FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

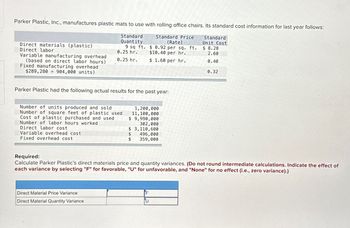

Transcribed Image Text:Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows:

Direct materials (plastic)

Direct labor

Variable manufacturing overhead

(based on direct labor hours)

Fixed manufacturing overhead

$289,280904,000 units)

Standard

Quantity

Standard Price

(Rate)

$ 0.92 per sq. ft.

Standard

Unit Cost

9 sq ft.

$ 8.28

0.25 hr.

$10.40 per hr.

2.60

0.25 hr.

$ 1.60 per hr.

0.40

0.32

Parker Plastic had the following actual results for the past year:

Number of units produced and sold

Number of square feet of plastic used

Cost of plastic purchased and used

Number of labor hours worked

Direct labor cost

Variable overhead cost

Fixed overhead cost

1,200,000

11,100,000

$ 9,990,000

302,000

$ 3,110,600

$

496,000

$

359,000

Required:

Calculate Parker Plastic's direct materials price and quantity variances. (Do not round intermediate calculations. Indicate the effect of

each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).)

Direct Material Price Variance

Direct Material Quantity Variance

U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introducing Material Variance

VIEW Step 2: Calculate the Actual Rate of Direct Material Purchase

VIEW Step 3: Calculate the Standard Quantity of Actual Output

VIEW Step 4: Calculate the Direct Material Price Variance

VIEW Step 5: Calculate the Direct Material Quantity Variance

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- The standard costs and actual costs for factory overhead for the manufacture of 3,000 units of actual production are as follows: Standard Costs Fixed overhead (based on 10,000 hours) Variable overhead 3 hours per unit @ $0.78 per hour 3 hours per unit @ $2.00 per hour a. $0 b. $624 favorable O c. $780 unfavorable O d. $624 unfavorable Actual Costs Total variable cost, $18,000 Total fixed cost, $7,900 The amount of the fixed factory overhead volume variance isarrow_forwardDjdarrow_forwardAdvanced Miniature Development manufactures computer graphics cards (GPUs). Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 GPUs were as follows: Cost Driver Direct materials Direct labor Factory overhead Instructions Determine the: Each GPU requires 0.5 hour of direct labor. f. Standard Costs 110,000 lbs. at $6.30 2,080 hours at $15.80 Rates per direct labor hr., based on 100% of normal capacity of 2,000 direct labor hrs.: Variable cost, $4.25 Fixed cost, $6.00 a. direct materials price variance b. direct materials quantity variance c. total direct materials cost variance d. direct labor rate variance direct labor time variance total direct labor cost variance g. the variable factory overhead controllable variance h. fixed factory overhead volume variance i. total factory overhead cost variance. Actual Costs 115,000 lbs. at $6.50 2,000 hours at $15.40 $8,200 variable cost $12,000 fixed costarrow_forward

- Bullseye Company manufactures dartboards. Its standard cost information follows: Direct materials (cork board) Direct labor Standard Quantity 0.50 square feet 0.90 hour Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($21,750/87,000) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard purchased and used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 0.90 hour Standard Price (Rate) $ 1.30 per square feet $5.00 per hour $0.50 per hour 74,000 43,000 $ 47,200 80,000 $ 98,000 $ 103,880 $ 33,000 Standard Unit Cost $ 0.65 4.50 0.45 0.25 Required: 1. Calculate the fixed overhead spending variance for Bullseye. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). 2. Calculate the fixed overhead volume variance…arrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($461,000 +922,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost S Variable overhead cost Fixed overhead cost 1,160,000 12,000,000 $ 16,800,000 320,000 $ 3,744,000 $ 1,100,000 $377,000 Standard Quantity 12 square foot 0.3 hour Standard Price (Rate) $ 1.45 per square foot $ 11.90 per hour Standard Unit Cost $ 17.40 3.57 0.3 hour $ 2.30 per hour 0.69 0.50 Required: Calculate Parker Plastic's direct materials price and quantity variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- A manufacturer reports the following costs to produce 17,000 units in its first year of operations: direct materials, $17 per unit, direct labor, $13 per unit, variable overhead, $153,000, and fixed overhead, $204,000. The total product cost per unit under variable costing is: Multiple Choice $30 per unit. $26 per unit. $39 per unit.arrow_forwardBramble Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-2 pound plastic at $6 per pound Direct labor-1.0 hours at $12.00 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit Direct materials (10,330 pounds) Direct labor (5,000 hours) Variable overhead Fixed overhead Total manufacturing costs Show Transcribed Text $64,046 61.000 52.122 21,578 The predetermined manufacturing overhead rate is $14 per direct labor hour ($14.00+ 1.0). It was computed from a master manufacturing overhead budget based on normal production of 5,200 direct labor hours (5.200 units) for the month. The master budget showed total variable overhead costs of $36,400 ($7.00 per hour) and total fixed overhead costs of $36,400 ($7.00 per hour) Actual costs for October in producing 5.100 units were as follows. $198.746 Overhead volume variance Overhead controllable variance $ $12.00 12.00 $ 7.00 7.00 The…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education