FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

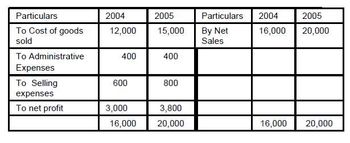

Transcribed Image Text:Particulars

To Cost of goods

sold

To Administrative

Expenses

To Selling

expenses

To net profit

2004

12,000

400

600

3,000

16,000

2005

15,000

400

800

3,800

20,000

Particulars

By Net

Sales

2004

2005

16,000 20,000

16,000 20,000

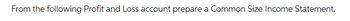

Transcribed Image Text:From the following Profit and Loss account prepare a Common Size Income Statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A B C D E Sales revenue $40,400 $75,400 $573,700 $34,800 $54,100 Cost of goods sold 19,200 50,500 273,600 19,400 30,500 Operating expenses 9,800 39,800 230,700 11,800 17,900 Total expenses 29,000 90,300 504,300 31,200 48,400 Operating profit (loss) $11,400 $(14,900) $69,400 $3,600 $5,700 Identifiable assets $34,500 $80,000 $501,100 $64,700 $50,400 Sales of segments B and C included intersegment sales of $20,000 and $101,000, respectively. (a) Determine which of the segments are reportable based on the: 1. Revenue test. 2 Operating profit (loss) test. 3. Identifiable assets test. Reportable Segmentarrow_forwardFor 20Y2, Macklin Inc. reported a significant increase in net income. At the end of the year, Chris Jenkins, the president, is presented with the following condensed comparative income statement: Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 $910,000 441,000 $469,000 $139,150 99,450 $238,600 $230,400 65,000 $295,400 65,000 $230,400 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue Income before income tax Income tax expense Net income 20Y1 $700,000 350,000 $350,000 $115,000 85,000 $200,000 $150,000 50,000 $200,000 50,000 $150,000 Required: Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place. Use the minus sign to indicate a decrease in the "Difference".columns.arrow_forwardThis is part a and b please answer botharrow_forward

- Net sales OR 165000 Cost of the goods sold OR 109000 Details Debit Credit General expenses 11700 Rent 5100 Salaries Payable 9300 Depreciation 1560 Account Payable 3575 Other income 2500 Calculate net profit Select one: O a. RO 31140 O b. RO 34715 O c. RO 40140 O d. RO 27265arrow_forwardIf the cost of goods available for sale equals $116,029, calculate the cost of goods sold using the table below. Cost per unit Number of units on hand Total cost $860 8 $1760 10 $945 8 6 32 $480 Ending inventory The cost of goods sold is S $6,880 $17,600 $7,560 $2,880 $34,920 ***arrow_forwardA9arrow_forward

- Question attached in screenshot below need help asap thanks aprpeciated i51oiyji1o5j1io5yj51oijygmi lo1 51arrow_forwardBased on the table given below, Net Income Model Data 1 B Sales Cost of Goods Sold $10.000.000 6400.000 Administrative Expenses 500,000 Selling Expenses 5.900.000 Depreciation Expenses 250.000 10 Interest Expenses 20000 11 Taxes $620,000 12 13 Model 14 15 Kiss Profi 1,000,000 16 Operating Expenses 52.110.000 19 Net Operating Inome 1.450.000 arnings Before Tenes 1350.000 19 20 Net Income which of the following formulas would be used to calculate the net income value using only the information in the Model, and not in the Data section?. -B6-B15 -B15-B16-B17+B18 -B5-B17 -B18-B11arrow_forwardPlease do not give solution in image format thankuarrow_forward

- K The following information relates to Fantastic Clothing, Inc. Net Sales Revenue Cost of Goods Sold Interest Expense Operating Expenses Calculate the net income. OA. $260,700 OB. $265,000 O C. $315,700 OD. $320,000 $550,000 230,000 4,300 55,000arrow_forwardSales revenue Variable cost of goods sold Fixed cost of goods sold Gross profit Variable operating expenses Fixed operating expenses Common fixed costs Operating income (a) $1,360,000 Q Search Baseball V V 919,000 V 123,800 317,200 183,800 85,200 65,000 ($16,800) Soccer $3,900,000 2,535,000 $ 202,200 $ 1,162,800 624,000 91,000 139,000 Basketball $2,560,000 2,065,600 178,000 316,400 Baseball 256,000 78,900 104,900 $308,800 ($123,400) Doug is concerned that two of the company's divisions are showing a loss, and he wonders if the company should stop selling baseball and basketball gear to concentrate solely on soccer gear. Prepare a segment margin income statement. Fixed cost of goods sold and fixed operating expenses can be traced to each division (If the amount is negative then enter with a negative sign preceding the number, e.g.-5.125 or parenthesis, eg (5,125)) C $ Total $7,820,000 5,519,600 $ 504,000 F 1,796,400 1,063,800 255,100 308,900 $168,600 Soccer $ B:arrow_forward2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education