FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

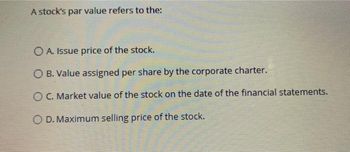

Transcribed Image Text:A stock's par value refers to the:

O A. Issue price of the stock.

O B. Value assigned per share by the corporate charter.

O C. Market value of the stock on the date of the financial statements.

D. Maximum selling price of the stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- 8. How would total stockholders' equity be effected by the declaration of each of the following? Stock dividend a. No effect b. Decrease c. Decrease d. No effect Stock Split Increase Decrease No effect No effectarrow_forwardIndicate the accounts increased or decreased to record the above stock transactions.arrow_forwardThe par value of a stock reflects the most recent market price. is immaterial in the majority of cases. O is selected by the SEC. O is indicative of the worth of the stock.arrow_forward

- When calculating book value per share of common stock, do you also subtract additional paid in capital of preferred stock?arrow_forwardWhats the difference btween authorized stock, issued stock, and outstanding stock?arrow_forward7. What is Stockholder Equity? Include Retained Earnings and Common Stock explanations.arrow_forward

- Treasury stock is generally accounted for by the * cost method. O market value method. O par value method. O stated value method.arrow_forwardstock refers to issued stock that is currently held by stockholders. O Authorized O Outstanding O Market Issuedarrow_forwardUse the information given to fill out missing boxes correctlyarrow_forward

- The category of equity that tracks the events relating to stockholder transactions is known as: Group of answer choices Retained Earnings Treasury Stock Paid-In Capital Awesome Categoryarrow_forwardAn offering of shares to institutional investors at a discount to the current market price is known as a: Select one: a. Initial Public Offering (IPO). b. Private Placement c. Rights Issue d. Dividend Reinvestment Plan (DRP).arrow_forwardPar value of a stock refers to the ________.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education