FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

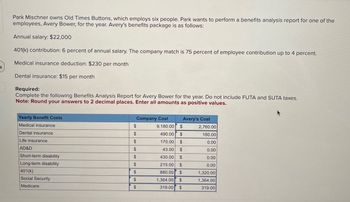

Transcribed Image Text:Park Mischner owns Old Times Buttons, which employs six people. Park wants to perform a benefits analysis report for one of the

employees, Avery Bower, for the year. Avery's benefits package is as follows:

Annual salary: $22,000

401(k) contribution: 6 percent of annual salary. The company match is 75 percent of employee contribution up to 4 percent.

Medical insurance deduction: $230 per month

Dental insurance: $15 per month

Required:

Complete the following Benefits Analysis Report for Avery Bower for the year. Do not include FUTA and SUTA taxes.

Note: Round your answers to 2 decimal places. Enter all amounts as positive values.

Yearly Benefit Costs

Medical insurance

Company Cost

Avery's Cost

$

9,180.00 $

2,760.00

Dental insurance

$

490.00 $

EA

180.00

Life insurance

$

EA

170.00 $

69

0.00

AD&D

$

43.00

69

$

0.00

Short-term disability

$

430.00 $

0.00

Long-term disability

$

215.00 $

69

0.00

401(k)

$

880.00 $

69

1,320.00

Social Security

$

69

1,364.00 $

69

1,364.00

Medicare

$

69

319.00 $

319.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jewel Lyman is an employee in the office of Salvaggio & Wheelers, Attorneys at Law. She received the following benefits during 2018: Medical insurance: $250 per month . Commuter pass: $500 per year Employer-paid membership to Anytime Gym: $75 per year Dependent care assistance: $3,600 per year Required: What is the total taxable amount for Jewel's 2018 benefits? Answer is complete but not entirely correct. Total taxable amount $6750arrow_forwardSam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year, Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip: Course Tuition Airfare Hotel (10 nights) Rental car (10 days) Meals at restaurants (10 days) What amount of travel expenditures can Sam deduct? $ 3,050 990 3,100 710 3,400arrow_forwardLee Sutherlin is a self-employed electrical consultant. He estimates his annual net earnings at $35,300. How much Social Security and Medicare must he pay (in $) this year? Social Security $ Medicare $arrow_forward

- Sarah purchases a health insurance plan. The annual premium is $7,000. The plan has the following characteristics: Copay for each visit to a provider is $40. Deductible = $4,000 Coinsurance is 65/35 Max out-of-pocket (after deductible): $5,000 On the first day of her plan year, she breaks her leg skiing. After 4 visits to various providers, the total medical bill for all expenses comes to $16,000. A. How much of the $16,000 does Sarah pay? B. How much of the $16,000 does the insurance company pay?arrow_forwardThe Financial Statements of harry and Belinda Johnson Suggest Budgeting Problems Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a trust fund set up by his deceased father’s estate. Belinda earns a salary of $6,400 per month, and she has many job-related benefits including flexible benefits program, life insurance, health insurance, a 401(k) retirement program, workplace financial education, and a credit union. The Johnsons live in an old apartment located approximately halfway between their places of employment. However, their rent will increase by $100 a month in July. Harry drives about ten minutes to his job, and Belinda travels about 15 min- utes via public transportation to reach her downtown job. Harry and Belinda’s apartment is very nice, but small, and it is furnished primarily with furniture given to them by some of his friends. Soon after getting married,…arrow_forwardLaMont works for a company in downtown Chicago. The company encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $284 per month. If LaMont receives one pass (worth $284) each month, how much of this benefit must he include in his gross income each year? If the company provides each employee with $284 per month in parking benefits, how much of the parking benefit must LaMont include in his gross income each year?arrow_forward

- You just graduated and started your new job. Your starting salary is $60,000/year. Your employer's 401(k) plan states that your employer will contribute 2% of your salary to your 401(k) regardless of whether you make any contributions or not - this is called a "non-elective contribution". They will also match your contributions, $1-for $1, up to 4% of your salary. Please answer the following questions: How much ($) will your employer contribute to your 401(k) per year if you make $0 contributions? (this is a non-elective contribution from your employer) $ 1200 What is the minimum amount ($) that you must contribute per year to get the maximum match from your employer? $2400 Assume that you make the minimum contribution to get the maximum match from your employer. What is the total amount ($) that will be contributed to your 401(k) for the year, including the employer's non-elective contribution, the employer's matching contribution, and your contribution? $ 6000 Assume that this annual…arrow_forwardMaxine, age 35, earns $200,000 annually from ABC Incorporated. ABC sponsors a SIMPLE, and matches all employee deferrals 100% up to a 3% contribution. What is the maximum employee deferral contribution to Maxine's SIMPLE account for this year? (a) $12,000. (b) $17,500. (c) $18,000. (d) $20,500. $12,500 is not an option!arrow_forwardThis year (2022), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $74,850 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) $ 1,200 Interest paid on accumulated student loans 2,970 Cost of purchasing a delivery uniform 1,570 Cash contribution to State University deliveryman program 1,385 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. What is Evan's AGI? What is Evan's Taxable Income?arrow_forward

- James has a yearly salary of $36,300 . His employer withholds $4382 in state and federal taxes and $3255 in FICA taxes throughout the year. He has the following monthly costs: transportation is $240 , cell phone bill is $50 , student loans require $230 in repayment, and rent is $675 . He is using the average monthly costs for each of the following in order to gain an idea of other monthly expenses: utilities are $120 , internet is $90 , health insurance is $363 , and groceries are $250 . How much money is left each month for discretionary spending after all necessities are accounted for? Round your answer to the nearest cent, if necessary.arrow_forwardLaMont works for a company in downtown Chicago. The firm encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $270 per month. a. If LaMont receives one pass (worth $270) each month, how much of this benefit must he include in his gross income each year? b. If the company provides each employee with $270 per month in parking benefits, how much of the parking benefit must LaMont include in his gross income each year?arrow_forwardCheck my work Ariana's health Insurance policy includes a deductible of $1,050 and a coinsurance provision requiring her to pay 20 percent of all bils. Her total bill is $8,700. What is Ariana's total cost? (Do not round intermediate calculations.) Imsured's cotarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education