FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

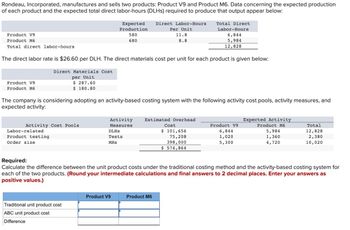

Transcribed Image Text:Rondeau, Incorporated, manufactures and sells two products: Product V9 and Product M6. Data concerning the expected production

of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

Product V9

Product M6

Total direct labor-hours

Product V9

Product M6

Direct Materials Cost

per Unit

$ 287.60

$ 180.80

The direct labor rate is $26.60 per DLH. The direct materials cost per unit for each product is given below:

Activity Cost Pools

Labor-related

Product testing

Order size

Expected

Production

580

680

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and

expected activity:

Traditional unit product cost

ABC unit product cost

Difference

Direct Labor-Hours

Per Unit

DLHS

Tests

MHS

11.8

8.8

Activity Estimated Overhead

Measures

Product V9

Product M6

Total Direct

Labor-Hours

6,844

5,984

12,828

Cost

$ 101,656

75,208

398,000

$ 574,864

Product V9

6,844

1,020

5,300

Expected Activity

Product M6

Required:

Calculate the difference between the unit product costs under the traditional costing method and the activity-based costing system for

each of the two products. (Round your intermediate calculations and final answers to 2 decimal places. Enter your answers as

positive values.)

5,984

1,360

4,720

Total

12,828

2,380

10,020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following production and cost data for two products, X and Y, manufactured by Company. Product X Product Y Sales price per unit $52 $40 Direct materials cost per unit $18 $8 Direct labor hours per unit 1.5 1.0 Machine hours per unit 3.0 2.0 The labor rate is $10 per hour. Variable overhead is $2 per direct labor hour. The company can hire sufficient labor for any production level. The company has 15,000 machine hours available each period. There is unlimited demand for each product. Assuming a company has achieved a reasonable level of cost accuracy, what is the most important determinant of whether cost information should be even more accurate?arrow_forwardHenry Company has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40/kg Direct Labor $ 3.00 0.40 hour $ 7.50/hour Variable Overhead $ 4.00 0.40 hour $ 10.00/hour Fixed Overhead* $ 4.80 0.40 hour $ 12.00/hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100 and $25,000, respectively.…arrow_forwardFleurant, Inc., manufactures and sells two products: Product W2 and Product P8. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product W2 400 5 2,000 Product P8 500 4 2,000 Total direct labor-hours 4,000 The direct labor rate is $37.10 per DLH. The direct materials cost per unit is $203.60 for Product W2 and $140.30 for Product P8. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product W2 Product P8 Total Labor-related DLHs $ 218,576 2,000 2,000 4,000 Production orders orders 18,538 400 380 780 Order size MHs 202,886 3,880 3,680 7,560 $ 440,000 Which of the…arrow_forward

- Sheddon Industries produces two products. The products' identified costs are as follows: Direct materials. Direct labor Multiple Choice The company's overhead costs of $55,000 are allocated based on direct labor cost. Assume 5,000 units of product A and 6,000 units of product B are produced. What is the cost per unit for product B? Note: Do not round intermediate calculations. $12.56 $14.56 Product A $ 21,000 15,000 $14.19 Product B $ 16,000 25,000arrow_forwardKesterson Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense Cost per Unit $ 6.30 $ 3.30 $ 1.25 $ 1.30 $ 0.60 Cost per Period $ 15,000 $ 4,200 If 7,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:arrow_forwardSalvatori, Inc., manufactures and sells two products: Product A4 and Product Q5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product A4 690 7.9 5,451 Product Q5 990 4.9 4,851 Total direct labor-hours 10,302 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product A4 Product Q5 Total Labor-related DLHs $ 167,558 5,451 4,851 10,302 Machine setups setups 15,050 1,250 1,150 2,400 Order size MHs 504,027 5,100 5,400 10,500 $ 686,635 The overhead applied to each unit of Product A4 under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forward

- Your Company makes three products in a single facility. These products have the following unit product costs: Product A Product B Product C Direct material $26.00 $26.00 $27.00 Direct labor 15.00 17.00 16.00 Variable manufacturing overhead 4.00 5.00 6.00 Fixed manufacturing overhead 21.00 28.00 23.00 Unit cost $66.00 $76.00 $72.00 Additional data concerning these products are listed below: Product A Product B Product C Mixing minutes per unit 3 2 2.5 Selling price per unit $76.00 $90.00 $84.00 Variable selling cost per unit $4.00 $3.00 $5.00 Monthly demand in units 1,500 3,000 4,000 The mixing machines are potentially the constraint in the production facility. A total of 18,000 minutes is available per month on these machines. Direct labor is a variable cost in this company. Required: How many minutes of mixing machine time would be required to satisfy demand for all three products?arrow_forwardThe following direct labor information pertains to the manufacture of Granny: Time required to make one unit - 2 DL hrs; Number of direct labor workers - 50 workers; number of productive hours per week, per worker - 40 hours; weekly wages per worker - P500; Workers' benefits treated as DL costs - 20% of wages. What is the standard direct labor cost per unit of product Granny?arrow_forwardMerone Company allocates materials handling cost to the company's two products using the below data: Modular Homes 5,700 570 770 Prefab Barns 8,700 170 270 Total expected units produced Total expected material moves Expected direct labor-hours per unit The total materials handling cost for the year is expected to be $370,590. If the materials handling cost is allocated on the basis of material moves, the total materials handling cost allocated to the modular homes is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forward

- Both the image are from the same question please helparrow_forwardGlover Company makes three products in a single facility. These products have the following unit product costs: Product A B C Direct materials $ 32.80 $ 49.30 $ 55.70 Direct labor 20.20 22.80 13.60 Variable manufacturing overhead 1.20 0.60 0.90 Fixed manufacturing overhead 13.50 9.10 9.70 Unit product cost $ 67.70 $ 81.80 $ 79.90 Additional data concerning these products are listed below. Product A B C Mixing minutes per unit 1.20 1.20 0.20 Selling price per unit $ 58.00 $ 80.40 $ 73.90 Variable selling cost per unit $ 0.60 $ 1.10 $ 2.30 Monthly demand in units 2,000 3,300 1,300 The mixing machines are potentially the constraint in the production facility. A total of 6,520 minutes are available per month on these machines. Direct labor is a variable cost in this company. Required: a. How many minutes of mixing machine time would be required to satisfy demand for all three products? b. How much of…arrow_forwardA company makes two products—Product A and B. Data regarding the two products follow: Direct Labor-Hours per Unit Annual Production Product A 0.75 20,000 units Product B 0.50 50,000 units Additional information is as follows: Product A requires $40 in direct materials per unit, and Product B requires $32. The direct labor wage rate is $18 per hour. The company’s activity-based absorption costing system has the following activity cost pools: Activity Cost Pool (and Activity Measures) Estimated Overhead Cost Expected Activity Product A Product B Total Machine setups (number of setups) $ 100,000 100 300 400 Special processing (machine-hours) $ 200,000 2,000 6,000 8,000 General factory (Direct labor-hours) $ 150,000 15,000 25,000 40,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education