FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Multiple Choice

о

O

O

O

$1,154,399

$655,132

$547,376

$496,221

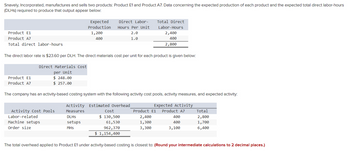

Transcribed Image Text:Snavely, Incorporated, manufactures and sells two products: Product E1 and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours

(DLHS) required to produce that output appear below:

Product E1

Product A7

Total direct labor-hours

Product E1

Product A7

Direct Materials Cost

per Unit

$ 248.00

$257.00

The direct labor rate is $23.60 per DLH. The direct materials cost per unit for each product is given below:

Activity Cost Pools

Labor-related

Expected

Production

1,200

400

Machine setups

Order size

Direct Labor-

Hours Per Unit

2.0

1.0

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Expected Activity

Activity Estimated Overhead

Measures

DLHS

setups

MHS

Total Direct

Labor-Hours

2,400

400

2,800

Cost

$ 130,500

61,530

962,370

$ 1,154,400

Product E1 Product A7

2,400

1,300

3,300

400

400

3,100

Total

2,800

1,700

6,400

The total overhead applied to Product E1 under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (The following information applies to the questions displayed below.) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $ 5.30 $ 2.80 $ 1.40 $4.00 $ 2.30 $2.20 $ 1.20 $ 0.45 2. For financial accounting purposes, what is the total amount of period costs igcurred to sell 10,000 units? (Do not round intermediate calculations.) Total period costarrow_forwardTesh, Inc., manufactures and sells two products: Product P9 and Product I9. Data concerning the expected production of each product and the expected total direct labour-hours (DLHs) required to produce that output appear below: Expected Production Direct Labour-Hours Per Unit Total Direct Labour-Hours Product P9 200 7.0 1,400 Product I9 400 6.0 2,400 Total direct labour-hours 3,800 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product P9 Product I9 Labour-related DLHs $71,136 1,400 2,400 Machine setups setups 42,880 300 200 General factory MHs 406,620 4,200 3,900 $520,636 The activity rate for the Machine setups activity cost pool under activity-based costing is closest to: a. $1,041.27 per setup b. $85.76 per setup c. $214.40 per setup d.…arrow_forwardConsider the following production and cost data for two products, X and Y, manufactured by Company. Product X Product Y Sales price per unit $52 $40 Direct materials cost per unit $18 $8 Direct labor hours per unit 1.5 1.0 Machine hours per unit 3.0 2.0 The labor rate is $10 per hour. Variable overhead is $2 per direct labor hour. The company can hire sufficient labor for any production level. The company has 15,000 machine hours available each period. There is unlimited demand for each product. Assuming a company has achieved a reasonable level of cost accuracy, what is the most important determinant of whether cost information should be even more accurate?arrow_forward

- Sheddon Industries produces two products. The products' identified costs are as follows: Direct materials. Direct labor Multiple Choice The company's overhead costs of $55,000 are allocated based on direct labor cost. Assume 5,000 units of product A and 6,000 units of product B are produced. What is the cost per unit for product B? Note: Do not round intermediate calculations. $12.56 $14.56 Product A $ 21,000 15,000 $14.19 Product B $ 16,000 25,000arrow_forwardA company makes two products—Product A and B. Data regarding the two products follow: Direct Labor-Hours per Unit Annual Production Product A 0.75 20,000 units Product B 0.50 50,000 units Additional information is as follows: Product A requires $15 in direct materials per unit, and Product B requires $8. The direct labor wage rate is $18 per hour. The company’s activity-based absorption costing system has the following activity cost pools: Activity Cost Pool (and Activity Measures) Estimated Overhead Cost Expected Activity Product A Product B Total Machine setups (number of setups) $ 100,000 145 255 400 Special processing (machine-hours) $ 200,000 3,500 4,500 8,000 General factory (Direct labor-hours) $ 150,000 15,000 25,000 40,000 Using activity-based absorption costing, the unit product cost for Product B is closest to:arrow_forwardCool Pool has these costs associated with production of 21,916 units of accessory products: direct materials, $63; direct labor, $134; variable manufacturing overhead, $11; total fixed manufacturing overhead, $637,294. What is the cost per unit under the absorption method? Round to the nearest penny, two decimal places.arrow_forward

- ELU Company makes two products in a single facility. These products have the following unit product costs: Product A Product B Direct materials $10.90 $15.80 Direct labour 12.50 12.60 Variable manufacturing overhead 2.40 1.20 Fixed manufacturing overhead 11.60 7.20 Unit product cost $37.40 $36.80 Additional data concerning these products are listed below. Product A Product B Mixing minutes per unit 2.00 1.00 Selling price per unit $55.80 $54.60 Variable selling cost per unit $2.10 $1.40 Monthly demand in units 2,000 1,000 The mixing machines are potentially a constraint in the production facility. A total of 4,000 minutes are available per month on these machines. Direct labour is a variable cost in this company. Required: How many minutes of mixing machine time would be required to satisfy demand for both products? How many of each product should be produced, rounded to the nearest…arrow_forwardDinesh Bhaiarrow_forwardHow do i calculate this? Perteet Corporation's relevant range of activity is 8,400 units to 16,000 units. When it produces and sells 12,200 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $7.80 Direct labor $4.00 Variable manufacturing overhead $1.80 Fixed manufacturing overhead $3.60 Fixed selling expense $0.70 Fixed administrative expense $0.40 Sales commissions $0.50 Variable administrative expense $0.55 If 9,800 units are produced, the total amount of manufacturing overhead cost is closest to:arrow_forward

- Your Company makes three products in a single facility. These products have the following unit product costs: Product A Product B Product C Direct material $26.00 $26.00 $27.00 Direct labor 15.00 17.00 16.00 Variable manufacturing overhead 4.00 5.00 6.00 Fixed manufacturing overhead 21.00 28.00 23.00 Unit cost $66.00 $76.00 $72.00 Additional data concerning these products are listed below: Product A Product B Product C Mixing minutes per unit 3 2 2.5 Selling price per unit $76.00 $90.00 $84.00 Variable selling cost per unit $4.00 $3.00 $5.00 Monthly demand in units 1,500 3,000 4,000 The mixing machines are potentially the constraint in the production facility. A total of 18,000 minutes is available per month on these machines. Direct labor is a variable cost in this company. Required: How many minutes of mixing machine time would be required to satisfy demand for all three products?arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials. Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Cost per unit Traceable fixed manufacturing overhead Alpha $ 42 42 26 34 31 34 $209 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Alpha Required: 1. What is the total amount of traceable fixed manufacturing overhead for the Alpha product line and for the Beta product line? Prev Beta $24 Beta 32 24 37 27 29 $173 1 2 3 *** 10 of 10 H Next >arrow_forwardMerone Company allocates materials handling cost to the company's two products using the below data: Modular Homes 5,700 570 770 Prefab Barns 8,700 170 270 Total expected units produced Total expected material moves Expected direct labor-hours per unit The total materials handling cost for the year is expected to be $370,590. If the materials handling cost is allocated on the basis of material moves, the total materials handling cost allocated to the modular homes is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education