FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Question attached in screenshot below

need help asap

thanks

aprpeciated

i51oiyji1o5j1io5yj51oijygmi

lo1

51

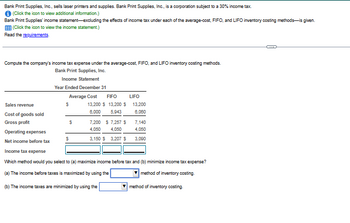

Transcribed Image Text:Bank Print Supplies, Inc., sells laser printers and supplies. Bank Print Supplies, Inc., is a corporation subject to a 30% income tax.

✪ (Click the icon to view additional information.)

Bank Print Supplies' income statement-excluding the effects of income tax under each of the average-cost, FIFO, and LIFO inventory costing methods-is given.

EEE (Click the icon to view the income statement.)

Read the requirements.

Compute the company's income tax expense under the average-cost, FIFO, and LIFO inventory costing methods.

Bank Print Supplies, Inc.

Income Statement

Year Ended December 31

Sales revenue

Cost of goods sold

Gross profit

Average Cost FIFO

$

$

13,200 $ 13,200 $

6,000 5,943

$

7,200 $ 7,257 $

4,050

4,050

3,150 $ 3,207 $

LIFO

13,200

6,080

7,140

4,050

3,090

Operating expenses

Net income before tax

Income tax expense

Which method would you select to (a) maximize income before tax and (b) minimize income tax expense?

(a) The income before taxes is maximized by using the

method of inventory costing.

(b) The income taxes are minimized by using the

method of inventory costing.

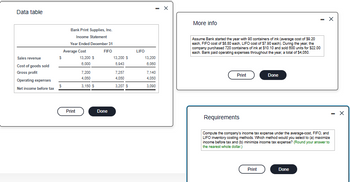

Transcribed Image Text:Data table

Sales revenue

Cost of goods sold

Gross profit

Operating expenses

Net income before tax

$

$

Bank Print Supplies, Inc.

Income Statement

Year Ended December 31

FIFO

Average Cost

Print

13,200 $

6,000

7,200

4,050

3,150 $

Done

13,200 $

5,943

7,257

4,050

3,207 S

LIFO

13,200

6,060

7,140

4,050

3,090

More info

Assume Bank started the year with 90 containers of ink (average cost of $9.20

each, FIFO cost of $8.80 each, LIFO cost of $7.90 each). During the year, the

company purchased 720 containers of ink at $10.10 and sold 600 units for $22.00

each. Bank paid operating expenses throughout the year, a total of $4,050.

Print

Done

Print

Requirements

Compute the company's income tax expense under the average-cost, FIFO, and

LIFO inventory costing methods. Which method would you select to (a) maximize

income before tax and (b) minimize income tax expense? (Round your answer to

the nearest whole dollar.)

X

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assistarrow_forwardChatGi X Gincome X > DeepL X zto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mhe Questi X ssignment i Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On December 31, Hawkin's records show the following accounts. $ 5,900 1,000 3,600 14,800 Cash Accounts Receivable Supplies Equipment Accounts Payable Hawkin, Capital, December 1 Hawkin, Withdrawals Services Revenue Wages Expense Rent Expense Utilities Expense HAWKIN Statement of Owner's Equity For Month Ended December 31 Hawkin, Capital, December 1 Add: Investments by owner Hawkin, Capital, December 31 6,400 15,300 1,800 $ 16,400 8,000 1,900 1,100 QS 1-16 (Algo) Preparing a statement of owner's equity LO P2 Use the above information to prepare a statement of owner's equity for Hawkin for the month ended December 31. Hint: Owner investments are $0 for the period. 0 Copia d X 0 0 chat.op X Log…arrow_forwardCan someone check and tell me if my answer is correct?arrow_forward

- Please help solve stepsarrow_forwardWP BAB140 Lab#2 Ch3 W2022 NWP Assessment Player UI Appli x A Player O New Tab G Taccounts. - Google Search + A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=59c96111-f5ca-414f-9f35-58b827278d0d#/question/1 E Apps W MarketWatch: Stock.. e Business News Market News | Seek... O FINVIZ.com - Stock.. 7 CVNA 228.28 A +1. S Stocktwits - The lar. EE Google Translate E Earnings and Econo. AV Short Interest Stock. * U.S. News | Reuters WSJ market volume E Reading list >> BAB140 Lab#2 Ch3 W2022 Question 2 of 4 > 0/ 2.5 Accounts Payable Aug. 5 (c) 18 3,600 Aug. 29 5,900 Aug.31 1,700 Sept. 12 7,200 Sept. 23 5,800 Sept.30 (d) Sales Aug. 10 50,000 Aug. 12 500 15 44,000 Aug. 31 (e) Sept. 12 (f) Sept. 25 400 Sept. 30 98,100arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forward

- f Qwileyplus log in - Search X w NWP Assessment Player Ul App X + https://education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=158b0479-2179-4251-b96d-ee6bbf0aa5fe#/question/7 13°C Partly sunny X w Chapter 15 Quiz Question 8 of 15 Current Attempt in Progress Crane Company has completed all of its operating budgets. The sales budget for the year shows 52,000 units and total sales of $2,340,000. The total unit cost of producing one unit is $20. Selling and administrative expenses are expected to be $312,000. Interest is estimated to be $10,400. Income taxes are estimated to be $208,000. Prepare a budgeted multiple-step income statement for the year ending December 31, 2022. CRANE COMPANY Budgeted Income Statement HH Search ENG US 4x D વા મી ક + 203 10:10 AM 2022-11-06 Ⓒarrow_forward=U&launchmuri=nttps76253A pps76252rportal6252FITal poks Login -. Bb Module 5- Chap 1 &. H Office templates & t.. Il - Chapter 5 6 Sul Saved Help Save & Exit N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.000Θ 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 1.09273 o.91514 3.0909 2.82861 3.1836 2.91347 1.12551 0.88849 1.15927 0.86261 1.19405 0.83748 4 4.1836 3.71710 4.3091 3.82861 5.3091 4.57971 5.4684 4.71710 6 6.4684 5.41719 6.6625 5.57971 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11 1.38423 0.72242 11.4639 8.53020 11.8078 8.78611 12.8078 9.25262 13.1920 9.53020 14.6178 10.25262 16.0863 10.95400 12 1.42576 0.70138 14.1920 9.95400 13 1.46853 0.68095 15.6178 10.63496 17.5989 11.63496 17.0863 11.29607 18.5989 11.93794 19.1569 12.29607 20.1569 12.56110 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 20.7616 12.93794 Rosie's…arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forward

- Blackboard Learn Bb 2193555 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193555?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=9lhjClppXf7wSeUqx.. E * O w WordCounter - Cou... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa. C Home | Chegg.com 2193555 1 / 1 100% + | PR 14-4B Entries for bonds payable and installment note transactions The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: оВJ. 3, 4 V 3. $61,644,484 Year 1 Еxcel July 1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. General Ledger Oct. 1. Borrowed $450,000 by issuing a six-year, 8% installment note to Intexicon Bank. The note requires annual payments of $97,342, with the first payment occurring on…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forwardFill in the missing amounts from the following T accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education