FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:S

Direct materials (cork board)

Direct labor

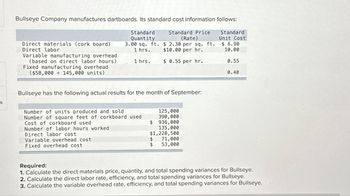

Bullseye Company manufactures dartboards. Its standard cost information follows:

Standard Price

(Rate)

$ 2.30 per sq. ft.

$10.00 per hr.

Standard

Unit Cost

Standard

Quantity

3.00 sq. ft.

1 hrs.

$ 6.90

10.00

Variable manufacturing overhead.

(based on direct labor hours)

Fixed manufacturing overhead

($58,000+145,000 units)

1 hrs.

$ 0.55 per hr.

0.55

0.40

Bullseye has the following actual results for the month of September:

Number of units produced and sold

Number of square feet of corkboard used

Cost of corkboard used

Number of labor hours worked

Direct labor cost

125,000

390,000

$ 936,000

135,000

$1,228,500

Variable overhead cost

Fixed overhead cost

$

71,000

$

53,000

Required:

1. Calculate the direct materials price, quantity, and total spending variances for Bullseye.

2. Calculate the direct labor rate, efficiency, and total spending variances for Bullseye.

3. Calculate the variable overhead rate, efficiency, and total spending variances for Bullseye.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Standard Product Cost Sana Rosa Furniture Company manufactures designer home furniture. Sana Rosa uses a standard cost system. The direct labor, direct materials, and factory overhead standards for an unfinished dining room table are as follows: Direct labor: standard rate $19.00 per hr. standard time per unit 3.50 hrs. Direct materials (oak): standard price $8.50 per bd. ft. standard quantity 15 bd. ft. Variable factory overhead: standard rate $3.20 per direct labor hr. Fixed factory overhead: standard rate $1.20 per direct labor hr. a. Determine the standard cost per dining room table. If required, round your answer to two decimal places.$. per dining room table b. A standard cost system provides Rosa Furniture management a cost control tool using the principle of ??? Using this principle, ??? cost deviations from standards can be investigated and corrected.arrow_forwardStandard Product Cost Atlas Furniture Company manufactures designer home furniture. Atlas uses a standard cost system. The direct labor, direct materials, and factory overhead standards for an unfinished dining room table are as follows: Direct labor: Direct materials (oak): Variable factory overhead: Fixed factory overhead: standard rate standard time per unit standard price standard quantity standard rate standard rate $15.00 per hr. 3 hrs. $11.00 per bd. ft. 19 bd. ft. $2.80 per direct labor hr. $0.80 per direct labor hr. a. Determine the standard cost per dining room table. If required, round your answer to two decimal places. per table $1 b. A standard cost system provides Atlas Furniture Company's management a cost control tool using the principle of . Using this principle, cost deviations from standards can be investigated and corrected.arrow_forwardThe standard cost sheet for a product is shown. Standard Cost Manufacturing Costs Standard price Standard Quantity per unit Direct materials $4.50 per pound 5.70 pounds $ 25.65 Direct labor $11.87 per hour 2.00 hours $ 23.74 Overhead $2.20 per hour 2.00 hours $ 4.40 $ 53.79 The company produced 3,000 units that required: 17,600 pounds of material purchased at $4.35 per pound • 5,910 hours of labor at an hourly rate of $12.17 per hour • Actual overhead in the period was $13,540 Fill in the Budget Performance Report for the period. Some amounts are provided. Round your answers to the ne Budget Performance Report Variance Manufacturing Costs: Actual Standard (Favorable)/ 3,000 units Costs Costs Unfavorable Direct materials $76,560 Direct labor 71,220 Overhead 13,540 $655arrow_forward

- Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Estimated total manufacturing overhead Estimated total direct labor-hours $ 64.20 $ 17.60 Activity Cost Pools and (Activity Measures) Supporting direct labor (direct labor-hours) 1.4 DLHS 19,000 units The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost $50.40 $ 12.40 1 DLHs 69,000 units $1,854,640 95,600 DLHs Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional…arrow_forwardStandard Product Cost Designer Furniture Company manufactures designer home furniture. Designer Furniture uses a standard cost system. The direct labor, direct materials, and factory overhead standards for a finished dining room table are as follows: Line Item Description Classification Value Direct labor: standard rate $20.00 per hr. Direct labor: standard time per unit 3.50 hrs. Direct materials (oak): standard price $10.00 per bd. ft. Direct materials (oak): standard quantity 17 bd. ft. Variable factory overhead: standard rate $2.40 per direct labor hr. Fixed factory overhead: standard rate $1.20 per direct labor hr. a. Determine the standard cost per dining room table. Round to two decimal places.fill in the blank 1 of 1$ per tablearrow_forwardRequired information [The following information applies to the questions displayed below.] BatCo makes baseball bats. Each bat requires 2.00 pounds of wood at $20 per pound and 0.30 direct labor hour at $20 per hour. Overhead is assigned at the rate of $40 per direct labor hour. Prepare a standard cost card for a baseball bat for BatCo. (Round your final answers to 2 decimal places.) Inputs Direct materials Direct labor Overhead Standard quantity or hours pounds DLH DLH Standard price or rate Standard cost per unitarrow_forward

- Standard Product Cost Santa Clara Furniture Company manufactures designer home furniture. Santa Clara uses a standard cost system. The direct labor, direct materials, and factory overhead standards for an unfinished dining room table are as follows: Direct labor: standard rate $19.00 per hr. standard time per unit 3.5 hrs. Direct materials (oak): standard price $16.50 per bd. ft. standard quantity 27 bd. ft. Variable factory overhead: standard rate $3.90 per direct labor hr. Fixed factory overhead: standard rate $2.10 per direct labor hr. a. Determine the standard cost per dining room table. per dining room table Using this b. A standard cost system provides the company's management a cost control tool using the principle of principle, cost deviations from standards can be investigated and corrected.arrow_forwardNorthwest Company produces two types of glass shelving: rounded edge and squared edge. The company reports the following cost data. Rounded Edge $ 34,800 11,600 Squared Edge $ 46,800 $ 81,600 31,200 Total Direct materials Direct labor Overhead (using plantwide rate) 42,800 41,400 79,400 120,800 $ 245, 200 $ Total product cost $ 87,800 157,400 Units produced Product cost per unit 11,600 $ 7.57 15,600 $ 10.09 Northwest's controller wants to apply activity-based costing to allocate the $120,800 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Budgeted Cost $ 6,200 Activity Cost Driver Purchase orders Activity Usage Squared Edge 471 orders Rounded Activity Purchasing Depreciation of machinery Setup Edge 149 orders Total 620 orders 63,000 Machine hours 500 hours 1,500 hours 2,000 hours 51,600…arrow_forwardBarley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost information follows: Standard Quantity Standard Price (Rate) Standard Unit Cost Direct materials (clay) 1.80 lbs. $ 1.90 per lb. $ 3.42 Direct labor 1.80 hrs. $ 16.00 per hr. 28.80 Variable manufacturing overhead (based on direct labor hours) 1.80 hrs. $ 1.10 per hr. 1.98 Fixed manufacturing overhead ($487,500.00 ÷ 195,000.00 units) 2.50 Barley Hopp had the following actual results last year: Number of units produced and sold 200,000 Number of pounds of clay used 368,200 Cost of clay $ 736,400 Number of labor hours worked 245,000 Direct labor cost $ 5,806,500 Variable overhead cost $ 390,000 Fixed overhead cost $ 470,000 Required:1. Calculate the direct materials price, quantity, and total spending variances for Barley Hopp.2. Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp.3.…arrow_forward

- Standard Product Cost Sana Rosa Furniture Company manufactures designer home furniture. Sana Rosa uses a standard cost system. The direct labor, direct materials, and factory overhead standards for an unfinished dining room table are as follows: Direct labor: standard rate $24.00 per hr. standard time per unit 2.50 hrs. Direct materials (oak): standard price $8.00 per bd. ft. standard quantity 18 bd. ft. Variable factory overhead: standard rate $2.80 per direct labor hr. Fixed factory overhead: standard rate $0.80 per direct labor hr, a. Determine the standard cost per dining room table. If required, round your answer to two decimal places. per dining room table V. Using this principle, major b. A standard cost system provides Rosa Furniture management a cost control tool using the principle of management by exception cost deviations from standards can be investigated and corrected.arrow_forwardSchwiesow Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Multiple Choice O $14,750 Variable administrative expense Fixed selling and administrative expense If 4,500 units are produced, the total amount of manufacturing overhead cost is closest to:arrow_forwardplease answer this with must explanation , computation for each parts and steps answer in text formarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education