor per unit: 0.40 hours at $16.00 per hour Manufacturing overhead: Allocated based on direct labor hours at a predetermined rate of $20.00 per direct labor hour Compute the standard cost of one unit of product I-Tal. (Round answer to two decimal places (e.g., 2.75).) Standard cost $arrow_forward>>>>__arrow_forward

- Tango Company produces and sells two products, Alpha and Zeta. The following information is available relating to its setup activities: ABODO Units produced Batch size (units) Total direct labor hours 7,000 Cost per setup $ 7,000 Use of activity-based costing would allocate the following amounts of setup cost to each unit: (Rounded to the nearest cent.) A) B) C) D) E) Alpha $ 175.00 $ 438.00 $ 12.92 $83.00 $9.00 Multiple Choice Option A Option B Option C Option D Option E Alpha Zeta $ 11.67 $963.14 $ 13.00 $ 20.00 $ 0.11 Zeta 66,000 600 800 40 118,000 $ 7,000arrow_forwardOlmo, Inc., manufactures and sells two products: Product KO and Product H9. The annual production and sales of Product of K0 is 600 units and of Product H9 is 600 units. The company has an activity- based costing system with the following activity cost pools, activity measures, and expected activity. Activity Measures Overhead Cost Product KO Estimated Expected Activity Activity Cost Pools Labor-related Production orders Product H9 Total 9,000 1,300 6,800 DLHS $ 550,408 53,419 836,016 6,000 700 3,800 3,000 orders 600 Order size MHs 3,000 $1,439,843 The overhead applied to each unit of Product KO under activity-based costing is closest to: (Round your Intermedlate calculations to 2 declmal places.) Multiple Cholce $611.60 per unlt $1.438.16 per unit. $778.62 per unit C479 95 nerınlt 3 自! 92°F AQI 61 9/9 pe here to search DELLarrow_forwardAarrow_forward

- A company which uses activity-based costing has two products: A and B. The annual production and sales of Product A is 12,000 units and of Product B is 10,500 units. There are three activity cost pools, with total cost and total activity as follows: Total Activity Product Product A Activity Cost Pool Total Cost Total Activity 1 Activity 2 Activity 3 52-54 $25,420 130 490 620 $38,400 $122,670 890 310 1,200 820 3,410 4,230 The activity-based costing cost per unit of Product A is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $10.79 $1.60 $4.80 $3.10arrow_forwardCoronado Inc. has conducted the following analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. The traditional and the activity-based costing systems assign the same amount of direct materials and direct labor costs. Products Product 540X Product 137Y Product 249S (a) Sales Revenue $210,000 Product 137Y * Your answer is incorrect. Product 540X $ LA LA 166,000 LA 94,000 Product 249S $ Total Costs Traditional $59,000 For each product line, compute operating income using the traditional costing system. 49,000 17,000 160060 131040 ABC 53900 $49,940 34,960 40,100arrow_forwardHaresharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education