FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need the answer to part B please.

Record the stock transaction occurring on Sept. 1.

Record the stock transaction occurring on Dec. 1.

Transcribed Image Text:Part A

During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders' equity.

The corporation was authorized to issue 100 million common shares, $1 par per share.

Required:

Prepare the appropriate journal entries to record each transaction.

Jan. 9 Issued 40 million common shares for $20 per share.

Mar. 11 Issued 5,000 shares in exchange for custom-made equipment. McCollum's shares have traded recently on the stock exchange at

$20 per share.

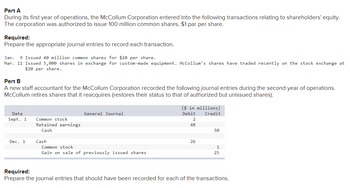

Part B

A new staff accountant for the McCollum Corporation recorded the following journal entries during the second year of operations.

McCollum retires shares that it reacquires (restores their status to that of authorized but unissued shares).

Date

Sept. 1

Dec. 1

Common stock

Retained earnings

Cash

Cash

General Journal

Common stock

Gain on sale of previously issued shares

($ in millions)

Debit

Credit

2

48

26

50

1

25

Required:

Prepare the journal entries that should have been recorded for each of the transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with finding the stock dividends & stock dividend distrubitable for June 30, the stock dividend distrubitable and common stock for July 10, and the cash dividend and dividends payable for Dec 18.arrow_forwardHolimont Ltd. (HL) has unlimited no-par common shares authorized. The following transactions took place in the first year: a. To record authorization of shares by board of directors (memorandum). b. Issued 200,000 shares at $20; collected cash in full and issued the shares. Share issue costs amounted to $67,000. Treat this amount as a reduction of the common share account. c. Received subscriptions for 100,000 shares at $30 per share; collected 70% of the subscription price. The shares will not be issued until collection of cash in full. d. Issued 400 shares to a lawyer in payment for legal fees related to trademark registration. The lawyer estimates that the legal services provided would have been worth $12,000. e. Issued 40,000 shares and assumed an $120,000 mortgage in total payment for a building with a fair value of $240,000. f. Collected balance on subscriptions receivable in (c).arrow_forwardHelp Be cleararrow_forward

- You have been asked to prepare a chart of stock prices for the upcoming semiannual stockholders' meeting for a company manufacturing and selling standard and deluxe computer components. The following table shows the company's stock prices on the first day of each month. Month Stock Price January $35.50 February $33.25 March $37.75 April $38.50 May $39.75 June $39.25arrow_forwardNeed some help with this financial accounting question.arrow_forwardIndicate the correct order in which to report the following accounts in the stockholders’ equity section of the balance sheet: Additional Paid-in Capital, Common Stock, Preferred Stock, Treasury Stock, and Retained Earnings.arrow_forward

- Hi, I need help assembling the following two journal entries. Thanks!arrow_forwardThe equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. Question: What is the total dollar amount for each of the four cash dividends? January 5 April 5 July 5 October 5.arrow_forwardIllumination Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year Budgeted costs of operating the plant for 2,000 to 3,000 hours: Fixed operating costs per year Variable operating costs Budgeted long-run usage per year Flashlight Division Night Light Division Practical capacity $500,000 OA. $500,000 B. $625.000 OC. $600,000 D. $650,000 $500 per hour 2,000 hours 1,000 hours 4,000 hours Assume that practical capacity is used to calculate the allocation rates Actual usage for the year by the Flashlight Division was 1,500 hours and by the Night Light Division was 800 hours If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?arrow_forward

- The journal entry to record a stock split includes a: Select one: a. None of the available choices b. Credit to the associated shares account c. Debit to Cash d. Debit to the associated shares accountarrow_forwardI need 3 paragraphs, 5 lines each. please do not copy and paste previously answered questions. Thank you!arrow_forwardLike a share of stock, EFTs trade _____ A) on an exchange B) once per day C) at an average price and depending upon the broker used may be subject to a _____ A) front end load fee B) back end loan fee C) brokerage commissionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education