FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

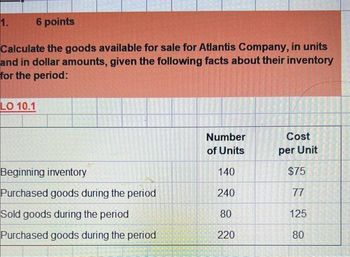

Transcribed Image Text:1.

6 points

Calculate the goods available for sale for Atlantis Company, in units

and in dollar amounts, given the following facts about their inventory

for the period:

LO 10.1

Number

of Units

Cost

per Unit

Beginning inventory

140

$75

Purchased goods during the period

240

77

Sold goods during the period

80

125

Purchased goods during the period

220

80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- What is the Weighted average cost per unit?arrow_forwardThe financial statements of CVS Caremark reported the following information (in millions): CVS Caremark Year 2 Year 1 Net sales $126,761 $123, 120 Cost of sales 102,978 100,632 Inventories, net 11, 045 11,032 The inventory turnover ratio for Year 2 is: Group of answer choices 9.33 8.32 10.22 11.48arrow_forwardSavitaarrow_forward

- Date January 1 May 5 November 3 Weighted Average Transaction Beginning inventory Purchase Purchase Cost Beginning Inventory Purchases: May 5 November 3 Total Calculate ending inventory and cost of goods sold for the year, assuming the company uses weighted-average cost. (Round your average cost per unit to 4 decimal places.) Number of units Number of Units 60 Cost of Goods Available for Sale 60 Average Cost per unit 220 140 420 Cost of Goods Available for Sale $ 220 140 420 $33,700.0000 $ Unit Cost $76 4,560 79 84 17,380 11,760 33,700 Total Cost $4,560 17,380 11,760 $33,700 Cost of Goods Sold - Weighted Average Cost Number of units sold Average Cost per Unit Cost of Goods Sold 375 $30,280.0000 $ 11,355,000.00 Ending Inventory - Weighted Average Cost Number of units in ending inventory Average Cost per unit 45 $ Ending Inventory 3,420.0000 $ 153,900.00arrow_forwardGiven the information below, what is the gross profit? Sales revenue Accounts receivable Ending inventory Cost of goods sold Sales returns Multiple Choice $76,000 $197,000 $79,000 $106,000 $ 345,000 60,000 118,000 239,000 30,000arrow_forwardFind the cost of goods sold if sales total $78,526 for the inventory table shown below. Cost per Total Retail price Total retail Units purchased unit per unit $985 43 $850 22 $2,115 Date of purchase Beginning inventory February 5 February 19 March 3 Goods available for sale Units sold Ending inventory 18 30 113 83 30 cost $36,550 $1,760 $38,720 $975 $17,550 $2,006 $490 $14,700 $610 $107,520 (Round to the nearest cent as needed.) value $42,355 $46,530 $36,108 $18,300 $143,293arrow_forward

- What is the weighted average unit cost using the following information? Beginning Inventory 11/1: 1,000 units at $25 per unit Purchase 11/10: 2,500 units at $30 per unit Purchase 11/15: 1,500 units at $20 per unit Sold 11/25: 2,500 units for $50 each $25.00 $26.00 $30.00 $36.00arrow_forwardNonearrow_forwardCalculate the correct gross profit for 20xxarrow_forward

- Refer to the following selected financial information from Phantom Corp. Compute the company's days' sales in inventory for Year 2. (Use 365 days a year.) Year 2 Year 1 Merchandise inventory 287,000 269,500 470,400 417,100 Cost of goods sold Multiple Choice 222.7. 251.2. 中arrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 32 $ 4 $ 128 April 1 52 6 312 June 1 42 7 294 November 1 47 8 376 173 $ 1,110 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 53 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 53 units).arrow_forwardUnits Purchased During the Year Date Units Cost per Unit Total Cost Beginning Inventory 20,000 5.10 $102,000 February 25 40,000 5.25 210,000 April 9 55,000 5.35 294,250 Totals 115,000 606,250 Units Sold During the Year Date Units February 28 50,000 April 15 12,000 Subtotals 62,000 What is cost of goods sold using perpetual system, LIFO cost flow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education