FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

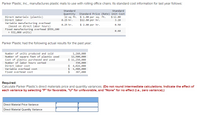

Transcribed Image Text:Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows:

Standard

Standard

Quantity

12 sq ft.

0.25 hr.

Standard Price (Rate) Unit Cost

$ 1.00 per sq. ft.

$12.80 per hr.

Direct materials (plastic)

$ 12.00

Direct labor

3.20

Variable manufacturing overhead

(based on direct labor hours)

Fixed manufacturing overhead $559, 200

+ 932,000 units)

0.25 hr.

$ 2.00 per hr.

0.50

0.60

Parker Plastic had the following actual results for the past year:

Number of units produced and sold

Number of square feet of plastic used

Cost of plastic purchased and used

Number of labor hours worked

Direct labor cost

Variable overhead cost

Fixed overhead cost

1,260,000

12,500,000

$ 11,250,000

330,000

$ 4,026,000

$ 1,480,000

24

387,000

Required:

Calculate Parker Plastic's direct materials price and quantity variances. (Do not round intermediate calculations. Indicate the effect of

each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).)

Direct Material Price Variance

Direct Material Quantity Variance

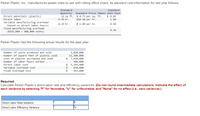

Transcribed Image Text:Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows:

Standard

Quantity

11 sq ft.

Standard

Standard Price (Rate) Unit Cost

$ 0.73 per sq. ft.

$10.40 per hr.

Direct materials (plastic)

$ 8.03

Direct labor

0.25 hr.

2.60

Variable manufacturing overhead

(based on direct labor hours)

Fixed manufacturing overhead

($326,880 + 908,000 units)

0.25 hr.

$ 2.00 per hr.

0.50

0.36

Parker Plastic had the following actual results for the past year:

Number of units produced and sold

Number of square feet of plastic used

Cost of plastic purchased and used

Number of labor hours worked

1,020,000

11,300,000

$ 7,910,000

306,000

3,335,400

630,000

363,000

Direct labor cost

Variable overhead cost

Fixed overhead cost

Required:

Calculate Parker Plastic's direct labor rate and efficiency variances. (Do not round intermediate calculations. Indicate the effect of

each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).)

Direct Labor Rate Variance

Direct Labor Efficiency Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- subject : Accountingarrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 3,000 units of actual production are as follows: Standard Costs Fixed overhead (based on 10,000 hours) Variable overhead 3 hours per unit @ $0.78 per hour 3 hours per unit @ $2.00 per hour a. $0 b. $624 favorable O c. $780 unfavorable O d. $624 unfavorable Actual Costs Total variable cost, $18,000 Total fixed cost, $7,900 The amount of the fixed factory overhead volume variance isarrow_forwardPrime Cost, Conversion Cost, Preparation of Income Statement: Manufacturing Firm Kildeer Company makes easels for artists. During the last calendar year, a total of 34,000 easels were made, and 35,000 were sold for $52 each. The actual unit cost is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total unit cost Required: $15.00 6.00 Ending units Dollar amount 4.00 14.00 The selling expenses consisted of a commission of $0.90 per unit sold and advertising co-payments totaling $94,500. Administrative expenses, all fixed, equaled $176,500. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was $109,200 for 2,800 easels. $39.00 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 1,800 ✓ 70,200 2. Prepare a cost of goods sold statement. Kildeer Company Statement of Cost of Goods Sold For the Year Ended December 31 Cost of goods manufactured Add: Beginning finished goods…arrow_forward

- S Direct materials (cork board) Direct labor Bullseye Company manufactures dartboards. Its standard cost information follows: Standard Price (Rate) $ 2.30 per sq. ft. $10.00 per hr. Standard Unit Cost Standard Quantity 3.00 sq. ft. 1 hrs. $ 6.90 10.00 Variable manufacturing overhead. (based on direct labor hours) Fixed manufacturing overhead ($58,000+145,000 units) 1 hrs. $ 0.55 per hr. 0.55 0.40 Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard used Cost of corkboard used Number of labor hours worked Direct labor cost 125,000 390,000 $ 936,000 135,000 $1,228,500 Variable overhead cost Fixed overhead cost $ 71,000 $ 53,000 Required: 1. Calculate the direct materials price, quantity, and total spending variances for Bullseye. 2. Calculate the direct labor rate, efficiency, and total spending variances for Bullseye. 3. Calculate the variable overhead rate, efficiency, and total spending variances for…arrow_forwardKBG Manufacturing has the following standard cost sheet for one of its products: Direct materials ( 5 ft. @ $5) $25 Direct labour (1 hours @ $10) 10 Variable overhead ( 1 hours@ $ 4) 4 Fixed overhead ( 1 hours@ $2*) 2 Standard unit cost 41 *Rate based on expected activity of 15,000 hours. During the most recent year, the following actual results were recorded: Production 10,000 units Fixed overhead $30,000 Variable overhead $57,000 Direct materials (71,250 ft. purchased) $361,620 Direct labour (15,900 hours) $ 182,580 Required: Compute the following variances: 1. Direct materials price and usage variances. 2. Direct labour rate and efficiency variancesarrow_forwardam.111.arrow_forward

- A company's standard cost system requires 7,000 direct labor hours per month jg. qtler taproduce 3,500 units of handbags. The management has set 2 standard of using 4.3 yards of direct materials per unit of handbag. Information regarding standard costs is mentioned below: Particulars Total standard direct materials cost Total standard direct labor cost Total standard variable manufacturing overhead (based on direct labor-hours) Amount $54,250 $42,000 $18,200 During November, the company produced 3,600 wits of handbags using 6 960 direct labor hours. Actual cots recordad isthe month of Novemb are ss allows:arrow_forwardAssume the following information appears in the standard cost card for a company that makes only one product: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 5 pounds $ 11.00 per pound $ 55.00 Direct labor 2 hours $ 17.00 per hour $ 34.00 Variable manufacturing overhead 2 hours $ 3.80 per hour $ 7.60 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,000. Assuming the company uses direct labor-hours to compute its predetermined overhead rate, what is the variable overhead efficiency variance?arrow_forwardParker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity 12 sq ft. 0.3 hr. Standard Price (Rate) $ 0.65 per sq. ft. $10.20 per hr. 0.3 hr. $ 0.70 per hr. Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($352,000 880,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 980,000 11,270,000 $ 7,100,100 289,000 Fixed Overhead Spending Variance Fixed Overhead Volume Variance Over- or Underapplied Fixed Overhead $ 2,832,200 $ $ 231,200 334,000 Standard Unit Cost $7.80 3.06 0.21 0.40 Required: Calculate Parker Plastic's fixed overhead spending and volume variances and its over- or underapplied fixed…arrow_forward

- Copland Components manufactures an electronic device for vehicle manufacturing. The current standard cost sheet for a device follows: Direct materials, ? ounces at $2.80 per ounce Direct labor, 0.4 hours at ? per hour Overhead, 0.4 hours at ? per hour Total costs $ ? per device ? per device ? per device $ 30 per device Assume that the following data appeared in Copland's records at the end of the past month: Actual production Actual sales 96,000 units 90,000 units Materials costs (505,000 ounces) $ ? Materials price variance 63,000 U Materials efficiency variance 70,000 U Direct labor price variance 18,750 F Direct labor (37,500 hours) Overapplied overhead (total) There are no materials Inventories. 918,750 25,200 Required: a. Prepare a variance analysis for direct materials and direct labor. b. Assume that all production overhead is fixed and that the $25,200 overapplied is the only overhead variance that can be computed. What are the actual and applied overhead amounts? c. Complete…arrow_forwardRequired information [The following information applies to the questions displayed below] Sedona Company set the following standard costs for one unit of its product for this year. Direct material (20 pounds @ $3.30 per pound) Direct labor (15 hours @ $6.00 per DLH) Variable overhead (15 hours @ $2.80 per DLH) Fixed overhead (15 hours @ $1.20 per DLH) Standard cost per unit The $4.00 ($2.80+ $1.20) total overhead rate per direct labor hour (DLH) is based on a predicted activity level of 43,500 units, which is 75% of the factory's capacity of 58,000 units per month. The following monthly flexible budget information is available. Flexible Budget Budgeted production (units) Budgeted direct labor (standard hours) Budgeted overhead. Variable overhead Fixed overhead Total overhead Actual variable overhead: Actual fixed overhead Actual total overhead $ 66.00 90.00 42.00 18.00 $ 216.00 $1,624,000 866,000 $ 2,490,000 Operating Levels (% of capacity) 75% 70% 40,600 609,000 $ 1,705, 200 783,000…arrow_forwardSedona Company set the following standard costs for one unit of its product for this year. Direct material (15 pounds $3.40 per pound) Direct labor (10 hours e S9.70 per DLH) Veriable overhead (10 hours $4.90 per DLH) Fied overhead (10 hours $2. 00 per DLH) Standard cost per unit $ 51.00 97.00 49.00 20.00 $ 217.00 The $6.90 ($4.90 - $2.00) total overhead rate per direct labor hour (DLH) is based on a predicted activity level of 41,300 units, which is 70% of the factory's capacity of 59,000 units per month. The following monthly flexible budget information Is avallable. Operat ing Levels (K of capacity) 65% 30, 350 383,500 Flexible Budget Budgeted production (units) Rudgeted direct labor (standard hours) Budgeted overhead Varlable overhead Fised overhead Total avertead 41, 300 413,000 75% 44, 250 442, 500 $1,879,150 826,000 $ 2,023, 700 826, 000 $ 2,849, 700 $2,168, 250 126, e00 $ 2,994, 250 $ 2,705, 150 During the current month, the company operated at 65% of capacity, direct labor of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education